Believing in America’s Love for Grocery Shopping: Blackstone To Take ROIC Private in $4B Cash Deal

Source: PropTechBuzz

I love going grocery shopping, especially in America.

I mean, I love shopping in general, but for whatever reason, I absolutely enjoy grocery shopping. As a kid who grew up in China, I even still remember my first time going into a Target store when I stayed a summer in the US with my aunt’s family in Minnesota during the summer of the first grade. Frankly, that experience at Target could quite possibly be the moment I fell in love with America.

In high school, I attended a boarding school in LA, and it wasn’t always convenient to get off campus, so I used to always look forward to the target runs my school would organize throughout the week. I can spend an hour just strolling through the different aisles, reading the nutrition labels of the latest snacks and drinks that I haven’t seen before, and picking out a few to try. I guess the only part of grocery shopping I don’t really enjoy is when I eventually go to check out and realize that I’ve spent way more than I thought I was going to spend on groceries this time around.

The truth is, I love going to the grocery stores, even when I don’t need groceries. And I think it’s going to stay this way for a while. Although I don’t expect everyone to be as passionate about wandering around supermarkets as I am, I think it’s safe to say grocery shopping is an experience that most people are not going to give up anytime soon… and Blackstone seems to believe this too.

Every time you run out for groceries, pick up a prescription or grab takeout from your local strip mall, you see first-hand why Blackstone just made a $4 billion bet on American retail and grocery-anchored shopping centers. While many retail headlines focus on the death of traditional retail as more and more shopping happens online via e-commerce, our daily shopping habits tell a different story - neighborhood shopping centers anchored by grocery stores and essential retail experiences continue to thrive.

On November 6, 2024, Blackstone Real Estate announced it would acquire Retail Opportunity Investments Corp. (ROIC) in a $4 billion deal, including outstanding debt. The transaction values ROIC at $17.50 per share in cash, representing a 34% premium to its closing price on July 29, 2024. This deal adds 93 grocery-anchored shopping centers across the West Coast to Blackstone's portfolio, but more importantly, it's a massive bet on how Americans will continue to shop for their essential needs.

The transaction raises fascinating questions about the future of retail: How are consumers' shopping patterns evolving? Why do grocery-anchored centers continue to thrive while malls and apparel-focused retailers struggle? And what does this tell us about the future of American retail as macroeconomic factors loom large with uncertainty from the Fed and Trump’s proposed fiscal policies?

Company Overviews:

Blackstone

The story of Blackstone really begins in Philadelphia, where a young Stephen Schwarzman first learned the fundamentals of business working at his family's linen store for 10 cents an hour. Even at the tender age of 14, his entrepreneurial spirit was evident - he started a lawn-mowing business employing his younger brothers and also sold candy door-to-door. More importantly, he saw bigger possibilities for his family's successful store. While his father was content with a business that provided well for the family, young Schwarzman proposed expanding it nationally. His father's satisfaction with the status quo frustrated him, planting seeds of ambition that would later define his career.

At Yale University, Schwarzman distinguished himself both academically and socially. Showcasing his early talent for innovative problem-solving, he founded a ballet society that successfully brought male and female students together - a rarity at the time. He even successfully challenged a 268-year-old rule preventing women from spending time in male dorms. These early successes caught the attention of Yale's elite Skull and Bones society, which invited him to join their ranks, providing valuable connections that would serve him throughout his career.

After graduating from Yale in 1969 and serving briefly in the Army, Schwarzman earned his MBA from Harvard Business School before landing at Donaldson, Lufkin & Jenrette. However, it was at Lehman Brothers where he truly cut his teeth. The environment was brutally demanding - in one memorable incident, he was berated over a single typo on page 56 of a 68-page report. At another of his first board meetings, a partner named Lou Glucksman publicly humiliated him, shouting "Who the hell are you?" in front of everyone. Rather than break him, these experiences hardened Schwarzman's resolve and taught him valuable lessons about attention to detail and organizational culture.

1985: Stephen A. Schwarzman sits between Roger Altman (Founder of Evercore) and Francois de Saint Phalle. At the time, Schwarzman was head of the global mergers and acquisitions team at Lehman Brothers, while Altman and de Saint Phalle ran the investment banking division.

Source: Achievement.org

His breakthrough at Lehman came with the Tropicana deal. When the orange juice company's CEO called seeking advice on buyout offers, Schwarzman jumped on the next flight despite having minimal preparation time. In just an hour before the board arrived, he formulated a strategy that would lead to a successful $488 million merger. This deal earned him partner status at just 31, an unprecedented achievement that showcased his ability to think on his feet and deliver under pressure.

However, Lehman Brothers was heading for turbulent times. Lou Glucksman, known for his volatile temper and for once ripping a phone from the wall to break a mirror, led a coup that forced out CEO Pete Peterson. As the firm began imploding under Glucksman's leadership, Schwarzman helped engineer its sale to American Express before departing himself.

In 1985, at age 38, Schwarzman could have comfortably retired if he wanted to, but he knew he was too ambitious and restless in nature to do so. Instead, he partnered with his former boss, Pete Peterson, to start something new, something that would grow bigger than even Schwartzman could have dreamt and named this new venture —Blackstone. Funnily enough, the name was simply supposed to be Peterson and Schwarzman, but Peterson didn’t want their names to be at the forefront of a disaster in the case that their venture flopped. Thus, instead, the name cleverly combines elements of both founders' names – "Schwarz," meaning black in German, and "Peter" or "Petros," meaning stone in Greek. With just $400,000 in startup capital, both Peterson and Schwarzman contributing $200k out of pocket, Blackstone began as a boutique M&A advisory firm, aiming to establish credibility and “pay rent” before venturing into the more ambitious territory of leveraged buyouts.

The early days of Blackstone’s private equity journey were humbling, to say the least. Despite sending 600 letters announcing their new venture, the phone barely rang. They faced rejection after rejection - around 450 by Schwarzman's count - while trying to raise their first private equity fund. As he later remarked in an interview about Blackstone’s early days, "If you ever had an ego, it's like sandpaper - you have nothing left by the end."

The turning point came during a Friday lunch meeting with Prudential's chief investment officer. As Schwarzman made his pitch, the CIO quietly ate his tuna sandwich on white bread, his Adam's apple bobbing up and down as he chewed. Finally, halfway through the second half of his sandwich, he looked up and casually said, "I think that's a good idea. Put me down for 100." Schwarzman could hardly believe his ears - $100 million from the world's most prestigious investor. As he later recalled, "I just didn't want him to choke on the rest of that sandwich."

Prudential's backing proved decisive. With their credibility established, Blackstone went on to raise $800 million for their first fund - a remarkable achievement for a first-time fund, especially in the wake of the 1987 stock market crash. However, success was followed by harsh lessons. While their first major deal, a U.S. Steel spinoff, generated a 130% annual return, their third investment in Edgecomb Steel turned disastrous. Within six months, the company couldn't pay interest on its debt, and Blackstone lost its entire investment. The experience deeply affected Schwarzman, who hated failure. In response, he built robust investment processes and risk management systems that would serve the firm well as it grew.

The 1990s marked a period of significant expansion. In 1991, under the visionary leadership of Jonathan Gray, Blackstone entered the real estate market. The firm began purchasing undervalued properties and enhancing their worth through strategic management. This move proved transformative - real estate became one of Blackstone's most profitable segments, eventually positioning the firm as the largest owner of commercial real estate globally. The firm’s real estate strategy combines opportunistic and Core+ investments to balance risk and return across its portfolio. Opportunistic funds specifically target undervalued or mismanaged properties, where Blackstone can apply its operational expertise to drive improvements and increase value. The Core+ strategy, by contrast, focuses on stabilized, cash-flowing assets that provide steady income—such as its logistics and multifamily residential properties—making the real estate branch both versatile and resilient.

Blackstone's growth trajectory reached new heights in 2007 with its decision to go public. Schwarzman orchestrated an extravagant IPO that captured Wall Street's attention, complete with lavish celebrations, including his own 60th birthday party featuring Rod Stewart. The IPO raised over $4 billion and valued Blackstone at $38 billion. During the television coverage, an exhausted Schwarzman watched himself on CNBC while eating dinner on a tray, struck by the surreal nature of what he'd built - it was "Blackstone Day" on television.

Just as Blackstone reached these unprecedented heights, the 2008 financial crisis hit. Yet under Schwarzman's steady leadership, the firm not only weathered the storm but emerged stronger, seizing distressed assets at a discount and positioning itself to benefit as markets recovered. His market timing proved particularly prescient with real estate - in 2006, sensing the market peak, he orchestrated the $39 billion purchase of Equity Office Properties, then immediately sold half the portfolio the same day, shocking the industry but protecting Blackstone from the coming crash.

Source: Blackstone 3Q’24 Earnings Press Release

Today, at age 77, Schwarzman continues to lead Blackstone as Chairman and CEO. The firm stands as the world's largest alternative asset manager, with over $1.11 trillion in assets under management and a wide-reaching influence extending across industries and continents, shaping markets and driving innovation in private equity, real estate, and beyond.

Blackstone's most recent financials continue to tell a similar story of robust earnings and growth. For the third quarter in 2024, Blackstone reported Fee Related Earnings (FRE) of $1.2 billion, or $0.96 per share, contributing to a total FRE of $4.5 billion, or $3.68 per share, over the last twelve months. 3Q’24 Total Segment Distributable Earnings were $1.4 billion, and LTM Total Segment Distributable Earnings were $5.7 billion. The 3Q’24 FRE and DE rose 5% and 6%, respectively, compared to 3Q’23. Furthermore, capital inflows for the quarter were $40.5 billion, bringing the LTM total to $166.7 billion, while deployments stood at $34.0 billion in the quarter and $123.4 billion over the LTM.

Of these earnings, Blackstone’s real estate holdings contributed over $325 billion in assets under management, $540 million in quarterly distributable earnings, and $5.8 billion in quarterly capital inflows. These inflows included $743 million of capital raised in the Blackstone Real Estate Income Trust (BREIT).

Retail Opportunity Investments Corp. (ROIC)

Retail Opportunity Investments Corp. (ROIC) is a self-managed real estate investment trust (REIT) that has grown from its founding in 2007 into a prominent player in the retail real estate market on the West Coast of the United States. The company specializes in acquiring, owning, and managing the kind of shopping centers you probably visit several times a week - neighborhood centers anchored by grocery stores, pharmacies, and everyday services.

Source: ROIC

In its early years, ROIC adopted an aggressive acquisition strategy, acquiring multiple properties that fit its profile. The company’s first major acquisition came in 2009 when it purchased a 95,000-square-foot shopping center in Los Angeles County anchored by a Rite Aid store, setting the foundation for its West Coast focus. By its second year, ROIC had expanded its holdings significantly, acquiring over a dozen additional properties. This rapid expansion was fueled by the company’s ability to identify undervalued or underperforming properties in high-demand locations, allowing it to generate value through re-tenanting and repositioning efforts.

The company currently owns 93 properties across the West Coast featuring tenants like Albertson's, Kroger, and regional grocers, alongside service providers, restaurants, and daily necessity retailers. By strategically focusing on necessity-based retail properties in densely populated, middle- to upper-income communities in metropolitan areas across California, Oregon, and Washington, ROIC has built a resilient portfolio that provides stable rental income through long-term leases with tenants, a strategy that has allowed it to withstand market fluctuations and economic downturns.

Financially, ROIC has demonstrated consistent performance. For the third quarter of 2024, the company reported a net income of $32.1 million, or $0.25 per diluted share, up from $8.4 million, or $0.07 per diluted share, in the same period the previous year. This growth was bolstered by strong leasing activity, with the company executing over 450,000 square feet of leases in the third quarter alone. ROIC also saw a 13.8% increase in same-space cash base rents on new leases, reflecting the strength of its market positioning and the high demand for grocery-anchored retail space. As of September 2024, ROIC’s portfolio was 97.1% leased, underscoring the resilience of its asset base. The company declared a $0.15 per share cash dividend in October 2024, continuing its commitment to returning value to shareholders.

Source: Allied Market Research

Industry Overview:

The Real Estate Investment Trust (REIT) industry has grown into a major component of global finance, transforming how investors approach real estate ownership and income generation. As of 2022, the global REIT market was valued at approximately $2.6 trillion, with projections indicating growth to $4.2 trillion by 2032 at a compound annual growth rate (CAGR) of 5.1%.

But before we completely dive headfirst into the industry overview, as someone who had no idea what REITs were before this blog, I thought a quick breakdown of what REITs actually are may be helpful for some.

What is a REIT?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate across various property sectors. REITs operate similarly to mutual funds but focus on real estate rather than stocks or bonds. Investors buy shares in a publicly traded or private REIT and earn returns through dividends generated from rental income or interest on mortgages. One of the core advantages of investing in REITs is liquidity—investors can buy and sell shares on major stock exchanges—while still gaining exposure to typically illiquid assets like real estate.

There are three primary types of REITs:

Equity REITs: These are the most common type of REITs and focus on owning and operating income-producing real estate. Their revenue comes primarily from leasing space and collecting rent from tenants.

Mortgage REITs (mREITs): These REITs provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities. They earn revenue from the interest on these loans.

Hybrid REITs: A combination of equity and mortgage REITs, hybrid REITs both own properties and finance real estate through mortgages.

Source: Napkin Finance

Now onto the industry analysis.

Retail REITs

Retail REITs, which were heavily impacted by the COVID-19 pandemic, have demonstrated surprising resilience. After a period of declining demand and increasing vacancies, the retail sector rebounded, particularly in segments like grocery-anchored shopping centers, fitness clubs, and experiential retail. Grocery-anchored centers continue to see strong occupancy rates, as these tenants provide essential services and attract steady foot traffic. According to data from CBRE, grocery-anchored centers had an average occupancy rate of 94.5% in Q2 2024, significantly higher than the overall retail average of 91.8%. Even with the growth of online grocery services, in-person grocery shopping remains popular, with over 80% of U.S. consumers still preferring to buy groceries in physical stores, according to a 2024 survey by the Food Industry Association.

Source: PwC Emerging Trends in Real Estate® 2025

Furthermore, open-air shopping centers/strip malls have also experienced robust demand, benefiting from consumer preference for outdoor spaces and a renewed emphasis on local shopping. This demand has kept retail vacancy rates at record lows, with strong leasing activity in spaces under 10,000 square feet and larger spaces of 20,000 to 35,000 square feet. These positive occupancy trends are reinforced by limited new development due to high construction costs, estimated to be 30-40% above pre-pandemic levels.

The retail landscape is also evolving in response to consumer preferences for unique, experiential shopping environments and quasi-medical services. Categories such as fitness centers, medispas, urgent care facilities, and even entertainment venues like arcades and competitive socializing spaces are increasingly taking over retail spaces that were once primarily occupied by traditional retailers. The trend toward experiential retail, which includes activities like indoor mini-golf, culinary experiences, and pop-up markets, reflects a demand for engaging, immersive shopping experiences that go beyond basic consumer transactions. Although these types of tenants bring foot traffic, some analysts express caution, noting that the success of experiential concepts depends on their ability to sustain consumer interest and adapt to changing trends.

The market has also seen a surge in quasi-medical tenants, including medispas and urgent care centers, which have rapidly grown in response to demand for convenient, localized healthcare options. Medispas, which provide services ranging from facials to more advanced treatments like Botox and cryotherapy, have doubled in number since 2018 and are a particularly fast-growing tenant segment. This trend highlights how non-traditional tenants can revitalize retail centers, adding diversity and resilience to a retail portfolio. Such tenants are expected to play a crucial role in maintaining retail real estate’s attractiveness as they continue to grow and expand their footprint.

Source: Mckinsey, Investing in the Rising Data Center Economy

To quickly touch on the broader world of REITs outside of retail, Industrial, logistics, and specialty REITs are a few high-growth sectors fueled by the rise of AI, e-commerce, and the need for rapid delivery infrastructure. Warehousing and distribution centers, particularly near urban areas, are in high demand as companies prioritize reducing shipping times and enhancing supply chain efficiency. With a focus on last-mile delivery and cold storage facilities to support sectors like online grocery and pharmaceuticals, logistics REITs are well-positioned for long-term growth, appealing to investors seeking stable, income-generating assets. Specialty REITs have also gained prominence by diversifying into non-traditional real estate assets such as data centers, cell towers, healthcare facilities, and self-storage. Data center REITs have been especially popular, benefiting from the digitalization of businesses and the increased need for cloud storage for training AI and LLMs. Moreover, cell tower REITs are expanding alongside 5G infrastructure, and Healthcare REITs, which provide stable income due to the essential nature of their services, are supported by aging demographics and demand for senior housing and outpatient facilities. These specialty REITs offer diversification benefits and resilience, attracting investors interested in growth outside of traditional real estate sectors.

Finally, recent merger and acquisition activity in the REIT sector has continued despite headwinds from high interest rates and elevated debt costs in early 2024. In the multifamily sector, Blackstone announced a $10 billion acquisition of Apartment Income REIT Corp. (AIRC), adding to its residential portfolio. The self-storage space saw significant consolidation as Extra Space Storage acquired Life Storage for $16 billion, creating a combined entity with a $46 billion enterprise value, while Public Storage acquired Simply Self Storage from Blackstone for $2.2 billion. The healthcare sector also experienced notable activity with the $21 billion merger between Healthpeak Properties and Physicians Realty Trust, forming a major healthcare-focused REIT with a diversified portfolio, including medical office buildings, senior housing facilities, and life science properties. In the retail sector, Realty Income Corp. expanded its single-tenant portfolio through the $9.3 billion acquisition of Spirit Realty Capital, bolstering its presence in the net lease segment.

These transactions highlight several key trends in REIT M&A activity: consolidation in specialized sectors such as healthcare and self-storage, privatizations by large investment firms, and a focus on core assets within specific property types. While rising interest rates have generally slowed M&A activity, companies continue to pursue strategic acquisitions to achieve economies of scale and expand geographic reach. As interest rates potentially stabilize or decline in late 2024, the industry may see increased M&A activity as companies seek new growth opportunities.

Deal Rationale:

Buyer's Perspective

This is Blackstone Real Estate’s investment thesis as written on their website:

Blackstone's acquisition of ROIC aligns perfectly with its thematic investment approach in high-quality real estate assets, particularly as a defensive play amid potential macroeconomic uncertainty. The portfolio of 93 grocery-anchored shopping centers across premier West Coast markets represents an opportunity to acquire high-quality retail assets with multiple pathways for value creation through active asset management and evolving retail trends.

First, the investment thesis capitalizes on the post-pandemic evolution of retail real estate. As Blackstone's Co-Head of Americas Acquisitions Jacob Werner noted, "The sector is experiencing accelerating fundamentals, benefiting from nearly a decade of virtually no new construction, while demand for brick-and-mortar grocery stores, restaurants, fitness and other lifestyle retailers remains healthy." This transformation is evidenced in ROIC's operational performance, with the portfolio achieving 13.8% rent growth on new leases and maintaining 97.1% occupancy, demonstrating both pricing power and sustained tenant demand. Moreover, the rise of hybrid work has increased daytime traffic to suburban retail centers, while consumers increasingly seek convenient "one-stop shopping" experiences. This shift has made grocery-anchored centers more valuable as neighborhood hubs that combine necessity-based retail with expanding service offerings.

Second, the portfolio's West Coast concentration provides built-in inflation protection and demographic tailwinds. The markets of Los Angeles, Seattle, San Francisco, and Portland feature high barriers to entry, with construction costs running 30-40% above pre-pandemic levels and stringent zoning regulations limiting new supply. These markets also benefit from strong population growth and high household incomes, supporting both occupancy stability and continued rent growth. As the National Retail Federation notes, even with proposed Trump administration tariffs potentially reducing consumer spending power by $46-78 billion annually, necessity-based retail in premium markets should remain resilient. Grocery-anchored centers historically demonstrate resilience during economic turbulence due to their focus on non-discretionary spending. ROIC's portfolio performance supports this defensive positioning - the company's Q3 2024 net income of $32.1 million was nearly four times higher than the previous year, demonstrating strong operational execution even amid market uncertainty.

Finally, Blackstone also sees a significant opportunity to enhance value through operational improvements and evolving retail functionality. The integration of service-oriented tenants - including medical offices, fitness centers, and personal services like medspas (which have doubled since 2018 to nearly 10,000 locations) - provides diversification and consistent traffic drivers. Quick-service restaurant expansion continues, with over 2,000 concepts planning nearly 11,000 new units in 2024. Additionally, these centers increasingly serve as last-mile fulfillment hubs, making them more valuable within the modern retail ecosystem as retailers adapt their omnichannel strategies.

Seller's Perspective

For ROIC shareholders, the transaction offers benefits even beyond the 34% premium to the pre-announcement share price.

The company has spent 15 years carefully assembling and optimizing its West Coast portfolio, focusing on high-barrier-to-entry markets with strong demographic fundamentals. However, as a public REIT, ROIC faces challenges in accessing capital for property improvements and modernization initiatives, particularly in the recent high-interest rate environment. Joining Blackstone's platform provides access to significant capital for property improvements and modernization initiatives that might be challenging to fund as a standalone public company. Blackstone's extensive relationships with national retailers and service providers could help attract premium tenants and implement innovative property enhancements. The firm's proven track record in retail property management and its ability to leverage technology for operational improvements could drive additional value creation.

Deal Structure:

On November 6, 2024, Blackstone Real Estate Partners X, a fund managed by Blackstone Inc., announced a definitive agreement to acquire Retail Opportunity Investments Corp. (ROIC) in an all-cash transaction valued at approximately $4 billion, including the assumption of outstanding debt. This acquisition is part of Blackstone’s broader strategy to expand its portfolio of necessity-based retail properties, particularly grocery-anchored shopping centers, which have proven resilient even during economic downturns.

Under the deal's terms, Blackstone will purchase all outstanding shares of ROIC for $17.50 per share in cash, representing a 34% premium over ROIC’s closing share price on July 29, 2024, the last trading day before reports of a potential sale surfaced. The valuation places ROIC at 6.23 times its annual sales and 17.42 times its EBITDA, a reflection of the high-quality assets and dependable income generation inherent in its grocery-anchored portfolio. The transaction will be financed through a combination of cash on Blackstone’s balance sheet and the assumption of ROIC’s existing debt.

In terms of advisory teams for this deal, on the sell side, J.P. Morgan served as the exclusive financial advisor to ROIC, with legal guidance from Clifford Chance US LLP. On the buy side, Blackstone’s team of financial advisors included BofA Securities, Morgan Stanley & Co. LLC, Newmark, and Eastdil Secured, with legal counsel provided by Simpson Thacher & Bartlett LLP.

The transaction has received unanimous approval from ROIC’s Board of Directors and is expected to close in the first quarter of 2025, subject to shareholder approval and customary regulatory clearances. Once completed, this acquisition will mark another significant addition to Blackstone’s already vast real estate portfolio, further cementing its position as one of the largest owners of commercial real estate globally.

Deal Discussion:

Blackstone’s acquisition of ROIC comes at a pivotal time for the retail real estate sector, and frankly the US and even the global economy in general. With Donald Trump returning to the U.S. presidency in 2024, his proposed policies could have significant implications for both this deal and the broader trends shaping the consumer & retail sector. Trump's economic agenda, which includes deregulation, tax cuts, and trade protectionism, could either bolster or challenge the fundamentals underpinning this acquisition.

Source: Business Standard

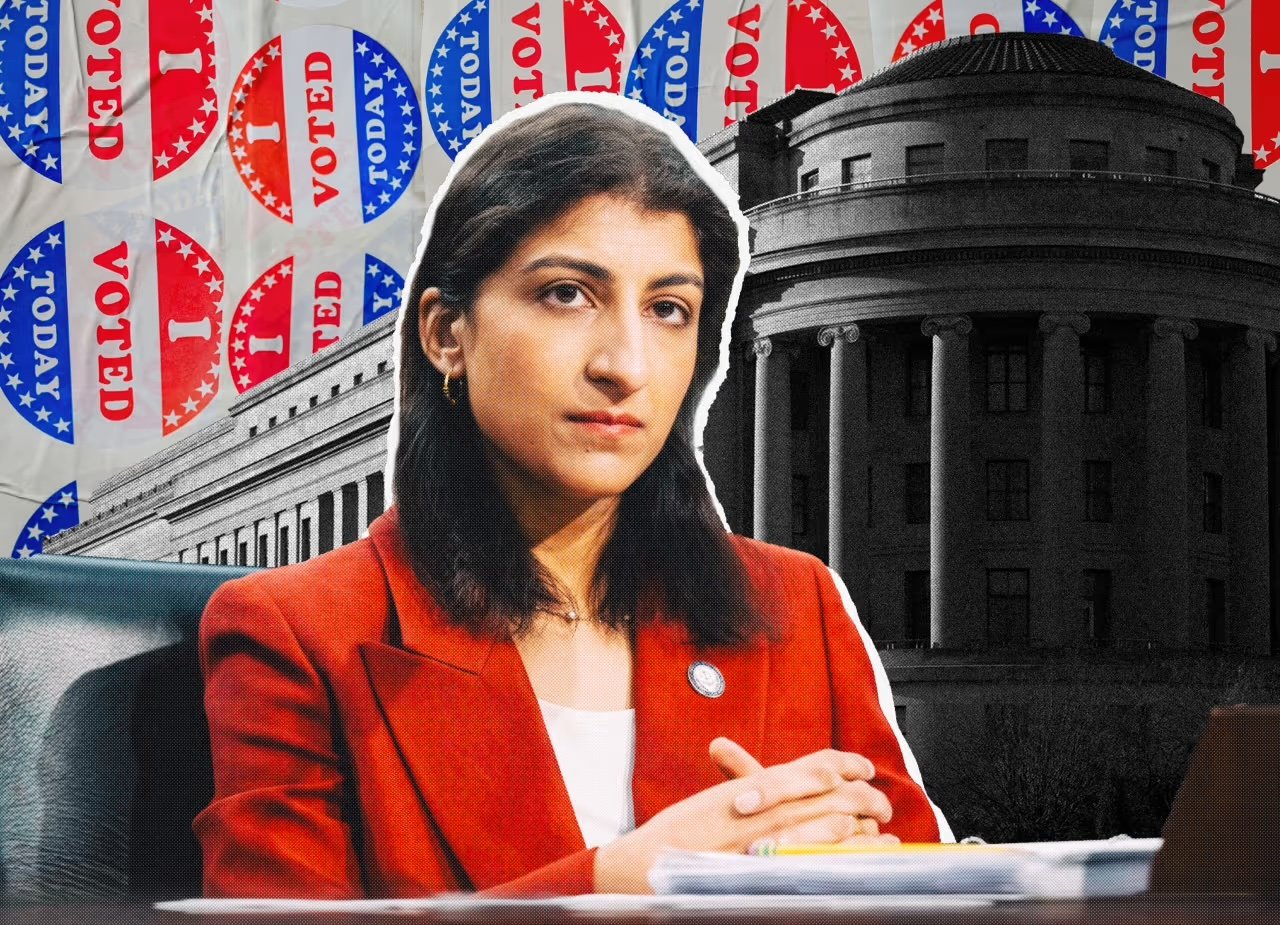

1. Deregulation and Its Impact on Retail Real Estate

An important by-product of Donald Trump's return to the presidency is the expected replacement of FTC Chair Lina Khan. This leadership change at the FTC, combined with Trump's broader deregulatory agenda, could significantly reshape the regulatory landscape for major real estate transactions in two key ways. First, Khan's departure signals a fundamental shift in antitrust philosophy - moving away from her aggressively broad view of merger enforcement toward more conventional evaluations that could benefit large-scale acquisitions like Blackstone's $4 billion ROIC deal. Goldman Sachs projects this regulatory pivot could help drive a 20% increase in M&A activity in 2025, with the ROIC transaction's Q1 2025 closing timeline aligning strategically with these changes. Second, Trump's deregulatory agenda, which during his first term included executive orders aimed at eliminating real estate development barriers, could streamline approval processes for property improvements within ROIC's portfolio. However, this deregulatory environment presents both opportunities and challenges - while it may benefit Blackstone's immediate acquisition and create favorable conditions for broader consolidation in the retail real estate sector (with several strip center REITs like InvenTrust, Kite Realty and Site Centers currently trading below NAV), reduced barriers to development might spark a surge in new supply, potentially affecting occupancy rates and rents in existing properties. Furthermore, while federal oversight may become more permissive, success will still require careful navigation of local and state regulations, particularly in ROIC's high-barrier West Coast markets where local oversight significantly impacts property development and operations

Source: WSJ

2. Tax Policy: Corporate Tax Cuts and SALT Deduction Cap

Trump’s tax policies are another critical factor that could influence the retail real estate landscape. In his first term, Trump’s Tax Cuts and Jobs Act reduced the corporate tax rate from 35% to 21%, a move that significantly benefited commercial real estate investors like Blackstone by lowering their overall tax burden. If Trump continues with further corporate tax reductions or extends favorable tax treatment for real estate investments (such as maintaining the 20% deduction for REIT dividends), Blackstone stands to benefit from a more favorable tax environment. Lower corporate taxes would increase Blackstone’s net income from ROIC’s properties, allowing the firm to reinvest more capital into property improvements or new acquisitions. This would further strengthen Blackstone's position as a dominant player in necessity-based retail real estate. However, one area where Trump's policies may pose challenges is the state and local tax (SALT) deduction cap, which was introduced in 2017 as part of the Tax Cuts and Jobs Act. The SALT cap limits deductions for state and local taxes to $10,000 per year—a policy that disproportionately affects high-tax states like California, where many of ROIC’s properties are located. This cap has made homeownership more expensive in these states by limiting the amount homeowners can deduct from their federal taxes. For consumers living in high-tax states like California, this cap reduces disposable income—potentially affecting their ability to spend on non-essential goods at retail centers anchored by grocery stores. While grocery stores themselves may remain resilient due to their essential nature, smaller retailers within these centers could see reduced foot traffic if consumers have less money to spend on discretionary items. Although Trump has expressed interest in lifting the SALT cap earlier than its scheduled expiration in 2025, it remains uncertain whether this will happen. If the cap remains in place, it could dampen consumer spending in key markets like California—potentially affecting foot traffic and sales at ROIC’s grocery-anchored centers.

3. Trade Policy: Tariffs and Construction Costs

Trump’s trade policies—particularly his use of tariffs—could have a mixed impact on retail real estate investments like Blackstone's acquisition of ROIC. During his first term, Trump imposed tariffs on a wide range of imported goods, including construction materials like steel and aluminum. These tariffs drove up construction costs for developers across the country. If Trump continues with his protectionist trade agenda during his second term—potentially imposing new tariffs on Chinese imports or other goods—this could increase the cost of maintaining or upgrading ROIC’s properties. Higher construction costs would eat into Blackstone’s margins and make it more expensive to renovate or expand grocery-anchored centers. For example, if Blackstone plans to modernize some of ROIC's older properties by adding new amenities or expanding parking lots, higher prices for imported steel or aluminum could significantly increase project costs. This would reduce Blackstone's return on investment unless they can pass these higher costs onto tenants through increased rents—a move that might not be feasible if consumer demand softens due to inflationary pressures. On the other hand, Trump’s focus on protecting domestic industries could benefit certain sectors that are key tenants in grocery-anchored centers—such as food producers or U.S.-based retailers—by shielding them from foreign competition. This protectionism could help stabilize demand for retail space in ROIC’s properties by ensuring that domestic retailers remain competitive against imports.

4. Immigration Policy: Labor Supply Challenges

One of Trump’s most controversial policy areas is immigration reform. His proposals to reduce both legal and illegal immigration could have significant implications for the construction industry—which relies heavily on immigrant labor—and, by extension, for retail real estate development. Immigrants make up about 31% of the U.S. construction workforce, according to data from the National Association of Home Builders (NAHB). If Trump follows through on plans for mass deportations or further restricts immigration flows, this could exacerbate labor shortages in the construction sector, driving up wages and making it more expensive to build or renovate properties like those owned by ROIC. Higher labor costs would likely be passed on to developers like Blackstone through increased construction bids, potentially slowing down planned upgrades or expansions at grocery-anchored centers. This would be particularly problematic if consumer demand softens due to higher interest rates or inflationary pressures.

5. Interest Rates: The Federal Reserve's Role

While Trump does not directly control interest rates (which are set by the Federal Reserve), his economic policies—particularly around deficit spending and inflation—could indirectly influence the Fed’s decisions and the borrowing costs for investors like Blackstone. During Trump's first term (2017-2021), mortgage rates fluctuated significantly due to market reactions to his economic policies: In 2017, mortgage rates averaged 4.03%, but by 2020, mortgage rates dropped to historic lows at around 3.11%.

Source: Crypotpolitan

If inflation rises due to Trump's proposed tax cuts or tariffs on imported goods, the Federal Reserve may be forced to recalibrate its current rate-cutting trajectory and potentially pause on interest rate cuts or even turn slightly hawkish to prevent overheating in the economy. Just this Thursday (November 14th), Fed Chair Jerome Powell even said, “Ongoing economic growth, a solid job market, and inflation that remains above its 2% target mean the Federal Reserve does not need to rush to lower interest rates.” This remark may point to borrowing costs remaining higher for longer for households and businesses alike, and high interest rates make it more expensive to finance acquisitions or property improvements for investors like Blackstone. Yet, on the flip side, Trump has also expressed a desire to see mortgage rates return to pandemic-era lows—a move that would benefit both homebuyers and commercial real estate investors by lowering financing costs.

Let’s imagine the two scenarios:

On the one hand:

If interest rates stay high or even start rising again over the next few years due to inflationary pressures stemming from Trump's fiscal policies (e.g., deficit spending), Blackstone may find it harder—or more expensive—to refinance existing debt associated with its acquisition of ROIC.

Higher borrowing costs could also limit Blackstone's ability to fund future acquisitions or property improvements without taking on additional risk through higher leverage ratios.

On the other hand:

Trump has expressed a desire to see mortgage rates return closer toward pandemic-era lows—a move that would benefit both homebuyers and commercial real estate investors by lowering financing costs.

If successful, lower interest rates would make it easier—and cheaper—for firms like Blackstone Real Estate Partners X fund (which acquired ROIC)to finance future acquisitions/expansions/upgrades without taking excessive risks associated with higher leverage ratios.

So, what does all this mean for consumers and retailers?

Well, to be honest, the future of retail is filled with uncertainty, and the implications of a Trump administration on retail are ambiguous.

But perhaps this is exactly why Blackstone is using this acquisition of ROIC to better align themselves with the broader trend toward investing in necessity-based retail properties that have proven resilient even during challenging economic times. Trump's return to office introduces several variables that could impact both this deal specifically and consumer & retail more generally:

Deregulation could lower development costs but may also lead to oversupply.

Tax policies such as corporate tax cuts would benefit investors like Blackstone, but continued limits on SALT deductions could dampen consumer spending.

Tariffs might drive up construction costs while protecting domestic industries that are key tenants.

Immigration restrictions could exacerbate labor shortages in construction.

Interest rate fluctuations driven by inflationary concerns may increase borrowing costs (again).

Ultimately, while some aspects of Trump's policies may create opportunities for growth in retail real estate investment, others introduce risks that Blackstone—and other investors—will need to carefully navigate as they integrate acquisitions like ROIC into their portfolios amidst evolving political and economic conditions.

Bear or Bull?

Bull Case

The bull case begins with the portfolio's exceptional fundamentals and irreplaceable nature. ROIC's 93 grocery-anchored shopping centers, concentrated in premium West Coast markets, boast an impressive 97.1% occupancy rate and have achieved 13.8% rent growth on new leases in Q3 2024. These metrics aren't just numbers on a page – they reflect the essential nature of these properties in their communities and their sustained ability to attract and retain tenants even in challenging environments. The portfolio's concentration in Los Angeles, Seattle, San Francisco, and Portland provides access to dense, high-income populations in markets with extreme barriers to entry.

What makes this portfolio particularly valuable is the current supply-demand dynamic. With construction costs running 30-40% above pre-pandemic levels and nearly a decade of minimal new retail construction, these properties would be virtually impossible to replicate today at any reasonable cost. This scarcity value, combined with the fact that over 80% of U.S. consumers still prefer in-store grocery shopping, creates a powerful moat around these assets.

Blackstone's operational expertise and scale advantages provide additional layers of potential value creation. With $325 billion in real estate assets under management, the firm brings unmatched capabilities in property management, tenant relationships, and access to capital. The opportunity to optimize tenant mix by incorporating growing categories like medical services, fitness centers, and experiential retail could drive additional value beyond base rental income. Furthermore, these centers increasingly serve dual roles as both shopping destinations and last-mile fulfillment locations, positioning them well for the evolving retail landscape.

Bear Case

However, the bear case presents serious concerns that cannot be ignored. The 34% premium over ROIC's pre-announcement share price and 17.42x EBITDA multiple appear aggressive, particularly in a rising rate environment. This rich valuation could limit upside potential and make it harder to generate attractive returns, especially if cap rates continue to rise with interest rates. The timing also raises eyebrows, with the acquisition occurring amid significant macroeconomic uncertainty.

The return of Donald Trump to the presidency adds another layer of complexity. His proposed tariffs – 60% on Chinese goods and a 10% universal tariff – could accelerate inflation and pressure consumer spending. These policies, combined with potential changes to tax and immigration laws, create an uncertain environment for retail real estate. The portfolio's heavy concentration in West Coast markets, while providing advantages, also exposes it to regional economic downturns, natural disaster risks, and state-specific regulatory challenges.

The retail landscape itself continues to evolve, with growing e-commerce penetration even in grocery, changing consumer preferences, and rising costs for tenants presenting ongoing challenges. While grocery-anchored centers have proven more resilient than other retail formats, they're not immune to broader industry trends and competitive pressures.

Final Verdict: Bullish

Ultimately, success will depend on careful execution and the ability to navigate macroeconomic challenges. Key metrics to monitor include occupancy rates, rental growth, property-level NOI growth, and the success of property improvements. While near-term headwinds are real, the long-term strategic value of this portfolio – essential retail properties in premium, supply-constrained locations – should prove resilient through market cycles. In an uncertain retail landscape, this collection of necessity-based assets, backed by Blackstone's proven execution capabilities, represents a compelling long-term investment opportunity despite the premium paid.

But at the end of the day, even in a world where all my essential groceries can be personalized by AI and delivered promptly to my doorstep, I don’t think I’ll ever stop going to grocery markets.

Source: Food and Wine