Transparency, Gaming, and Energy Drinks: Inside Keurig Dr Pepper's Acquisition of GHOST

Source: Brewbound

The FDA cites that 400 milligrams of caffeine per day is generally the upper limit for safe caffeine consumption in most healthy adults… so that’s exactly how much caffeine I drink every day. A fasted cup of black cold brew in the morning, followed by Ito-En green tea throughout the day, and a non-negotiable pre-workout/soccer energy drink have been my go-to routine since my senior year of high school. While my choices of coffee and green tea have stayed relatively consistent throughout the years, I just can’t seem to settle on one kind/brand of energy drink or pre-workout before my gym sessions or soccer practices. But in defense of my indecisiveness, there always seem to be new energy drink brands and flavors popping up every couple of months or even weeks.

The energy drinks selections in convenience stores, supermarkets, and even my Amazon shopping feed look vastly different from what they did a couple of years ago and pretty different even from what they looked like last year. Gone are the days when the choices were limited to Red Bull, Monster, and Rockstar, each competing to be the most “extreme.” Today, browsing the coolers feels more like exploring a carefully curated boutique, with sleek cans sporting everything from gaming collaborations to better-for-you ingredients. Celsius, Reign, C4, Prime, and Ghost are just a few names of the many emerging energy drink brands trying to differentiate themselves in a rapidly growing energy drink market.

On October 24, 2024, Keurig Dr Pepper (KDP) announced it would acquire a 60% stake in Ghost Energy for $990 million in cash, with plans to purchase the remaining 40% in 2028. The deal values Ghost at approximately 16.1x EBITDA, a premium that reflects both Ghost's rapid growth—having more than quadrupled its sales in just three years—and KDP's ambitions in the energy drink category. But this isn't just another beverage industry consolidation play. Ghost's success represents something larger: a shift in how younger consumers view and consume energy drinks, moving from pure functionality to lifestyle and identity.

For KDP, a company historically associated with coffee pods and soft drinks, this acquisition marks a bold move in building what it calls a "platform approach" to the rapidly expanding energy drink category. Following its stake in C4 Energy and distribution agreement with Black Rifle, KDP is assembling a portfolio that covers multiple consumer need states: C4 for performance, Black Rifle for patriot-minded coffee lovers, and now Ghost for lifestyle and gaming enthusiasts. This acquisition also raises several intriguing questions about the future of the beverage industry. How are changing consumer preferences toward cleaner ingredients and transparency reshaping the energy drink landscape? What roles do social commerce and gaming culture play in building modern beverage brands? And perhaps most importantly, how are traditional distribution networks evolving to meet the demands of digital-first brands? The answers to these questions could determine not just the success of this acquisition but the very future of how we discover, consume, and connect with beverage brands."

Company Overviews:

Another fun company history to dive into, particularly because it really is three stories intertwined into one.

Keurig Dr Pepper

The story of Keurig Dr Pepper is really three stories in one: a coffee revolution, a soda romance, and a modern beverage powerhouse. While most know the company from its ubiquitous K-Cup coffee pods or the distinctive 23 flavors of Dr Pepper, the path to becoming a $50+ billion beverage giant is filled with strategic moves, bold bets, and transformative mergers.

Morrison’s Old Corner Drug Store. Source: Dr. Pepper Musuem

The oldest chapter of this story begins in 1885 in Waco, Texas, at Morrison's Old Corner Drug Store. Wade B. Morrison employed a pharmacist named Charles Courtice Alderton who, when not filling prescriptions, experimented with various combinations of fruit extracts and sweeteners at the store's soda fountain. One particular blend of twenty-three flavors proved enormously popular with customers. Initially called a "Waco," Morrison would later rename it "Dr Pepper" (though the reason for this name choice remains a mystery to this day).

As demand grew beyond what the drugstore could produce, Morrison partnered with beverage chemist Robert S. Lazenby to form the Artesian Manufacturing and Bottling Company in 1891. The drink's popularity led to its first major expansion when the Southwestern Soda Fountain Company of Dallas purchased the rights to produce and sell Dr Pepper fountain syrups in 1898. By 1902, the company had changed its name to Dr. Pepper Company, and in 1904, it made its national debut at the Louisiana Purchase Exposition in St. Louis.

The company's early marketing was innovative for its time. In the 1920s, Dr Pepper developed its famous "10-2-4" slogan based on research from Columbia University's Dr. Walter H. Eddy, who found that human blood sugar levels dropped at 10:30 AM, 2:30 PM, and 4:30 PM. The company leveraged this research through its "Drink a Bite to Eat" campaign, which gained new significance during World War II when sugar rationing threatened the soft drink industry. Dr Pepper successfully positioned itself as an energy booster for soldiers and workers through a promotional booklet titled "The Liquid Bite."

The post-war era brought significant growth. In 1945, the company built a new headquarters in Dallas, featuring a stunning four-story facility with custom murals by New York artist Arthur Crisp. A landmark legal victory came in 1963 when a district court ruled that Dr. Pepper was not a cola, allowing independent bottlers to distribute Dr Pepper alongside Coca-Cola or Pepsi without violating franchise agreements. This ruling helped fuel explosive growth—under CEO Woodrow Wilson Clements' leadership, from 1968 to 1977, sales skyrocketed from $41.9 million to $226.8 million.

Nearly a century after Dr Pepper's creation, the second chapter of our story began in 1981, when Bob Stiller, after tasting an exceptional cup of coffee near a Vermont ski resort, traced it back to its source in Waitsfield, Vermont. With an entrepreneurial spirit and $20,000 borrowed from family, Stiller purchased a two-thirds stake in what would become Green Mountain Coffee Roasters. By 1984, Stiller became the sole proprietor, buying out his partners for $100,000. Those early years were lean—it took four years to turn a profit—with Stiller selling to anyone who would buy, from gas stations to high-end restaurants, even giving away free samples when advertising budgets ran dry. His persistence paid off; by 1991, Green Mountain had over a thousand wholesale clients, generating $11 million in annual sales with a profit of $200,000.

Left to Right: Sweeney, Sylvan (photoshopped on), and Dragone with early models of the Keurig brewer and K-Cup pods. Source: Buy/Don’t Buy

Meanwhile, the third strand of our story was taking shape at Colby College in Maine during the late 1970s, where John Sylvan and Peter Dragone first met as roommates. In 1992, they united their entrepreneurial spirits to found Keurig, choosing the name thinking it meant "excellence" in Dutch (it actually translates closer to "proper" or "neat"). The early days were marked by constant setbacks, with unreliable prototype machines threatening to derail the company before it even got started. A breakthrough finally came in 1994 when a Minneapolis-based investor provided a crucial $50,000 investment, followed by a more substantial $1 million from a Cambridge-based fund.

The paths of Green Mountain and Keurig began to converge in 1993 when, along with their partner Dick Sweeney, Sylvan and Dragone met up with Bob Stiller to talk about building a single-cup coffee maker, and Stiller bought a stake in the company, seeing the potential of single-serve coffee brewing. By 1996, Green Mountain had acquired a 35% stake in the company. In 1998, Keurig unveiled its inaugural brewing system, the B2000, designed specifically for office environments, with an ingenious business model—provide brewing machines to distributors for free and profit from ongoing K-Cup pod sales.

A quick side note here on Keurig’s business model: Although many compare Keurig’s recurring revenue model to the “razor and blades” model, the pod maker’s business model stands out from the traditional model by creating a more positive purchasing experience. Rather than a costly and frustrating replacement model—like ink cartridges or razor blades—where the consumable feels like a necessary expense, Keurig’s K-Cups are what customers actually desire. The coffee machine simply serves as the vehicle, making each purchase a satisfying choice rather than a begrudged necessity. This psychological shift builds brand loyalty, reduces consumer frustration, and drives recurring revenue in a more sustainable way.

But I digress. By the 2000s, Keurig made its pivotal move into the home market with the launch of the B100 brewer, supporting it with aggressive in-store demonstrations and sampling programs. By 2006, Green Mountain had fully acquired Keurig, setting the stage for explosive growth. This acquisition marked a fundamental shift in Green Mountain's business model, transitioning from low-margin wholesale coffee to high-margin single-serve pods. The numbers tell the story: K-Cup sales commanded $40-50 per pound compared to less than $10 per 10-ounce bag for traditional coffee. Nonetheless, success brought challenges, including environmental concerns about K-Cups and patent expiration in 2012. The company was acquired by JAB Holding Company for $13.9 billion in 2015, setting the stage for its transformative merger with Dr Pepper Snapple Group in 2018, creating Keurig Dr Pepper in an $18.8 billion deal.

Now, to tie it all together, we can return to the Dr. Pepper side of the story. The 1970s marked both triumphs and challenges for Dr Pepper. The company expanded its portfolio to include Diet Dr Pepper, Pepper Free (a caffeine-free version), Canada Dry, and Welch's soda flavors. In 1977, the company launched what would become one of its most successful advertising campaigns ever—"Be a Pepper." Featuring David Naughton's catchy "I'm a Pepper" jingle, the campaign helped drive Dr Pepper to become the nation's fourth-largest soft drink company by 1983, capturing a 6.9% market share.

However, the late 1970s and early 1980s brought significant headwinds. The company took on substantial debt, acquiring bottling plants and purchasing Canada Dry in 1982 for $175 million. As the soft drink market matured and competition intensified, Dr Pepper found itself in an increasingly difficult position. The company's market share declined from 5.5% to 4.9% between 1980 and 1983, squeezed by the marketing muscle of Coca-Cola, PepsiCo, and Seven-Up (then owned by Philip Morris). The proliferation of new brands, starting with Seven-Up's Like Cola in 1982, also pushed Dr Pepper off valuable shelf space.

Under President Chuck Jarvie, the company shifted focus to national advertising at the expense of supporting independent bottlers, weakening these crucial relationships. Though sales increased from $370.6 million in 1981 to $516 million in 1982, this growth was largely attributed to the Canada Dry acquisition. Earnings told a more sobering story, falling from $29.9 million in 1981 to $12.5 million in 1982.

By late 1983, Dr Pepper began searching for a buyer, preferably a large conglomerate, that could help it compete more effectively. The search culminated in February 1984 when shareholders accepted a leveraged buyout offer from Forstmann, Little, and Company, taking the company private at $22 per share. Under new ownership, Dr Pepper sold off many fixed assets, including Canada Dry (to R.J. Reynolds Industries for about $175 million) and all ten company-owned bottling plants.

Source: Tea and Coffee Trade Journal

Despite these challenges, Dr Pepper showed remarkable resilience. By 1985, its centennial year, the brand had climbed to the number three position in the market with a 7.5% share, marking the biggest sales year in the company's 100-year history. Another major transformation came in 1986 when Dr Pepper merged with Seven-Up after both companies were acquired by investment firm Hicks and Haas. Manufacturing operations moved to St. Louis, though corporate headquarters remained in Dallas. By 1992, Dr Pepper/Seven-Up Companies, Inc. had become the industry's third-largest marketer, with an 11.1% domestic market share and net sales exceeding $658 million. In 1995, Cadbury Schweppes acquired the company, renaming it Cadbury Schweppes Americas Beverages and establishing a new headquarters in Plano, Texas. Yet, after a decade and some change, the soft drink divisions were later spun off in 2008 to create the Dr Pepper Snapple Group and ultimately merged with Keurig to create the beverage conglomerate we know today.

Today, KDP operates a vast portfolio spanning coffee, soft drinks, water, and energy beverages. The company generated $51.36 billion in revenue and $5.7 billion in profit in FY2024, showing 12% year-over-year profit growth despite macroeconomic headwinds. Under the leadership of CEO Tim Cofer, KDP continues to demonstrate an appetite for strategic acquisitions and partnerships that extend beyond its traditional categories, as evidenced by its investments in C4 Energy, distribution agreement with Black Rifle Coffee's energy drinks, and most recently, its acquisition of Ghost Energy. This latest chapter suggests that the innovative spirit that drove both Charles Alderton's original 23-flavor experiment and Green Mountain's embrace of single-serve coffee continues to shape KDP's strategy in the modern beverage industry.

GHOST

Founded by Dan Lourenco and Ryan Hughes in 2016, Ghost initially made its mark as the "first lifestyle sports nutrition brand," challenging the traditional, perfection-driven fitness industry with a focus on authenticity and community. Ghost’s entry into energy drinks in 2020, through a partnership with Anheuser-Busch InBev, leveraged its established presence in supplements and resonated with consumers seeking transparency and functionality. Unlike traditional brands that limit flavor to basics, Ghost built its identity on co-branded flavors, collaborating with iconic brands like Sour Patch Kids, Warheads, and Oreo to craft familiar, crave-able tastes that transcend typical fitness products. This innovation instantly broadened Ghost's appeal, as each product introduced an element of nostalgia, drawing a diverse audience beyond core fitness enthusiasts.

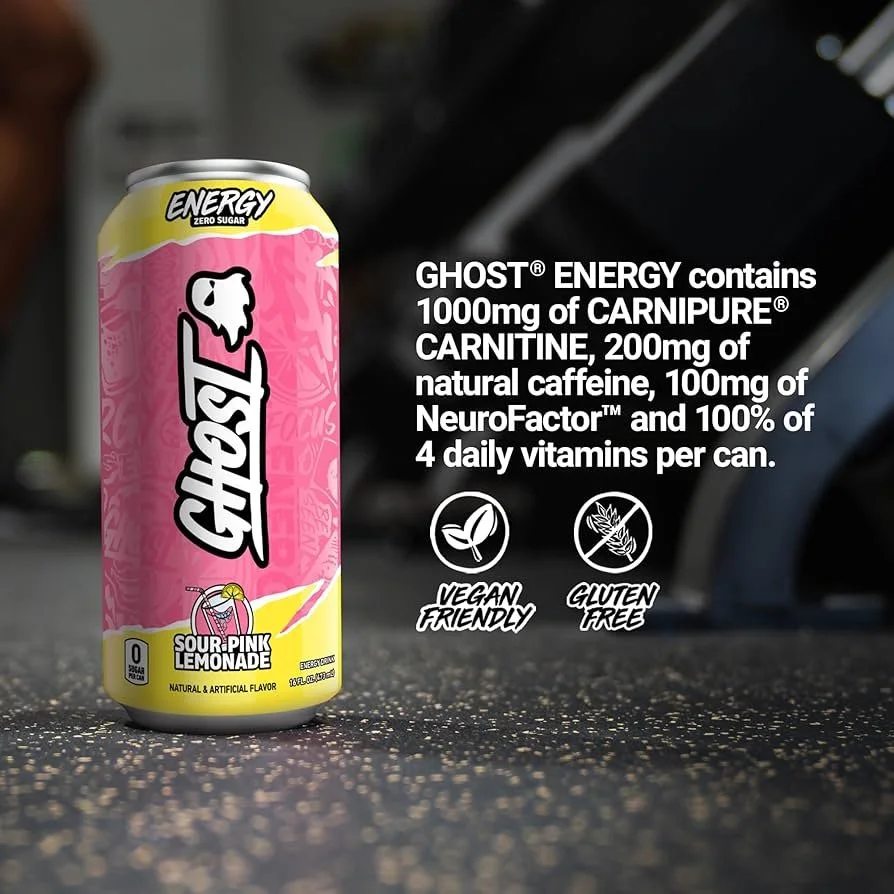

While traditional energy drink brands relied on extreme sports sponsorships and masculine marketing, Ghost built its identity around gaming culture, social media engagement, and innovative flavor collaborations. The brand's partnerships with iconic candy brands like Sour Patch Kids, Warheads, and Swedish Fish helped create a unique identity that resonated with younger consumers who grew up gaming and scrolling through TikTok. Ghost Energy’s “full disclosure” approach also sets it apart by listing all active ingredients, offering a refreshing alternative to the often-opaque formulas of competitors. The brand aims for simplicity in its ingredients, focusing on what works without proprietary blends, which it felt were barriers to transparency. Ghost’s internal marketing team champions a direct, unfiltered communication style, including a YouTube series called "Behind the Brand" that reveals its product development and entrepreneurial journey, resonating with consumers who crave connection and authenticity.

Through a partnership with Anheuser-Busch InBev, Ghost Energy launched into the broader convenience and grocery market in 2021. The brand's growth has been nothing short of meteoric, expanding from availability in just five to six markets to national distribution at major chains like Kroger, 7-Eleven, and Publix. This rapid expansion helped Ghost capture approximately a 3% share of the energy drink market, an impressive feat in a category dominated by established players.

Source: Walmart

Industry Overview:

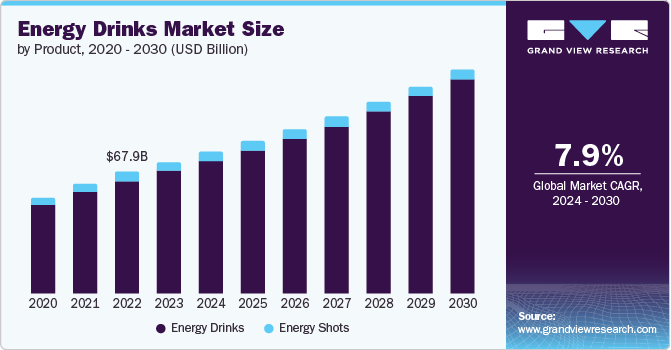

The global energy drinks market, valued at USD 73.81 billion in 2023, is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2024 to 2030. Currently valued at $23 billion in the U.S. alone, the category has evolved far beyond its origins as a niche product for late-night truckers and college students pulling all-nighters. Today's energy drink market reflects broader shifts in consumer behavior, technology, and culture, particularly in how younger generations approach health, wellness, and social identity.

Source: Grand View Research

Several key trends are reshaping the energy drinks landscape. First, we're seeing a significant shift in consumption occasions. While energy drinks were historically associated with extreme sports or cramming for exams, they've become everyday lifestyle products. According to recent market research, over 30% of adolescents in the U.S. and up to 70% in Europe report regular consumption of energy drinks. This mainstreaming of energy drinks has led to a proliferation of sub-categories targeting specific consumer needs and occasions.

The demographic profile of energy drink consumers has also evolved dramatically. The category is no longer dominated by young male consumers seeking an aggressive, extreme image. Today's energy drink market over indexes with what industry analysts call "Genzennials"—the overlap of younger Millennials and Gen Z consumers who prioritize authenticity, transparency, and digital engagement. These consumers approach energy drinks differently than previous generations, seeking products that align with their values and lifestyle rather than just functional benefits.

Perhaps the most significant shift has been in how brands go to market. Traditional distribution models, built around beer distributors and convenience stores, are being challenged by direct-to-consumer channels and digital marketing. The rise of gaming culture has been particularly influential, with esports and streaming creating new occasions and communities around energy drink consumption. This has led to a boom in gaming-focused energy drinks, with brands competing for a share of the throat in both physical and digital spaces.

However, the industry faces several headwinds. Health concerns around high caffeine and sugar content continue to draw scrutiny from regulators and health advocates. This has driven innovation in "better-for-you" formulations, with brands introducing natural caffeine sources, reduced sugar options, and functional ingredients like nootropics and adaptogens. The category has also become increasingly competitive, with traditional beverage companies, startup brands, and even retailers launching their own energy drink lines.

Distribution remains a critical battlefield. The traditional three-tier beverage distribution system is evolving as brands experiment with direct-to-consumer models and alternative routes to market. This has created tension between established distribution networks and emerging channels, particularly as brands seek to balance scale with maintaining premium positioning and brand authenticity.

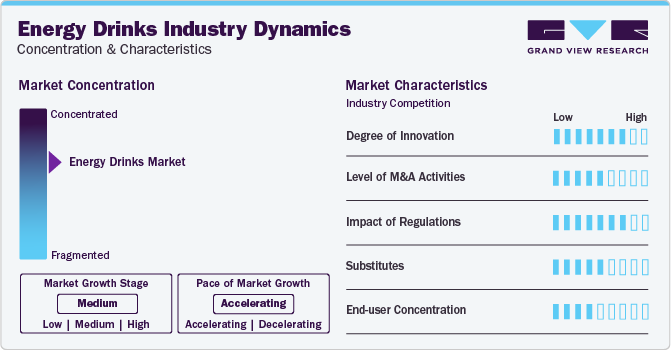

The competitive landscape is equally complex. While Red Bull and Monster still dominate with a combined market share exceeding 70%, challenger brands like Celsius, C4, and Ghost have carved out significant niches by targeting specific consumer segments and need states. This fragmentation has led to a wave of consolidation as larger beverage companies seek to build comprehensive energy drink portfolios. Recent examples include PepsiCo's $550 million investment in Celsius and KDP's stake in C4.

Source: Grand View Research

Price dynamics within the category are also evolving. Premium pricing has become more common as brands position themselves as lifestyle products rather than merely functional beverages. The average price per unit has increased by over 15% since 2020, driven by both premiumization strategies and inflationary pressures. Despite these price increases, category volume growth has remained robust, suggesting strong consumer loyalty and relatively inelastic demand.

Looking ahead, several trends bear watching. The rise of GLP-1 weight loss drugs like Ozempic could impact consumption patterns, potentially accelerating demand for sugar-free and functional energy products. The growing influence of social media and gaming culture continues to reshape marketing and distribution strategies. Additionally, environmental concerns around packaging and sustainability are driving innovation in materials and supply chain practices.

Deal Rationale:

Buyer's Perspective

As KDP CEO Tim Cofer stated in the announcement, "GHOST is a differentiated brand with significant growth potential, and we are excited to partner with its founders to take the business to the next level. This acquisition strengthens our position in the attractive energy drink category, accelerating our portfolio evolution toward consumer-preferred, growth-accretive spaces through a disciplined deal structure."

The rationale behind KDP's $990 million investment can be broken down into several key components:

First, this acquisition represents KDP's commitment to building a platform-based approach to the energy category. With C4 Energy serving the performance segment, Black Rifle targeting the patriot-minded consumer, and now Ghost capturing the gaming and lifestyle space, KDP is assembling a portfolio that addresses distinct consumer need states. This diversified approach allows KDP to compete more effectively against category leaders like Monster and Red Bull, who have historically dominated through a one-brand-fits-all strategy.

Second, Ghost's direct-to-consumer expertise and social media savvy provide KDP with valuable capabilities in digital engagement and e-commerce. While KDP has strong relationships with traditional retailers, Ghost brings expertise in building direct relationships with consumers through social media, influencer partnerships, and online sales. This digital-first approach is particularly valuable as younger consumers increasingly discover and purchase beverages through social platforms.

Third, Ghost's strong position in the gaming community opens up new opportunities for KDP. The gaming industry, worth over $300 billion globally, has become a crucial battleground for beverage brands. Ghost's partnerships with esports organizations and gaming influencers give KDP immediate credibility in this space, something that would be difficult to build organically.

Finally, the deal structure—acquiring 60% now with a path to full ownership in 2028—allows KDP to learn from Ghost's founders while maintaining the entrepreneurial culture that has driven the brand's success. This staged approach also helps manage integration risks and provides time for KDP to understand and preserve the unique elements that make Ghost appealing to its core consumers.

Seller's Perspective

I think Ghost CEO Dan Lourenco explains the rationale pretty well: "We could not be more excited to build the future of GHOST together with KDP. As we thought about our company's next chapter, KDP's track record of cultivating disruptive brands, similar challenger mindset, and shared vision for the energy category and beyond made it the right home for our brand and team."

For Ghost's founders, the decision to partner with KDP offers several compelling advantages. First, KDP's extensive distribution network and operational infrastructure can accelerate Ghost's growth beyond what would be possible independently. KDP's announcement of a $250 million investment to transition Ghost's distribution agreements suggests a firm commitment to scaling the brand.

The timing of the sale also appears opportune. With interest rates at historic highs and consumer spending showing signs of pressure, partnering with a larger strategic buyer provides Ghost with financial stability and resources to continue its growth trajectory. The deal's structure, which keeps the founding team involved, suggests a focus on long-term value creation rather than a quick exit.

Deal Structure:

KDP's acquisition of Ghost includes several key components that reveal the strategic thinking behind the deal. The initial $990 million cash investment for a 60% stake values the company at approximately 3x net revenue or 16.1x EBITDA on a projected 2024 basis. After accounting for anticipated cash tax benefits of around $140 million (net present value), the enterprise valuation represents an attractive multiple compared to recent beverage industry transactions.

The deal is structured in two stages: the initial 60% stake acquisition, followed by the purchase of the remaining 40% in 2028 at a pre-negotiated valuation scale reflecting Ghost's 2027 financial performance. This phased approach serves multiple purposes: it aligns incentives for Ghost's founders to continue growing the business, provides KDP time to learn Ghost's unique culture and operations, and spreads the financial impact across multiple years.

Additionally, KDP plans to invest up to $250 million starting in mid-2025 to transition Ghost Energy's existing distribution agreements before integrating the brand into KDP's direct store delivery network. This significant investment in distribution infrastructure demonstrates KDP's commitment to maintaining Ghost's growth momentum while bringing it into its established system.

For this deal, BofA Securities served as financial advisor to Keurig Dr Pepper, with Cleary Gottlieb Steen & Hamilton LLP acting as legal advisor. Morgan Stanley & Co. LLC served as financial advisor to GHOST, with Winston & Strawn LLP acting as legal advisor.

Deal Discussion:

The acquisition of Ghost by Keurig Dr Pepper (KDP) sheds light on three fundamental shifts reshaping the beverage industry: the evolution of consumer preferences toward cleaner ingredients and transparency, the growing influence of social commerce and gaming culture in brand building, and the transformation of traditional distribution networks to meet digital-first demands. Each of these trends carries broader implications for how food and beverage companies must adapt to changing consumer expectations and purchasing behaviors.

1. Evolving Consumer Preferences Toward Cleaner Ingredients and Transparency

First, the consumer demand for transparency and cleaner ingredients is a driving force behind the beverage industry’s transformation. According to Mintel’s 2025 Food & Drink Trends report, 31% of consumers are actively seeking beverages with no added sugar, reflecting a significant shift toward health-conscious consumption. Ghost’s “first full disclosure” approach directly addresses this demand by listing exact ingredient quantities, thereby providing a level of transparency that builds consumer trust.

Source: Amazon

Furthermore, the rise of GLP-1 weight loss medications like Ozempic has impacted the market by prompting consumers to redefine their relationship with food and drink. A study published in the Journal of Diabetes Science and Technology (Smith et al., 2022) found that patients using GLP-1 medications are increasingly focused on nutritional density and health benefits over calorie counting. Ghost's clean ingredient positioning aligns with these shifts, tapping into the growing demand for “food as medicine”—a concept emphasizing products that offer functional benefits such as improved mental clarity or enhanced stamina.

This trend is part of a broader movement in the beverage sector, where brands are crafting products that not only refresh but also contribute to a healthier lifestyle. Energy drinks, historically criticized for high sugar content and synthetic additives, are embracing the clean-label movement. While competitors like Celsius and Bang have introduced functional ingredients like adaptogens and botanical extracts, Ghost sets itself apart through its commitment to full transparency and the use of clinically studied ingredients at efficacious doses. Unlike brands that rely on proprietary blends, Ghost provides consumers with detailed product information, enhancing credibility and differentiating itself in a crowded market.

2. The Influence of Social Commerce and Gaming Culture

Building on the importance of health and transparency, brands are increasingly recognizing the need to connect with consumers through their lifestyles and interests, especially in the digital sphere. The rise of gaming culture exemplifies this shift. According to Newzoo's 2023 Global Games Market Report, over 81% of Gen Z individuals play video games regularly, making gaming a mainstream cultural platform. Ghost's partnerships with esports organizations like FaZe Clan and collaborations with nostalgic brands like Sour Patch Kids demonstrate an astute understanding of where their target audience spends time and attention.

By embedding itself within gaming culture, Ghost transcends traditional marketing by becoming an active participant in its consumers' daily experiences. This deepens brand engagement and fosters a sense of community and belonging. Ghost leverages social media platforms, live streams, and influencer collaborations to create interactive and immersive marketing campaigns. For example, hosting gaming tournaments or releasing limited-edition products tied to popular games generates excitement and encourages consumers to share their experiences online, amplifying the brand's reach through user-generated content.

Source: Amazon

This approach transforms energy drinks from mere consumables into symbols of lifestyle and identity, resonating with consumers on a personal level. It taps into experiential marketing, focusing on creating memorable interactions rather than just promoting product features. By aligning its products with the passions and interests of its target demographic, Ghost enhances customer loyalty and differentiates itself in a crowded market. However, this focused alignment with gaming culture also presents potential risks. Over-reliance on a specific demographic may limit the brand's appeal to a broader audience, potentially hindering expansion into other market segments. While gaming is significant among younger consumers, older demographics or those outside the gaming community may not connect with the brand's messaging, which could cap its market potential.

Additionally, the digital landscape is rapidly evolving; platforms rise and fall in popularity, and consumer behaviors shift quickly. Changes in social media algorithms can affect content visibility and engagement rates. Brands like Ghost must continuously adapt their strategies to stay relevant, requiring significant investment in market research, content creation, and technological innovation. This can strain resources and impact long-term sustainability if not managed carefully.

3. Transformation of Traditional Distribution Networks

Third, and perhaps most significantly, traditional distribution networks are being compelled to evolve to meet the demands of digital-first brands. Ghost's experience with Anheuser-Busch InBev (AB InBev) exemplifies both the strengths and limitations of traditional distribution systems. According to Beer Business Daily, by partnering with AB InBev, Ghost expanded its presence in convenience stores from a modest 4% to approximately 50%. This dramatic increase highlights how leveraging an established distribution network can rapidly scale a brand's physical availability.

Source: CSP Daily News

However, despite this significant growth, the partnership also revealed limitations. Traditional distribution networks like AB InBev's are primarily designed for broad physical distribution and may not fully support the nuanced needs of digital-native brands that rely on data-driven insights, real-time inventory management, and seamless integration between online and offline channels.

To fully leverage Ghost's digital-first identity, KDP plans to integrate omnichannel strategies into its distribution model. This includes utilizing data analytics to predict demand across both physical retailers and online platforms, enhancing direct-to-consumer channels, and forming partnerships with e-commerce providers. For instance, KDP intends to implement real-time inventory management systems to ensure product availability across all channels—whether on Amazon, in gaming cafés, or in traditional retail outlets. Additionally, KDP is exploring digital engagement initiatives like QR codes on packaging that link consumers to exclusive online content or promotions, effectively bridging the gap between physical products and digital experiences.

The challenge for KDP and similar companies lies in adapting their established distribution networks to accommodate these modern omnichannel requirements. Legacy systems may not be equipped to handle the complexities of real-time data sharing and multi-channel fulfillment. Moreover, significant investments in digital infrastructure may not yield immediate returns, potentially impacting short-term financial performance. KDP's substantial investment signals a commitment to overcoming these hurdles, but the endeavor carries inherent risks.

Furthermore, Ghost's success underscores the growing importance of non-traditional retail channels. Venues like gaming cafés, esports tournaments, and direct-to-consumer platforms have become pivotal for both brand building and sales generation. Traditional beverage distribution networks, which historically focus on convenience stores and supermarkets, must now adapt to support these emerging channels while maintaining operational efficiency. KDP's investment suggests that while digital channels are gaining prominence, the reach and efficiency of traditional distribution networks remain essential for achieving widespread market penetration. Integrating both traditional and digital channels is crucial for brands aiming to meet consumers wherever they are.

Strategic Expansion in a Competitive Landscape

The implications of these trends extend far beyond energy drinks. The acquisition of Ghost by KDP represents a significant evolution in how major beverage companies approach growth and innovation within an increasingly fragmented market. KDP's "platform-based approach," as described by CEO Tim Cofer, aims to strengthen the company's position in one of the fastest-growing beverage categories. While KDP has established a strong portfolio across coffee, soft drinks, and water segments, its recent ventures into the energy category—such as acquiring a 30% stake in C4 Energy for $863 million in 2022 and entering a distribution agreement with Bloom's ready-to-drink beverages—demonstrate an aggressive strategy to capture diverse consumer needs.

This expansion occurs amidst intensifying competition, with PepsiCo investing $550 million in Celsius and Monster acquiring Bang. Major beverage companies are racing to secure their positions in a category that continues to outpace overall industry growth. However, the aggressive push into the energy drink market is not without challenges. The market is becoming increasingly saturated, and consumer loyalty can be unpredictable, especially among younger demographics who are quick to adopt new trends. Additionally, regulatory scrutiny over health claims and functional ingredients could pose risks, requiring companies like KDP to navigate complex compliance landscapes while integrating new acquisitions.

As consumer preferences shift toward health-conscious lifestyles and digital channels become integral to the purchasing journey, food and beverage companies must balance the maintenance of efficient distribution systems with the development of new capabilities in digital engagement and community building. This evolution is likely to reshape not only how beverages are marketed and sold but also how the entire industry approaches product development, distribution, and consumer engagement. The KDP acquisition of Ghost exemplifies this transformative period, highlighting the need for adaptability and innovation in a rapidly changing market landscape.

Bear or Bull?

When all is said and done, well, what is it gonna be? Bear or Bull?

Bull Case

The acquisition of Ghost Energy by Keurig Dr Pepper (KDP) represents a strategic alignment that could significantly enhance KDP's position in the rapidly growing energy drink market. Ghost's unique positioning taps into burgeoning consumer segments that prioritize authenticity, health-conscious ingredients, and digital engagement—especially among Gen Z and younger Millennials. With KDP's extensive resources and distribution capabilities, Ghost can accelerate its expansion both geographically and demographically, potentially increasing market share and entering new markets more swiftly than it could independently. Moreover, KDP stands to gain valuable expertise in social commerce and community building from Ghost's successful digital strategies, which are increasingly crucial in the digital age. This synergy could invigorate KDP's broader portfolio, fostering innovation and stronger connections with a younger, digitally native audience.

Bear Case

Despite the strategic rationale, several challenges and risks could hinder the success of the acquisition. The high valuation and financial risk are significant concerns; acquiring a 60% stake for $990 million values Ghost at approximately 16.1x EBITDA, which is steep compared to industry norms. For perspective, one of the highest profile energy drink investments, PepsiCo's investment in Celsius, was at about 12.5x EBITDA. This premium assumes continued rapid growth and seamless integration—outcomes that are not guaranteed.

KDP’s stock even dropped more than 10% since the announcement of the deal, from $36.70 on October 23rd to $32.88 as of October 29th. However, the stock slip must be taken with a grain of salt as KDP announced the acquisition on the same day it released its earnings report, where they reported a miss on top-line earnings. This makes it difficult to determine how much of the share price drop was due to disappointing earnings versus the acquisition news. Yet, if investors had been enthusiastic about the deal, it very well might have offset the impact of weaker earnings. Furthermore, considering KDP’s stock price has been plummeting faster than my energy levels after a Dr. Pepper sugar rush, it’s fair to say the deal didn’t land well with investors.

Additionally, the energy drink market is intensely competitive, with dominant players like Red Bull and Monster and new entrants bolstered by significant investments from beverage giants like Pepsi and Coca-Cola. Finally, over-reliance on niche markets like gaming could limit Ghost's broader appeal, especially if consumer trends shift.

Final Verdict: Slightly Bullish

Given the evolving consumer landscape and KDP's strategic intent, the deal has the ingredients for success but is accompanied by substantial risks. The energy drink market's growth and Ghost's strong brand appeal provide a solid foundation. Yet, the high stakes involved necessitate careful management to realize the acquisition's full potential. Ultimately, there are strong arguments for both the bear and bull cases, but given that the deal latches onto many ongoing trends of the greater food and beverage sector— ingredient transparency, social commerce, and demand for “healthier caffeine” options— it is reasonable to believe that these tailwinds can outweigh the potential challenges.

At the end of the day, one thing is clear: acquisitions are deeply embedded in KDP’s history. Just look at the company name, Keurig Dr. Pepper—two brands you wouldn’t normally associate together. This kind of bold strategy is deeply rooted in the company’s heritage, so I’m inclined to believe they’ll find a way to make it work.

Ghost Energy Drink Review!

After some careful deliberation, I’ve finally come up with the most fitting way to end this blog: to have my first-ever Ghost energy drink and give it a rating out of ten. The flavor I ended up picking was orange cream, and although I might be a little bit biased given I spent almost 20 hours researching and writing about this acquisition, I would genuinely give the drink a solid 9/10 for its taste. I definitely could see myself drinking Ghost more often, so perhaps I could’ve been a little more bullish on this deal when I wrote the bear or bull section 😆