Window Shopping to Screen Browsing: Mytheresa to acquire Yoox Net-a-Porter from Richemont

Source: HighXtar

When it comes to shopping for luxury goods, I’ve always just been a window shopper. Not only because I don’t have the money as a broke college student, but coming from a family that runs a clothing manufacturing business, it always pained us to see just how much these luxury brands can markup their products when the cost of making the clothing (our profit margin) is an extremely small fraction of their price tag.

I had always imagined luxury shopping to be an experience entailing strolling down glamorous avenues and shopping malls, peering into gleaming store windows, being greeted by impeccably dressed sales associates, and walking out with that beaming paper shopping bag. But while that experience still holds its allure for many, the epitome of luxury retail, as with almost all things retail, is gradually shifting to the digital realm. Today, window shopping is a lot easier for me when it simply involves scrolling through beautifully curated websites, adding coveted items to digital shopping carts, but never making the purchase. This digital evolution in luxury retail has been brewing for years, but recent events have supercharged the trend.

On October 7, 2024, Mytheresa, the German luxury e-tailer, announced its acquisition of Yoox Net-A-Porter (YNAP) for €555 million from Swiss luxury goods conglomerate Richemont. This strategic move is designed to establish a premier international, multi-brand digital platform in the luxury sector. The new entity aims to offer discerning luxury consumers worldwide an expertly curated selection of high-end brands and products, with a focus on differentiation and exclusivity.

But beyond the glitz and glamour, this acquisition raises intriguing questions about the future of luxury retail. How will this deal navigate the challenges of maintaining exclusivity in the digital age? Can it successfully address the growing demand for personalization and sustainability in luxury? And perhaps most crucially, how will it adapt to the economic headwinds facing the industry, particularly in China – a market that has long been the engine of growth for luxury brands?

Company Overviews:

As some of you probably realize by now, I enjoy diving deep into the rabbit hole of company histories. I find the stories behind companies fascinating, and frankly, I’ve noticed that a better understanding of company history also helps deepen my understanding of a company’s deal rationales and strategies. So, hopefully, these detailed company overviews can help you all too.

Mytheresa

Mytheresa today operates as a luxury e-commerce platform, offering a curated selection of high-end fashion and accessories from over 200 of the world's most coveted luxury brands. The story of Mytheresa is one of passion, vision, and transformation in the world of luxury fashion retail. It all began when Susanne and Christoph Botschen, a couple who met during their fashion school studies, opened a luxury womenswear store called Theresa in Munich in 1987. This small boutique, nestled in one of Germany's wealthiest cities, quickly distinguished itself among high-end designer stores thanks to the Botschens' unique approach to fashion retail.

Source: Pentagram

Susanne and Christoph formed a formidable partnership, with Christoph managing finances while Susanne oversaw buying. Susanne's keen eye for fashion trends and willingness to take risks set Theresa apart. She wasn't afraid to challenge Munich's often conservative clientele with bold choices like expensive flannel shirts and ripped designer jeans. Her understanding of emerging trends, such as grunge, gave Theresa a fashion-forward reputation that eventually caught the attention of traditional luxury brands. As Susanne once said in an interview with German ELLE, "You have to be truly obsessed with fashion."

Throughout the 1990s and early 2000s, Theresa's reputation grew steadily. Prestigious labels like Gucci, Prada, and Saint Laurent began offering their clothing and accessories at the store, contributing to increasing sales numbers. However, the real game-changer came in 2006 when Christoph proposed taking their business online. Susanne later called this "the best idea he ever had besides marrying me." Two years ahead of online fashion giant Zalando, the Botschens transitioned from retailer to e-tailer, founding Mytheresa.com.

Initially, Mytheresa.com was simply an online version of their Munich store, based in Aschheim, a small town northeast of Munich. However, the Botschens saw the potential to reach a much broader audience. As Susanne explained, "We always targeted an international and very trend-oriented audience. It was only a natural succession to make our unique selection of high-end designer labels available to a broader public." Despite entering a space already occupied by established players like Net-a-Porter and Stylebop, the Botschens were confident in their unique approach, differentiating Mytheresa by focusing exclusively on womenswear and curating a selection that catered specifically to continental European tastes.

The following years saw remarkable growth for Mytheresa. The company expanded its online presence with French and Italian websites in 2012, followed by Arabic in 2015, Chinese in 2016, Korean in 2017, and Spanish in 2018. To support this growth, Mytheresa opened new logistics centers: a 10,000m² facility in Kirchheim, Munich, in 2013, and a larger 32,000m² center in Heimstetten, Munich in 2017. The company also diversified its offerings, launching Mytheresa Kids in 2019 and Mytheresa Men in 2020, along with a dedicated men's store in Munich.

Source: Mytheresa

By 2014, Mytheresa's revenues had surpassed the €100 million mark, with more than two-thirds coming from outside Germany. The company was shipping to over 120 countries with a highly localized approach. This success attracted the attention of potential buyers, and in 2014, Mytheresa was acquired by the Neiman Marcus Group. However, the company's journey as an independent entity wasn't over. In a significant milestone, Mytheresa debuted on the New York Stock Exchange in 2021, achieving a valuation of more than $3 billion.

Recent years have seen continued innovation and expansion. In 2022, Mytheresa launched its Life category for home décor and lifestyle products and expanded into Greater China with a Shanghai office. In 2023, the company opened a new 55,000m² state-of-the-art distribution center at Halle/Leipzig Airport and introduced certified pre-owned luxury watches to its offerings. Today, Mytheresa stands as a testament to the Botschens' vision, offering products from over 200 of the world's most coveted luxury brands to customers in more than 130 countries.

To take a quick look at the business financially, Mytheresa reported net sales of €840.9 million in FY 2024 (Fiscal year ending on June 30th, 2024), a 9.8% increase from FY23, with GMV growing 7.1% to €913.6 million. The company's gross profit margin was 45.7%, down from 49.6% in the prior year. Adjusted EBITDA reached €25.8 million with a 3.1% margin. H2 FY24 saw improved performance, with net sales up 13.8% and GMV growth of 11.4%, alongside a significant profitability increase with an adjusted EBITDA margin of 4.3%. Q4 specifically showed net sales growth of 9.7% and GMV growth of 7.8%. The company continued to focus on exclusive brand collaborations and high-impact customer events. Mytheresa's Leipzig warehouse now processes over 80% of orders, leading to the decision to close the Heimstetten facility. For FY25, the company projects GMV and Net Sales growth between 7% and 13%, with an Adjusted EBITDA margin of 3% to 5%.

Throughout its evolution, Mytheresa has maintained its commitment to offering a curated selection of luxury brands, exclusive designer collaborations, and exceptional customer service. The company's success story illustrates how a deep understanding of fashion, coupled with strategic business acumen and a willingness to embrace digital transformation, can turn a local boutique into a global luxury e-commerce leader.

Yoox Net-a-Porter (YNAP)

Source: Hypebeast

Like Mytheresa, YNAP operates as a leading luxury e-commerce group formed by the merger of Yoox and Net-A-Porter in 2015. While Mytheresa was making waves in Germany, a parallel revolution in luxury e-commerce was unfolding in the UK and Italy. In 2000, two visionaries independently launched ventures that would combine to form YNAP. In London, Natalie Massenet, an American-born former fashion journalist with Women's Wear Daily and Tatler, founded Net-A-Porter. Massenet's innovative concept was to create a magazine-style website where readers could seamlessly "click to buy" the products featured in editorial content. This idea was born out of her experience trying to source products online for fashion shoots. With £1.2 million in start-up costs, raised with the help of her then-husband and co-founder Mark Quinn-Newall, Massenet launched Net-A-Porter from her Chelsea flat in London.

The early days of Net-A-Porter were marked by a scrappy, start-up mentality. The operation was so modest that the company's now-iconic black delivery boxes were initially stacked in Massenet's bathtub. Despite initial skepticism from designers and investors who questioned the viability of a luxury fashion retailer without a physical storefront, Net-A-Porter persevered. A breakthrough came in 2001 when designer Roland Mouret agreed to sell his collection through the website. By 2004, the same year it won "Best Fashion Shop" at the British Fashion Awards, Net-A-Porter had become profitable.

Simultaneously, in Milan, Federico Marchetti was launching Yoox, a company with a different but equally innovative approach to online luxury retail. The name YOOX, created by Costas Constantinou, cleverly combined the male (Y) and female (X) chromosome letters, linked by "OO," representing the infinity symbol. Yoox's business model focused on buying up overstocked or unsold items from previous seasons directly from renowned fashion houses and selling them online at discounted outlet prices. This approach allowed luxury brands to offload last year's merchandise without undermining their brand value or cannibalizing sales at their existing stores. Both companies experienced rapid growth in the following years. Net-A-Porter expanded its offerings, launching The Outnet, a site for previous seasons' designs at discount prices, in 2009, and Mr Porter, a menswear site, in 2011. The company also ventured into beauty products and print media, launching Porter magazine in 2014. Yoox, meanwhile, began building its own warehouses in 2007 and expanded beyond fashion into artwork sales. In 2008, Yoox launched The Corner, a full-price online menswear store, followed by womenswear in 2009.

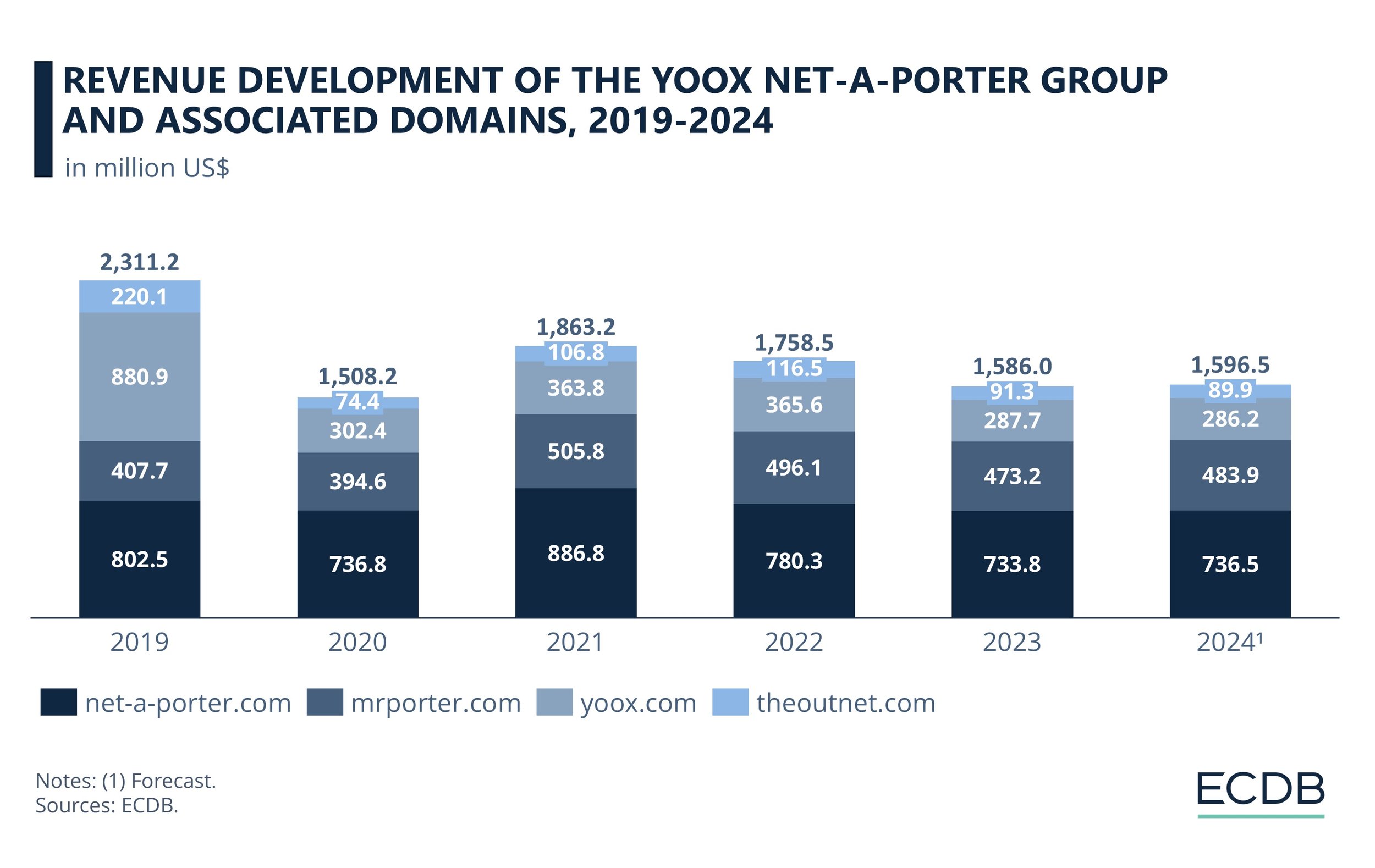

The trajectories of these two e-commerce pioneers converged in 2015 when Yoox and Net-A-Porter announced their merger. The deal, which went into effect in October of that year, created the YOOX Net-A-Porter Group (YNAP), a true powerhouse in online luxury retail. The combined entity boasted revenues of about $1.4 billion and 24 million unique visitors annually across its platforms. The merger brought together Net-A-Porter, Mr Porter, The Outnet, and Yoox under one corporate umbrella, serving customers in approximately 180 countries.

Following the merger, YNAP continued to evolve. In 2018, Swiss luxury goods holding company Richemont, which had previously invested in Net-A-Porter, acquired 95% of YNAP's available shares. This acquisition marked a new chapter for the group, integrating it more closely with one of the world's leading luxury conglomerates. However, challenges persisted, and in 2023, YNAP posted a significant €1.46 billion loss.

In 2023, Richemont had initially planned to sell a 47.5% stake in YNAP to Farfetch, but this deal fell through when Farfetch encountered financial difficulties. During the six-month period from April through September 2023, YNAP's sales declined by 10% at constant currency rates, and Richemont reported substantial write-downs related to YNAP:

A €3.4 billion write-down was announced in Richemont's full-year results for the previous fiscal year.

An additional €0.5 billion write-down was reported, reflecting both the decline in Farfetch's market capitalization (which had implications for the valuation of YNAP) and a reduction in the expected fair value of Richemont's remaining stake in YNAP.

In its financial reporting, Richemont classified YNAP under "discontinued operations," reporting a negative result of €655 million. This figure includes both operational losses and write-downs. When the €527 million write-down is subtracted from this total, it implies that YNAP's operational losses for the period were approximately €128 million.

These financial challenges ultimately led Richemont to seek a new buyer for YNAP, culminating in the acquisition by Mytheresa in 2024.

Richemont

To fully understand the context of this deal, we also need to take a closer look at Richemont, YNAP's parent company until the Mytheresa acquisition. Compagnie Financière Richemont SA, more commonly known as Richemont, is a Swiss-based luxury goods holding company with a rich history dating back to 1941. Founded by South African entrepreneur Anton Rupert, the company's journey from a small tobacco business to a global luxury powerhouse is a testament to strategic vision and astute acquisitions. The formal establishment of Richemont came in 1988 when Johann Rupert, Anton's son, proposed splitting the Rembrandt Group, creating a Swiss-based holding company for international assets and luxury brands. Listed on both the Swiss and Johannesburg stock exchanges, Richemont embarked on an aggressive expansion strategy under Johann Rupert's leadership, acquiring some of the world's most prestigious luxury brands.

Richemont's ownership structure is also worth mentioning, with the Rupert family maintaining significant control through Compagnie Financière Rupert, which holds 51% of the voting rights. Looking ahead, Richemont continues to focus on long-term sustainable growth, customer-centricity, and digital innovation while also placing increased emphasis on sustainability and diversity. This strategic direction, coupled with its impressive brand portfolio and global reach, positions Richemont to continue its dominance in the ever-evolving luxury goods market.

Today, Richemont's brand portfolio is a veritable who's who of the luxury world, spanning three main segments: Jewelry Maisons, Specialist Watchmakers, and Fashion & Accessories. Key brands include Cartier, Van Cleef & Arpels, IWC Schaffhausen, Jaeger-LeCoultre, Montblanc, and Chloé, among others. This diverse portfolio has driven impressive financial performance, with the company reporting sales of €20.6 billion and an operating profit of €4.8 billion in fiscal year 2024. Richemont's global presence is substantial, with over 2,400 mono-brand boutiques across more than 150 locations worldwide, employing over 40,000 people.

Source: Quartr

Industry Overview

Source: Grand View Research

The luxury goods market was valued at $366.23 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. This robust growth is fueled by several interrelated factors: rising disposable incomes in emerging markets like China and India, the increasing purchasing power of younger consumers (millennials and Gen Z), and the pervasive influence of social media and influencer marketing.

As the luxury market expands, it's simultaneously experiencing a dramatic shift towards digital channels. In 2023, e-commerce accounted for approximately 23% of total luxury sales, or roughly $84 billion – a significant leap from just 12% in 2019. This rapid digital transformation reflects changing consumer preferences and shopping habits, particularly among younger luxury consumers. Looking ahead, industry experts predict that by 2025, 30% of luxury sales will occur online, with this share potentially rising to 40% by 2030. This trajectory underscores the growing dominance of e-commerce in the luxury sector and the need for brands to adapt to this digital reality.

Within this evolving digital landscape, several key trends are reshaping how luxury brands engage with consumers. Personalization has become paramount, with companies leveraging AI and machine learning to offer tailored product recommendations and services. This data-driven approach not only enhances the shopping experience but also helps brands build stronger, more personalized relationships with their customers. Alongside this push for personalization, there's a growing emphasis on sustainability and ethical luxury. Consumers are increasingly demanding transparency in supply chains and eco-friendly practices, prompting luxury brands and retailers to prioritize sustainability initiatives in their operations and product offerings.

The focus on sustainability has also given rise to another significant trend: the growth of the resale market and circular economy within luxury goods. Platforms specializing in pre-owned luxury items are gaining traction, appealing to environmentally conscious consumers and those seeking more affordable entry points into luxury brands. This trend is not only addressing sustainability concerns but also broadening the consumer base for luxury goods, potentially reshaping traditional retail models in the process.

As the lines between online and offline shopping blur, successful luxury retailers are embracing omnichannel strategies. By integrating digital and physical touchpoints, brands aim to create seamless customer journeys that cater to diverse shopping preferences. This omnichannel approach is further enhanced by technological innovations such as augmented reality (AR) and virtual try-ons, which are bridging the gap between digital and physical retail experiences. These technologies offer new ways for consumers to interact with luxury products, potentially increasing engagement and reducing hesitation in online purchases.

While these trends are global in nature, their impact varies across different regions. North America and Europe continue to be important markets, but the Asia Pacific region is emerging as the key driver of growth in the luxury goods sector. In 2023, Asia Pacific accounted for 39.7% of global luxury goods revenue, with China playing a particularly significant role. This shift in the geographic center of luxury consumption is further emphasized by projections that by 2026, over one-third of the world's billionaires will be from the Asia Pacific region. This demographic shift represents both an opportunity and a challenge for luxury brands, requiring them to adapt their strategies to cater to the preferences and cultural nuances of these emerging markets.

Source: Grand View Research

Despite the promising growth prospects and exciting innovations, the luxury e-commerce industry faces several significant challenges. Perhaps the most fundamental is maintaining the essence of exclusivity in an increasingly accessible online environment. The digital landscape has made luxury goods more visible and available to a broader audience, potentially diluting the sense of rarity that many luxury brands cultivate. This democratization of luxury poses a complex challenge: how to leverage the reach of digital platforms while preserving the aura of exclusivity that is central to luxury branding.

Closely related to this issue is the persistent problem of counterfeit goods. The anonymity and reach of the internet have made it easier for counterfeiters to operate, threatening brand integrity and consumer trust. Luxury brands and e-commerce platforms must invest heavily in authentication technologies and processes to combat this threat, adding another layer of complexity to their digital operations.

Furthermore, the evolving regulatory landscape, particularly concerning data privacy, presents ongoing challenges for luxury e-commerce. As governments worldwide implement stricter data protection laws, luxury retailers must navigate complex compliance requirements while still striving to offer the personalized experiences that consumers have come to expect. This balancing act between personalization and privacy is likely to remain a key challenge in the coming years, requiring constant innovation and adaptation.

Finally, the competitive dynamics of the luxury market are also shifting, with many luxury brands increasingly focusing on direct-to-consumer (DTC) channels. This trend toward vertical integration poses a potential threat to multi-brand platforms as brands seek greater control over their online presence and customer relationships. As a result, e-commerce platforms in the luxury space must continuously innovate and add value to maintain their relevance in the market. Some major players in this market include LVMH Group, Kering SA, Chanel LTD, Burberry Group PLC, Prada S.p.A, Coty Inc., Estée Lauder Companies Inc., Shiseido Company, Limited, L'Oréal S.A., and Hermès International S.A.

Deal Rationale:

Buyer’s Perspective

First, Mytheresa’s decision to acquire YNAP is rooted in the pursuit of scale and market leadership. The combined entity will boast annual revenues exceeding €3 billion, instantly elevating Mytheresa's status in the luxury e-commerce sector. This increased scale is not merely about size; it translates into enhanced negotiating power with brands and suppliers, a critical advantage in an inflationary environment where margins are under pressure. Moreover, in a market where the ability to invest in technology and customer experience is paramount, the larger revenue base provides the financial muscle needed to drive innovation and growth.

Second, geographic complementarity is another key driver of this acquisition. Mytheresa has traditionally held a strong position in Europe, while YNAP has established a solid presence in North America. This acquisition creates a truly global platform, allowing for more efficient market penetration and cross-pollination of best practices across regions. The expanded geographic footprint not only diversifies revenue streams but also provides a hedge against regional economic fluctuations, an important consideration given the recent volatility in key luxury markets like China.

Third, the acquisition also represents a significant opportunity for data enrichment and enhanced customer insights. By combining their respective customer bases, Mytheresa gains access to a wealth of information on shopping behaviors and preferences across a broader spectrum of luxury consumers. This expanded data set will enable more sophisticated personalization strategies, targeted marketing efforts, and potentially, the development of new products and services tailored to evolving consumer demands.

Fourth, from a brand portfolio perspective, the acquisition allows Mytheresa to offer a wider range of brands and price points, catering to a more diverse customer base while maintaining its luxury positioning. YNAP's established relationships with top-tier luxury brands complement Mytheresa's curated selection, creating a more comprehensive offering that can appeal to a wider range of luxury consumers. This diversification is particularly important as the definition of luxury continues to evolve, with younger consumers often mixing high-end pieces with more accessible items.

Fifth, technological synergies represent another crucial aspect of this acquisition. YNAP has invested heavily in its technology stack and logistics infrastructure over the years. By leveraging these assets, Mytheresa can enhance its own operations and customer experience, potentially leapfrogging competitors in areas like personalization, inventory management, and delivery speed. In an industry where the quality of the digital experience is increasingly as important as the products themselves, these technological capabilities could prove to be a significant competitive advantage.

Finally, this acquisition can be seen as a strategic response to the growing threat of disintermediation and changing consumer behavior in the luxury sector. As more luxury brands invest in their own direct-to-consumer channels, multi-brand platforms like Mytheresa and YNAP need to offer compelling value propositions to both consumers and brand partners. This acquisition also comes at a moment when the luxury industry is grappling with changing consumer behaviors, such as the increase in online shopping, accelerated by the global pandemic. By consolidating two major players, this acquisition creates an entity better positioned to capture this growing online demand, and, with its enhanced scale, geographic reach, and technological capabilities, Mytheresa will be better equipped to remain a vital part of the luxury ecosystem.

Seller’s Perspective

For Richemont, the sale of YNAP to Mytheresa offers a strategic exit from a loss-making investment while allowing it to continue benefiting from potential growth in luxury e-commerce through its stake in Mytheresa.

After taking control of YNAP in 2018, Richemont struggled to make the e-commerce platform profitable, leading to significant write-downs—€1.5 billion and €3.4 billion in the last two fiscal years. Additionally, Richemont had attempted to sell YNAP to Farfetch in 2022, but the deal fell through when Farfetch encountered financial challenges.

Moreover, this deal with Mytheresa allows Richemont to finally divest YNAP while maintaining a 33% equity stake in Mytheresa. This ensures that Richemont retains exposure to the high-growth luxury e-commerce sector without the burden of operating YNAP directly. This partial stake aligns with Richemont's broader strategy of refocusing on its core luxury goods businesses, such as jewelry and watches, where it holds a stronger competitive advantage.

Deal Structure:

On October 7th, 2024, Richemont announced that it would sell YNAP to Mytheresa with a cash position of €555 million and no financial debt, subject to customary closing adjustments. In exchange, Richemont will receive a 33% equity stake in Mytheresa's fully diluted share capital. Additionally, Richemont will provide YNAP with a €100 million revolving credit facility over six years to finance its general corporate needs, including working capital.

Upon completion of the transaction, Mytheresa will integrate YNAP’s luxury divisions—Net-A-Porter and Mr Porter—into its platform, creating a unified group with distinct luxury storefronts. This integration will leverage shared infrastructure and operational best practices while maintaining the brands' unique identities. YNAP’s off-price divisions, comprising Yoox and The Outnet, will be separated from the luxury segment to create a more efficient operating model. The deal also involves the discontinuation of YNAP’s white-label division once Richemont’s Maisons migrate to other platforms.

Richemont will retain significant influence within the new entity, gaining the right to nominate a member and an observer to Mytheresa's Supervisory Board. Furthermore, Richemont's shareholding in Mytheresa will be subject to a one-year lock-up period post-closing, followed by an additional year where only limited sales transactions may occur.

This transaction, expected to close in the first half of 2025, is subject to customary regulatory approvals. Richemont anticipates a €1.3 billion write-down on YNAP’s net assets, which accounts for various factors such as Mytheresa's share price, currency fluctuations, and YNAP's financial position at the time of closing.

Deal Discussion:

A particularly fascinating dynamic in the luxury market today is the tight relationship between China’s property market and luxury demand, which is starkly illustrated by the country's "ghost cities." The correlation between China’s real estate values and the purchasing behavior of its luxury consumers runs deep. Roughly 60% of Chinese household wealth was tied to property before prices peaked in 2021, and as home values have collapsed, so too has consumer confidence. Barclays estimates that falling home prices have destroyed approximately $18 trillion in household wealth, equating to roughly $60,000 per family. This has created a significant chilling effect on discretionary spending, with a 17% drop in luxury consumption among affluent Chinese consumers so far in 2024.

Source: WSJ

This decline in wealth is hitting luxury brands hard. Chinese consumers, who account for about one-third of global luxury spending, are pulling back, and UBS estimates that luxury sales to Chinese shoppers will shrink by 7% in 2024, with an additional 3% decline projected for 2025. Luxury spending in China has always been closely tied to property wealth rather than the stock market or broader economic growth, which means efforts by Beijing to kickstart the economy—such as cutting mortgage rates and rolling out consumption coupons—are doing little to stimulate high-end purchases. For luxury brands, this creates a substantial risk, given that fixed costs like expensive retail rents remain high, meaning any reduction in revenue from key customers like Chinese luxury buyers could disproportionately affect profit margins.

In the context of the Mytheresa-YNAP acquisition, this downturn in Chinese luxury spending is a crucial factor shaping the rationale for the deal. By acquiring YNAP, Mytheresa is strategically positioning itself to diversify its revenue streams away from a heavy reliance on China. As Chinese spending continues to falter, luxury e-commerce platforms like Mytheresa are turning their focus to more stable markets in Europe and North America, as well as emerging markets that could compensate for the decline in Chinese demand. Geographic diversification is essential for luxury retailers now more than ever, and this acquisition allows Mytheresa to leverage YNAP’s infrastructure to expand its global footprint and mitigate the risk posed by economic volatility in China.

The situation in China’s property market affects not only how luxury retailers allocate their resources but also how they tailor their marketing and product strategies. Luxury brands may need to shift their focus away from Chinese consumers in the short term, but the longer-term implications are profound. Chinese consumers who typically spend between $7,000 and $43,000 annually on luxury goods are pulling back due to uncertainty around their personal finances, and this group is unlikely to return to its previous levels of spending until property values stabilize. This forces retailers like Mytheresa to rethink their approach, prioritizing consumers in markets where economic conditions are more favorable while keeping a close watch on any potential recovery in China.

The ghost cities themselves serve as a symbol of the over-leveraged, overbuilt nature of China’s property market, where an estimated 60 million housing units sit unoccupied. These half-finished developments are not only a headache for the Chinese government but also for luxury brand executives in Paris and Milan, whose revenues are tied to the financial health of China’s affluent consumers. While luxury brands are unlikely to be top of mind for Chinese policymakers, their fates are indeed intertwined. A significant recovery in the luxury market depends, in part, on Beijing’s ability to stabilize home prices and restore consumer confidence. However, more recently, despite initial hopes raised by Beijing's aggressive stimulus plans announced last month that unleashed a boom in the Chinese stock market, China's economic planning agency failed to announce additional measures to kickstart growth as some investors had hoped. This lack of follow-through on economic stimulus is particularly concerning for the luxury sector.

For Mytheresa, this deal with YNAP isn’t just about expanding scale—it's also about adapting to a shifting global luxury landscape. As China's real estate woes continue to unfold, luxury retailers must find new ways to engage consumers in other regions while staying nimble enough to re-enter the Chinese market when the opportunity arises. The scale and infrastructure that Mytheresa gains from YNAP provide it with the flexibility to navigate this uncertainty. This allows Mytheresa to build resilience against potential downturns in specific markets while still positioning itself to capture renewed demand when China's economic conditions improve.

The luxury sector’s reliance on China has long been a double-edged sword, and the current downturn illustrates how interconnected the fates of luxury brands and China’s economic health really are. Mytheresa’s acquisition of YNAP represents a strategic response to this evolving risk landscape, giving the combined entity the strength to withstand the shifting winds of global luxury demand. As China's ghost cities continue to cast a shadow over consumer sentiment, luxury retailers will need to keep adjusting their strategies, ensuring they’re not overly exposed to any one market's fortunes.

Abandoned Real Estate Project in China. Source: Architectural Digest

Bear or Bull?

Bull Case

The bull case, in short, is the deal rationales executed well.

Yet, the Mytheresa-YNAP acquisition can exceed initial expectations based on the strategic rationale, potentially catapulting the combined entity to the forefront of luxury e-commerce. By leveraging their combined technological prowess and data resources, they might develop predictive algorithms that anticipate fashion trends, giving them a significant edge in inventory management and customer offerings. Geographically, they could be uniquely positioned to capture emerging luxury markets in Southeast Asia or the Middle East, areas currently underserved by existing players. Their enhanced focus on sustainability could evolve into a major differentiator, potentially pioneering new industry standards in eco-friendly practices or circular fashion. Moreover, Richemont's retained stake might open doors to exclusive brand collaborations or first access to limited collections, further cementing the platform's appeal to discerning luxury consumers. In the best-case scenario, this acquisition could redefine the luxury e-commerce landscape, setting new benchmarks for personalization, sustainability, and global reach that competitors will struggle to match, ultimately delivering value that exceeds the initial €3 billion combined Gross Merchandise Value.

Bear Case

However, the acquisition is not without significant challenges that could undermine its success. Chief among these is YNAP's historical struggle with profitability, as evidenced by Richemont's substantial write-downs in recent years. Turning around an underperforming asset of this size will require considerable effort and resources from Mytheresa, potentially diverting attention and capital from other growth initiatives.

The integration process itself presents another major hurdle. Merging two large e-commerce operations is inherently complex and risky, with the potential for operational disruptions that could alienate customers and strain relationships with brand partners. This risk is compounded by the need to maintain the distinct identities of each platform while realizing synergies – a delicate balance that will require skilled management.

The competitive landscape adds another layer of complexity to the deal. Established players like Farfetch and Matchesfashion continue to innovate, while luxury brands are increasingly focusing on direct-to-consumer strategies. This trend towards disintermediation could reduce the importance of multi-brand platforms like Mytheresa and YNAP, challenging their value proposition in the luxury ecosystem.

Macroeconomic factors, particularly in China, pose a further threat. With luxury sales in China expected to decline, a prolonged downturn in this key market could have ripple effects across the entire industry. While geographic diversification helps, a global luxury market without a strong Chinese consumer base could significantly impact the combined entity's growth prospects.

Financial considerations also weigh heavily on the bear case. While the deal structure appears favorable, with YNAP coming with a cash position and no debt, Mytheresa may still need to take on significant debt to finance the acquisition and fund necessary investments. This increased leverage could strain Mytheresa's balance sheet, limiting its flexibility to respond to market changes or pursue other strategic initiatives.

Lastly, regulatory scrutiny presents another potential hurdle. As the deal creates a significant player in the luxury e-commerce space, it may attract antitrust attention, particularly in Europe, where both companies have a strong presence. Any regulatory challenges could delay the deal's completion or result in required divestitures, potentially undermining some of the anticipated synergies.

Final Verdict: Bearish

For the first time in the three-month history of M&A Fabric, I’m leaning slightly bearish on an acquisition. The potential for Mytheresa to emerge as a dominant force in luxury e-commerce is undeniable. The combined scale, geographic diversification, and technological capabilities position the company to capitalize on the ongoing shift toward online luxury shopping. The ability to offer a truly global, multi-brand platform with advanced personalization capabilities could indeed set a new standard in the industry.

However, the challenges and risks associated with this acquisition are significant and cannot be overlooked. YNAP's historical profitability issues, as evidenced by Richemont's substantial write-downs, present a formidable hurdle. The integration process will be complex and resource-intensive, potentially distracting Mytheresa from its core operations. The competitive landscape is intensifying, with both established e-commerce players and luxury brands themselves strengthening their direct-to-consumer strategies. The recent disappointment in China's economic stimulus measures underscores the fragility of the luxury market's biggest growth engine. Ultimately, while Mytheresa's management has demonstrated strong execution in the past, the magnitude of this acquisition and the challenges it presents make it difficult to be overly optimistic about its short to medium-term prospects. The potential rewards are substantial, but the risks are equally significant. Mytheresa will need to navigate these challenges with exceptional skill to realize the full potential of this acquisition.