Barbarians at the Gate? Echoes of RJR Nabisco Inside the $58 Billion Battle for 7-Eleven

“It’s plain as the nose on your face that this company is wildly undervalued… The only way to recognize these values, I believe, is through a leveraged buyout.”

— F. Ross Johnson, former CEO of RJR Nabisco, from Barbarians at the Gate: The Fall of RJR Nabisco

Source: Nikkei Asia

This summer, in my attempt to balance internship assignments without sacrificing time for personal growth, I picked up Barbarians at the Gate. I first watched the film earlier in the summer, and while I definitely enjoyed the film, I found the book’s deep dive into the histories of key figures and companies irresistible; for a company history geek like me, it was the perfect blend of drama and insight. The book brought the 1980s to life—an era where egos clashed and fortunes were made or broken. The author, Bryan Burrough, painted a vivid picture of ambition and greed, all wrapped in the largest leveraged buyout at the time. Little did I know, the lessons of that story would take on new relevance by the summer's end, echoing in the unfolding drama of another corporate saga: the $58 billion battle for the future of 7-Eleven.

Thirty-six years later, the Alimentation Couche-Tard bid for Seven & i Holdings (the parent company of 7-Eleven) has emerged as one of, if not the most significant development in the convenience store industry. What began in August 2024 as a $39 billion "friendly, non-binding proposal" has spiraled into a high-stakes bidding war involving rejected offers, revised bids, and an unexpected $58 billion management buyout offer from Junro Ito, a member of Seven & i's founding family.

But while Barbarians at the Gate played out in the smoke-filled rooms of Manhattan, today's drama spans continents and cultures. 7-Eleven isn’t just the world’s largest convenience store chain—it’s a symbol of adaptability, mastering the art of being simultaneously global and local. From rice balls crafted by Kyoto master chefs in Japan to the ever-rotating hot dogs in the U.S., the brand is a testament to how convenience retail can reflect and adapt to diverse markets. Where Ross Johnson’s innate need for action fought for a stagnant stock price and Henry Kravis for supremacy in the LBO game he “invented,” emotions and egos prevailed over sound business logic in the battle for RJR Nabisco. In a similar yet drastically distinct fashion, today’s combatants must wrestle with questions that cut to the heart of this developing story:

What are the potential implications of Junro Ito’s management buyout on Seven & i's strategic direction and operational structure, and how do these compare to Alimentation Couche-Tard’s acquisition strategy?

The Ito family’s $58 billion bid represents an $11 billion premium over ACT's offer in what could potentially be the largest LBO in history. Is this premium justified by business fundamentals, or does it represent an emotional overpayment that could burden the company with excessive debt?

How should Seven & i’s board balance shareholder returns, stakeholder interests, and national identity when evaluating the competing acquisition proposals?

Through this blog, I hope to provide a perspective on these questions, drawing parallels between the lessons of the RJR Nabisco LBO in the 1980s and the nuances of modern global M&A, all through the lens of an avid convenience store lover who has visited countless 7-Elevens all over Asia and the US.

What unfolds here is more than just another takeover attempt. It’s a story that bridges past and present, East and West, family legacy and corporate ambition. And as both RJR Nabisco’s LBO and this unfolding drama teach us, when the stakes involve iconic brands and competing visions for the future… There are always barbarians at the gate.

Company Overviews:

7 Eleven

Picture Dallas, Texas, in 1927. Refrigerators are luxury items, costing the equivalent of $8,000 in today's money. Most families rely on ice blocks to keep their food fresh, making regular trips to local ice houses. At one such establishment, a Southland Ice Company employee named John Jefferson Green had what must have seemed like a modest proposal: why not sell eggs, milk, and bread alongside the ice? This simple idea – bringing convenience to customers rather than forcing customers to seek out convenience – would revolutionize retail.

Southland Ice Company. Source: 7-Eleven

The beauty of Green's innovation wasn't just its simplicity; it was its perfect timing. America was becoming increasingly mobile, and households needed flexible shopping options. Joe C. Thompson Sr., one of Southland's founding directors, recognized the potential. He not only approved Green's experiment but eventually acquired the entire Southland Ice Company to expand the concept, eventually becoming the founder of 7-Eleven. In 1928, fate handed the young company an unexpected marketing coup. When manager Jenna Lira brought back a totem pole from Alaska and placed it outside her store, it became such an attention-grabbing novelty that executives quickly added totem poles to all locations. The stores became known as "Tote'm Stores" – a clever double meaning playing on both the totem poles and customers "toting" away their purchases. This early lesson in branding would serve the company well in decades to come.

But soon later, the Great Depression tested the young company's resilience. Despite filing for bankruptcy in 1931, Southland survived through reorganization and some creative financing from Dallas banker W.W. Overton Jr., who sold company bonds for seven cents on the dollar. It's worth noting that this early brush with financial restructuring would foreshadow a similar crisis and resurrection in the 1990s.

Birth of an Icon (1946-1980)

In 1946, as America embraced post-war prosperity, Southland made a decision that would quite literally define the company: stores would operate from 7:00 AM to 11:00 PM, seven days a week. The name "7-Eleven" was born, and with it, a new retail paradigm. But you know what’s better than having your stores open 16 hours a day for seven days a week? Yup, you guessed it: having it open 24/7. In 1963, an Austin, Texas store stayed open all night to accommodate celebrating University of Texas football fans, and the resulting sales proved so impressive that the 7-Eleven began experimenting with its own 24-hour operation. The business recognized that American society was fundamentally changing as shift work became more common and urban areas grew more active at night and actively positioned itself to serve this evolving market.

Two product launches during this period would cement 7-Eleven's place in American culture. In 1965, the company introduced the Slurpee, a semi-frozen carbonated drink that would become a cultural touchstone. By 2023, annual Slurpee sales would reach 153 million units – enough to give almost half of the entire nation a brain freeze. The 1976 introduction of the Big Gulp similarly transformed beverage retail as the 32-ounce cup doubled soft drink sales within three months. At the time, these were masterclasses in understanding consumer psychology. The Slurpee, with its rotating flavors and collectible cups, created an experience that transcended the simple act of buying a drink. The Big Gulp's success demonstrated that Americans would embrace larger portions if offered at the right price point – an insight that would influence fast food marketing for decades to come.

First Ever 7-Eleven. Source: Texas State Historical Association

The Japanese Transformation (1980s-1990s)

By the late 1980s, 7-Eleven faced what appeared to be an existential crisis. The Thompson family, fearing a hostile takeover by Canadian financier Samuel Belzberg, initiated a $5.2 billion leveraged buyout in 1987 to take Southland Corporation private. The timing couldn't have been worse – the 1987 stock market crash sent shockwaves through the financial system, forcing the company to sell assets ranging from its Chief Auto Parts chain to its original ice business.

Source: Nipponia

Ultimately, salvation came from unexpected quarters. In Japan, a company called Ito-Yokado had been operating 7-Eleven stores since 1974 through a licensing agreement. Under the leadership of Toshifumi Suzuki, the Japanese operation had evolved into something even more remarkable than the 7-Elevens in America. While American 7-Elevens were still primarily selling cigarettes and Big Gulps, Japanese stores were offering fresh sushi, banking services, and sophisticated inventory management systems that could predict sales down to the hour.

When Southland filed for Chapter 11 bankruptcy in 1990, Ito-Yokado and its subsidiary Seven-Eleven Japan stepped in, acquiring 70% of the company for $430 million cash in 1991. Suzuki, nicknamed "Hurricane Suzuki" for his aggressive reform style, was shocked by the condition of American stores. In his autobiography, he described walking into stores that looked more like warehouses – dimly lit, dirty, with merchandise haphazardly piled in aisles.

The Modern Era (2000-Present)

The turn of the millennium marked the beginning of 7-Eleven's most transformative period. Under Japanese ownership, the company embarked on a comprehensive modernization of its operations, fundamentally reshaping the convenience store model it had pioneered decades earlier. The Japanese influence catalyzed a complete overhaul of 7-Eleven's operations, implementing sophisticated item-by-item inventory management using real-time sales data, a practice that had revolutionized Japanese stores since 1982. This system's complexity is astonishing: each store maintains approximately 3,000 different products, with inventory levels constantly adjusted based on local preferences, weather patterns, and even local events.

The company developed a proprietary retail information system that transformed store operations, enabling precise demand forecasting and reducing waste while ensuring product availability. Stores can automatically adjust orders based on historical sales data, weather forecasts, and local events, maintaining a delicate balance between product availability and waste minimization. This sophisticated approach to inventory management has become a cornerstone of 7-Eleven's modern operational excellence.

In 2005, Seven-Eleven Japan completed its acquisition, making 7-Eleven a wholly owned subsidiary of the newly formed Seven & i Holdings. The company pursued strategic acquisitions, including the landmark $21 billion Speedway purchase in 2020, which added 3,800 locations to its North American network and particularly strengthened 7-Eleven's presence in key Midwest and East Coast markets. The company also expanded its global footprint through master franchise agreements and direct operations, reaching 19 countries. Each market demonstrates 7-Eleven's ability to adapt its model while maintaining operational consistency. In Japan, stores partner with Michelin-starred chefs to develop rice balls. In Thailand, you'll find national favorites like the Tom Yum Goong soup. And, of course, in the US, the hot dogs keep rotating.

As of 2024, 7-Eleven's operational metrics reflect its global scale, with 84,500 stores worldwide serving over 50 million customers daily. In the first half of FY2024 (earnings released on October 10th, 2024), 7-Eleven reported solid revenue growth despite pressures on profitability. Group total sales rose to ¥9,287.0 billion, a 6.8% year-over-year increase, driven by strong performance across its global operations. Revenues from operations increased to ¥6,035.5 billion, up 8.8% compared to the prior year, exceeding initial forecasts by ¥429.5 billion.

However, profitability metrics showed some contraction. EBITDA declined to ¥471.5 billion, reflecting 95.0% of the prior year’s performance, as inflationary pressures and rising costs weighed on margins. Earnings per share (EPS) fell sharply to ¥20.09, a 33.7% decrease from ¥30.28 in FY2023. These earnings contractions, perhaps, played a part in giving rope to Couche Tard to pursue a tender offer.

Source: Seven and i Investor Relations

Alimentation Couche Tard

Source: Canada Convenience Store News

In the Montreal suburb of Laval 1980, Alain Bouchard opened the doors to a single convenience store, carrying with him the weight of a childhood marked by his father's business bankruptcy and an unwavering determination to build something lasting. That modest beginning would grow into Alimentation Couche-Tard, a global retail empire that today spans 16,700 stores across 31 countries. The name he chose – "Couche-Tard," French for "night owl" – would prove remarkably prescient for a company that would spend the next four decades staying ahead of the competition, always watching, always adapting.

The early years were marked by methodical expansion and a laser focus on operational excellence. By 1985, Bouchard made his first significant move, acquiring 11 Couche-Tard branded stores in the Quebec City region. This acquisition set the template for what would become the company's signature approach: identify undervalued assets, implement sophisticated systems, and dramatically improve efficiency. Within five years, the network had grown to 34 stores, but Bouchard was just getting started.

The 1990s saw Couche-Tard emerge as a fierce disciple of strategic acquisitions and sharp integration. The watershed moment came in 1997 with the acquisition of C-Corp Inc., a subsidiary of Provigo, which added 245 Provi-Soir stores in Quebec and 50 Winks stores in Ontario and Alberta. This move marked Couche-Tard's first significant expansion beyond its home province and demonstrated Bouchard's ability to execute increasingly complex transactions.

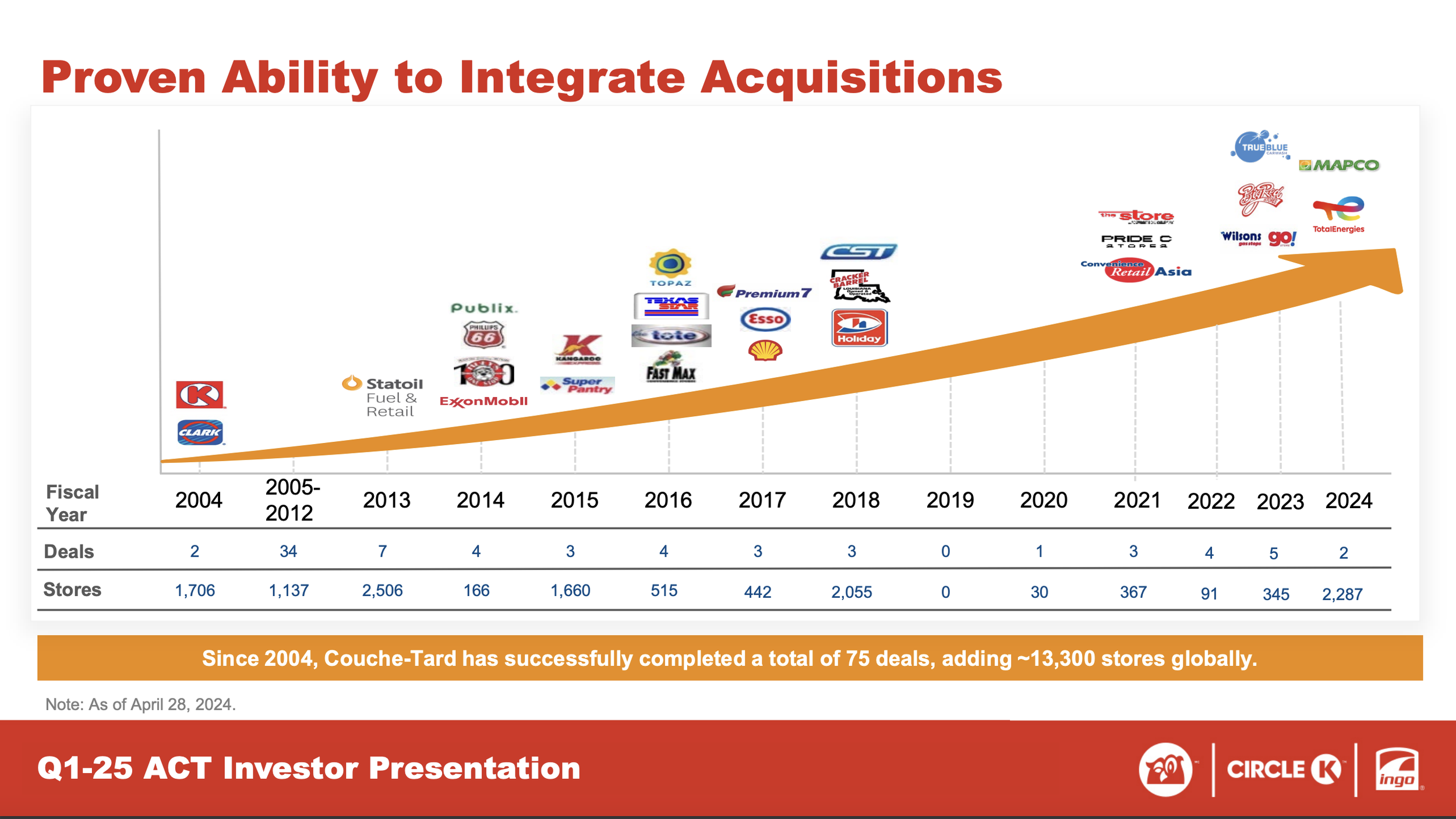

However, it was the 2003 acquisition of Circle K from ConocoPhillips that truly transformed the company from a Canadian success story into a North American powerhouse. The deal, which brought 1,663 stores across 16 American states under the Couche-Tard umbrella, showcased the company's ability to not just acquire but successfully integrate large-scale operations. The Circle K brand was maintained and strengthened, while Couche-Tard's operational excellence was carefully woven into the fabric of the business. From there, Couche Tard began its ascent via a series of continued aggressive acquisitions.

Couche-Tard today has expanded its store network largely through mergers and acquisitions, which account for 73% of its total 14,425 stores as of the most January 2024. Yet, despite operating over 7,000 stores across the United States, the company holds only about a 5% share of the national market. The U.S. convenience store industry is highly fragmented, offering Couche-Tard significant opportunities for further consolidation. Currently, 7-Eleven is the largest player in the U.S. market, followed by Couche-Tard, Casey's, and Murphy's. Interestingly, more than 60% of the market is controlled by single-store operators. This fragmentation is why Couche-Tard emphasized during its 2023 Investor Day that consolidating the U.S. market remains a strategic priority, but who would’ve thought that this meant attempting to devour the number one player in convenience retail?

Source: Alimentation Couche Tard Investor Relations

The acquisition strategies have worked like a charm so far, and the numbers tell a story of remarkable value creation. By 2024, Couche-Tard had grown into a $71.86 billion revenue enterprise, generating $12.05 billion in operating income and $4.23 billion in net income (All TTM numbers). Perhaps most impressively, the company has maintained a return on capital employed between 15-20% throughout its expansion, demonstrating an unusual ability to grow while maintaining profitability – a feat that has eluded many retail empires.

But for Couche-Tard's most recent quarter (Q2 fiscal 2025, earnings released November 25th, 2024), financial results painted a mixed picture of resilience and ongoing challenges. Net earnings attributable to shareholders reached $708.8 million, or $0.75 per diluted share, compared to $819.2 million ($0.85 per diluted share) in the same quarter of fiscal 2024. EBITDA stood at $1.5 billion, an increase of $37.4 million, or 2.5%, compared with the corresponding quarter of fiscal 2024. While total merchandise and service revenues grew to $4.4 billion, representing a 6.6% increase, same-store merchandise revenues faced headwinds across all regions, declining by 1.6% in the United States, 1.5% in Europe and other regions, and 2.3% in Canada. These declines largely reflected constrained discretionary spending among low-income consumers and the continued decline in cigarette sales. The quarter also saw varying performance in fuel volumes, with same-store road transportation fuel volumes decreasing by 2.2% in the United States—partly due to hurricane impacts in the Southeast—while showing modest increases of 0.1% in Europe and 0.5% in Canada. Despite these challenges, the company continues to execute its growth strategy, entering into agreements to acquire 290 convenience retail and fuel sites in the United States during and immediately following the quarter's end. This latest financial performance, while showing some pressure points, demonstrates Couche-Tard's ability to maintain substantial profitability even as it navigates challenging economic conditions and continues its strategic expansion.

Today's Couche-Tard bears little resemblance to that first store in Laval. The company has evolved into a sophisticated retail operation that's actively reshaping the future of convenience. Fresh food offerings now compete with quick-service restaurants, while advanced analytics and loyalty programs drive customer engagement. The company is also positioning itself for the future of transportation, leading initiatives in electric vehicle charging stations while maintaining its traditional fuel business. Moreover, the acquisition machine continues to hum efficiently. In 2024 alone, Couche-Tard acquired 270 GetGo stores from Giant Eagle and made aggressive moves into the European market, including 1,600 TotalEnergies service stations in Germany and the Netherlands. But perhaps nothing better illustrates the company's ambition than its 2024 bid for Seven & i Holdings. The initial $39 billion offer, later raised to $47 billion, represents exactly the kind of transformative deal that has defined Couche-Tard's history – even as it faces competition from a $58 billion management buyout proposal.

Source: Alimentation Couche Tard Investor Relations

Junro Ito/Ito Kogyo

There are two sides to every story. But for this story, there are three.

In the intricate tapestry of Japanese corporate history, few names carry the weight and legacy of the Ito family. From a modest clothing shop opened in 1920 by Masatoshi Ito's uncle, the family enterprise blossomed into Seven & i Holdings, a global retail giant best known for its ubiquitous 7-Eleven convenience stores. This conglomerate, with over 85,000 stores worldwide, stands as a testament to a century of ambition, innovation, and adaptability. At the helm of this legacy, today is Junro Ito, the youngest of Masatoshi Ito's three children, whose leadership and strategic vision are pivotal as Seven & i Holdings faces a defining moment.

Source: The Japan Times

Born into a family that had already etched its name into Japan's retail landscape, Junro Ito chose to forge his path with a blend of reverence for tradition and a forward-looking mindset. Educated at Gakushuin University—an institution renowned for nurturing members of Japan's imperial family—he expanded his horizons by earning an MBA from Claremont Graduate University in the United States (Claremont is where I lived for 4 years during high school!). After his education in the States, before joining the family conglomerate, Junro honed his skills at Mitsui Trust & Banking, immersing himself in finance and corporate strategy. This experience outside the family sphere equipped him with a unique blend of insider knowledge and external insights. When he ultimately joined Seven & i Holdings in 1990, it was not as an apparent heir but as an executive committed to understanding every facet of the business. Over three decades, he ascended to the role of executive vice president and board member, earning respect for his methodical approach and strategic acumen.

Central to the Ito family's influence is Ito-Kogyo, often described as their investment vehicle but functioning as much more. Holding an 8.2% stake in Seven & i Holdings, Ito-Kogyo is the company's second-largest shareholder, wielding significant influence over its direction. Beyond its investment role, Ito-Kogyo is a key player in Japan's petroleum distribution industry, reflecting the family's diversified business interests. Under the joint stewardship of Junro and his sister, Hisako Yamamoto, Ito-Kogyo serves as both a guardian of the family's legacy and a driver of strategic initiatives, amplifying their ability to shape the future of Seven & i Holdings.

The passing of Masatoshi Ito in 2023 marked a pivotal moment. As the patriarch who transformed a single store into a global powerhouse, his death signaled a generational shift in leadership. Junro and Hisako, now the principal stewards of the family legacy, faced the challenge of honoring their father's vision while steering the company through the complexities of modern global capitalism.

When Alimentation Couche-Tard made a bold $47 billion takeover bid for Seven & i Holdings, aiming to consolidate and expand its global footprint. The offer presented a threat to the Ito family's control and the company's identity as a distinctly Japanese enterprise. In response, Junro Ito and Ito-Kogyo orchestrated a decisive countermove. In November 2024, they announced a ¥9 trillion ($58 billion) management buyout proposal—the largest in Japanese corporate history, and if completed, it would also be the largest LBO in history, period. This audacious bid was not merely a defensive tactic but a strategic vision to preserve Seven & i Holdings' autonomy and cultural heritage.

For Junro Ito and Ito-Kogyo, this battle is deeply personal. It is about honoring a century-old family legacy while steering the company toward a future aligned with their values and vision. As the world watches this corporate drama unfold, one thing remains clear: the Ito family is determined to shape the future of their company—and, by extension, a part of Japan's economic landscape—on their own terms.

Industry Overview:

The global convenience store industry finds itself at a critical inflection point. Valued at $2.37 trillion in 2023 and projected to reach $3.66 trillion by 2031, the industry's 5.6% CAGR reflects its historic resilience. While North America leads with 47% of global revenue and $297.8 billion in U.S. in-store sales (representing 35% of brick-and-mortar retail operations), the most compelling growth story is emerging in Asia-Pacific, where a 6.4% CAGR through 2028 is being driven by expanding middle-class populations and rapid urbanization in countries like China, Vietnam, and India. This resilience was particularly evident during the COVID-19 pandemic when convenience stores' localized accessibility and smaller footprint allowed them to thrive while larger retail formats struggled.

Source: Mintel

This growth, however, masks fundamental challenges to the industry's traditional business model. Most critically, its two historic profit centers are eroding: tobacco sales have declined from 31.5% to 29.4% of total sales, while the rise of electric vehicles threatens the gas station model that has long driven foot traffic. With over three million EVs registered in 2023, convenience stores must adapt not just their infrastructure but their entire customer experience – charging takes longer than filling up, creating both a challenge and an opportunity for retailers to reimagine their stores. Additional headwinds include rising real estate costs in prime urban locations and increasing competition from grocery chains and e-commerce platforms offering competitive alternatives.

In response, convenience stores are fundamentally reimagining their value proposition. Foodservice has emerged as the new growth engine, now accounting for 20.4% of sales, with stores introducing fresh options, sustainable choices, and innovative grab-and-go solutions. This shift requires not just new products but new capabilities: AI-driven inventory management to reduce waste, advanced payment systems to speed checkout, and sophisticated loyalty programs to drive engagement. Leading operators like Circle K and 7-Eleven are already showing how this transformation can work, leveraging digital technology to enhance both operations and customer experience. For example, Circle K's partnership with Too Good To Go to reduce food waste demonstrates how operators can align operational efficiency with consumer values.

Looking ahead, the convenience store industry's trajectory suggests continued evolution and growth. At the end of the day, for consumers to shop at convenience stores more often, the retailers need exactly that – convenience. Success will increasingly depend on operators' ability to balance technological innovation with personalized service while maintaining operational efficiency.

Source: Mintel

Deal Rationale:

Alimentation Couche-Tard’s Perspective

1. Capturing Valuation Arbitrage

Before Couche Tard’s first announcement to acquire Seven and i on August 19th, Seven & i was trading at a market value of $38.3 billion—a significant discount to Couche-Tard's $54 billion, despite Seven & i operating five times more stores globally (85,800 vs. 16,700). This dramatic undervaluation, paired with its robust Japanese operations, creates a compelling case for acquisition. Although Seven & i's share price has risen by 16% post-announcement (now trading at a market cap of $44 billion), reflecting its newfound appeal, the company still trades at a lower forward price-to-earnings ratio compared to Couche-Tard, suggesting continued room for value creation.

2. Strategic Growth Necessity

Couche-Tard’s ambitious growth plan of achieving 11.7% annual EBITDA growth by 2028 is under pressure. The company’s EBITDA actually shrank last fiscal year (FY 23-24), leaving the company in search of a catalyst to regain momentum.

Acquiring Seven & i Holdings—a titan in the fragmented U.S. convenience store market and a global player with an established footprint in high-growth regions like Asia— offers an immediate solution to these growth challenges. Couche-Tard recognizes that organic growth in the U.S. is hampered by slow permitting processes and limited real estate availability, and this acquisition can better position Couche-Tard to accelerate its global expansion and diversify its revenue streams effectively. Moreover, Couche-Tard even announced a $1.6 billion deal to acquire GetGo Café + Markets on the same day as the bid for Seven & i, further demonstrating the company’s desire for growth.

Source: Alimentation Couche Tard Investor Relations

3. Margin Transformation Potential

Seven & i's Japanese operations are a benchmark for operational excellence, achieving an impressive operating margin of 27%, compared to Couche-Tard's margin of just below 6%. This stark contrast highlights the potential for Couche-Tard to significantly improve its profitability by adopting Seven & i's best practices in inventory management, fresh food offerings, and franchise models. As the convenience retail industry shifts towards food-focused operations, Seven & i's leadership in high-margin categories provides a valuable blueprint for Couche-Tard to pivot away from declining fuel and tobacco sales.

4. Gaining Expertise in Fresh Foods and Leadership in a Transforming Market

With traditional revenue sources like fuel and tobacco in decline and high-margin categories like food service gaining prominence, Seven & i's expertise in fresh food innovation and advanced retail operations in Japan align well with Couche-Tard's necessary strategic objectives. Acquiring Seven & i would not only provide access to new capabilities to better meet consumer demands but also position Couche-Tard as the definitive leader in convenience retail. This move would set a new standard for scale, efficiency, and innovation in the industry, allowing Couche-Tard to stay ahead of evolving market trends and consumer preferences.

5. Operational Synergies and Efficiency Gains

Couche-Tard has a strong track record of extracting value from acquisitions through operational efficiencies, and Seven & i presents a prime opportunity to continue this trend. According to analysis from RBC Capital Markets, about 31% of Circle K stores are located within one mile of a 7-Eleven or Speedway (Also owned by Seven and i), creating opportunities to optimize logistics, consolidate supply chains, and eliminate redundancies to extract cost synergies. Nevertheless, this implies that the deal would attract heightened scrutiny from U.S. antitrust regulators, who are cautious about any developments that increase market concentration in the food and fuel sectors. For example, the proposed merger between supermarket giants Kroger and Albertsons was ultimately blocked by the FTC. Yet, to my surprise, a combined 7-Eleven and Couche-Tard, the number one and two players in the C-store industry, wouldn’t even control more than 13% of the U.S. convenience store market.

Junro Ito/MBO’s Perspective

Junro Ito and Ito-Kogyo offer a distinctly different rationale. While Couche-Tard’s bid centers on global integration, Ito-Kogyo’s ¥9 trillion ($58 billion) management buyout emphasizes cultural preservation and longer-term strategic focus.

1. Preserving Cultural Identity

The rationale at its core is the desire to protect Seven & i Holdings’ distinctly Japanese identity. The family recognizes 7-Eleven as more than just a convenience store chain—it’s a symbol of Japan’s retail innovation, celebrated for high-quality fresh food, customer service, and operational precision. Concerns over potential changes to these hallmarks under foreign ownership, especially by Alimentation Couche-Tard, have driven the family’s resolve to maintain domestic control. This sentiment aligns with broader national pride and economic sovereignty, as public sentiment in Japan often leans toward safeguarding iconic enterprises from foreign acquisition.

2. Strategic Restructuring Opportunities

In addition to cultural preservation, the buyout offers an opportunity for comprehensive strategic restructuring. Over the years, Seven & i has grown into a sprawling conglomerate with underperforming assets, including Ito-Yokado supermarkets and Sogo & Seibu department stores, weighing on profitability. Taking the company private would provide the operational freedom to divest non-core assets and focus on its core business, the highly profitable 7-Eleven brand. Freed from public market pressures, Seven & i could also prioritize longer-term strategic initiatives such as expanding digital platforms, enhancing sustainability efforts, and innovating store formats. A leaner structure and faster decision-making processes would allow the company to allocate resources more effectively and strengthen its position in the evolving global convenience store market.

Source: The Japan Times

3. A Response to Shareholder and Market Pressures

Activist investors, including ValueAct, have repeatedly urged Seven & i to streamline its operations and unlock value through a sharper focus on its convenience store business. Ito’s bid could be viewed as a response to these pressures, signaling a willingness to address concerns about inefficiencies and undervaluation.

4. An LBO that makes sense and is feasible

Lastly, the feasibility of the leveraged buyout and the undervaluation of Seven & i shares bolster the rationale for the deal. As mentioned in Couche Tard’s rationale, Seven & i trades at a relatively low valuation despite operating five times the number of stores as ACT and maintaining superior margins in its Japanese operations. Even after a 16% rise in share price post-bid announcements, the company remains attractively priced compared to global peers. Ito’s bid is currently supported by ¥6 trillion ($40 billion) in loans from Japan’s three largest banks—Sumitomo Mitsui, Mitsubishi UFJ, and Mizuho—along with potential partnerships with private equity firms like KKR and Bain Capital. This robust financial backing demonstrates confidence in the Ito family’s vision and their ability to execute the buyout successfully.

Deal Structures:

ACT’s latest offer, valued at ¥7 trillion ($47.2 billion), is structured as an all-cash acquisition, financed with a mix of debt and equity, aimed at acquiring 100% of Seven & i’s equity. The new proposal of $18.19 per share is about a 22% premium on top of Couche-Tard's previous rejected offer of $14.86 per share, or about $38.5 billion. The company’s financing plan includes significant support from the Canadian pension fund Caisse de Dépôt et Placement du Québec (CDPQ), which has expressed its willingness to provide a mix of equity and debt financing. The company is working with legal and regulatory advisors to navigate Japan’s Foreign Exchange and Foreign Trade Act and U.S. antitrust concerns, which pose significant hurdles to the deal. In early September, ACT retained Goldman Sachs as a financial advisor.

On the other side, the Ito family’s ¥9 trillion ($58 billion) management buyout proposal reflects a distinctly domestic strategy. Backed by Japan’s largest financial institutions—Sumitomo Mitsui Financial Group, Mitsubishi UFJ Financial Group, and Mizuho Financial Group—the Ito family has secured ¥6 trillion ($40 billion) in loan commitments. To raise the remaining ¥3 trillion ($18 billion), the family has recently engaged private equity firms, including KKR & Co, Bain Capital, and Apollo Global Management, to explore potential partnerships. This financial backing underscores confidence in Junro Ito’s leadership and the feasibility of the management buyout. Ito-Kogyo’s proposal aims to streamline Seven & i’s operations by divesting underperforming segments, focusing on its profitable 7-Eleven brand, and preserving its Japanese identity. Nomura Holdings is reportedly advising Ito-Kogyo on the deal, providing strategic guidance for financing and restructuring.

Seven & i Holdings currently has a special committee of independent outside directors to evaluate the proposals. Led by Stephen Hayes Dacus, the committee is working with undisclosed financial and legal advisors to assess the bids and explore standalone opportunities for the company. The committee’s role is pivotal in ensuring that shareholder value is maximized, whether through a transaction or independent restructuring.

Several prominent financial institutions are involved in the potential acquisition of Seven & i Holdings. Mitsubishi UFJ Morgan Stanley Securities is advising Seven & i Holdings, while Nomura Holdings is guiding the special committee of the board examining the offers. The Ito family has SMBC Nikko Securities as their financial advisor, with Daiwa Securities Group counseling Itochu Corp., a partner in the Ito family's proposal. As mentioned, Goldman Sachs is the financial advisor for Alimentation Couche-Tard’s bid.

Deal Discussion:

“History doesn’t repeat itself, but it often rhymes.”

— Mark Twain (reputedly)

The battle for Seven & i Holdings invites striking parallels to the 1988 RJR Nabisco leveraged buyout, and I believe this comparison offers valuable insights into how mega-deals and LBOs have evolved over the 36 years. While both contests showcase the timeless forces of pride, emotion, and ambition in M&A, the differences reveal how dealmaking has grown more complex in an interconnected global economy.

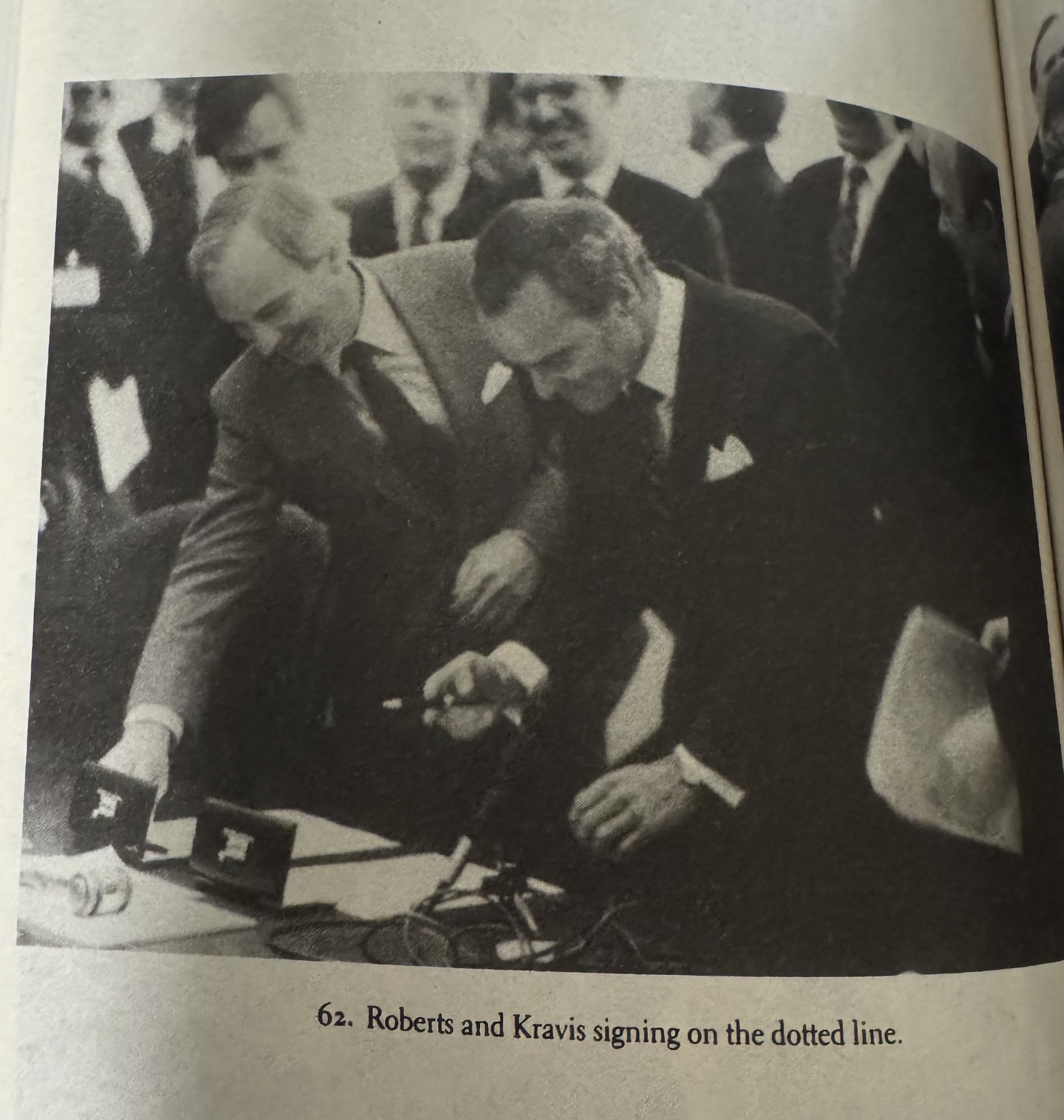

Pride, Price, and Passion

The RJR Nabisco saga revealed how ego could derail billion-dollar deals through both greed and seemingly trivial matters. Just as today, it began with a management buyout attempt that unleashed competitive forces beyond anyone's control. Ross Johnson's initial $75 per share bid sparked a frenzied two-month contest that ended with KKR's winning $109 offer— a 45% premium. The board ultimately rejected management's higher $112 bid, citing concerns about Johnson's proposed compensation package that would have given him and seven executives 20% ownership potentially worth billions without putting up any capital - a deal overflowing with greed.

RJR Nabisco Deal Tombstone. Source: Wall Street Oasis

But what truly killed Johnson's bid was Wall Street's ego manifesting in the most absurd ways. For example, when running bond offerings, hierarchy was rigidly defined by position in tombstone advertisements— dense blocks of text announcing deals in financial newspapers. In these ads, once buried among the stock tables at the back of The Wall Street Journal and New York Times, the lead bank's name typically appeared on the left side, while secondary participants were listed to the right. In Barbarians at the Gate, Salomon's leaders, John Gutfreund and Tom Strauss, were almost willing to scrap the largest takeover in history over the placement of their firm's name in these tombstone advertisements because appearing on the right side beneath Drexel would make Salomon look like "an afterthought." George Roberts, Kravis's cousin and co-founder of KKR, summed up the situation well: "Everyone's interested in everything except doing a business deal. It's all jockeying for ego and position" (Burrough 328).

Today's battle for Seven & i Holdings may echo similar patterns of ego and escalation, pride and passion, though perhaps manifested differently through Japan's corporate culture. With Couche-Tard's initial $39 billion approach triggering both a revised $47 billion offer and a potential $58 billion management buyout proposal from the Ito family, the underlying dynamics appear more complex than mere financial opportunity. Just as RJR's drama revolved around Wall Street status symbols, the Seven & i contest seems to have become entangled with questions of national pride and corporate independence.

The Japanese concept of "keiretsu"— the traditional system of corporate relationships and cross-shareholdings— might appear as arcane to outsiders as tombstone ad placement but could shape deal dynamics in similarly powerful ways. The Ito family's 49% premium likely isn't driven by individual ego. Instead, it may very well reflect a form of collective institutional pride. Japan's three largest banks have aligned to provide ¥6 trillion in financing, possibly not just because they see an investment opportunity but because allowing Seven & i to fall into foreign hands could represent a symbolic challenge to Japan Inc. This may parallel how Salomon couldn't bear being seen as secondary to Drexel - except here, an entire nation's financial establishment appears reluctant to cede control to foreign capital. Where RJR's deal spiraled out of control due to fragmented egos, Seven & i's premium bid seems enabled by more coordinated institutional backing, though the long-term implications of such high leverage may be just as lethal.

A Tale of Two Industries in Transition: Leverage and Legacy

The timing parallels between RJR and Seven & i are particularly instructive. RJR in 1988 was facing declining U.S. tobacco consumption - cigarette sales had fallen nearly 10% since 1981 despite price increases, while litigation costs had soared from $5 million to $75 million annually. Funnily enough, a key challenge that Seven & i must confront today is also regarding the decline in cigarette/tobacco sales; except this time around, the decline is even steeper: cigarette sales have plunged 26% since 2019 to 80-year lows. Alongside the rise of electric vehicles threatening the gas station model that has long driven foot traffic, the convenience store market is undergoing a crucial transitional period. Unlike RJR, which still generated massive cash flow with 35% operating margins in tobacco versus just 11% in food, Seven & i can't rely on a similarly profitable core business to drive transformation - its U.S. operations achieve just 3.5% margins compared to 27% in Japan.

The timing of both deals reveals a sobering parallel - iconic companies taking on massive leverage just as their core businesses face existential challenges. RJR, in 1988, confronted declining U.S. tobacco consumption, with cigarette sales falling nearly 10% since 1981 despite price increases, while litigation costs soared from $5 million to $75 million annually. KKR's winning bid saddled RJR with $31 billion in debt on a $25 billion buyout just as these headwinds intensified. The crippling leverage forced a desperate cycle of asset sales and restructuring that ultimately cost KKR $730 million in losses.

Funnily enough, a key challenge that Seven & i must confront today is also regarding the decline in cigarette/tobacco sales; except this time around, the decline is even steeper: cigarette sales have plunged 26% since 2019 to 80-year lows. Meanwhile, other headwinds, such as the rise of electric vehicles, threaten the gas station model that has long driven foot traffic. Adding massive leverage at this juncture could force similar desperate measures - particularly since, unlike tobacco's addictive pricing power, convenience store customers are going to be much more price-sensitive.

But the Seven & i's transformation challenge appears even more complex. Where RJR primarily needed to manage tobacco's decline while leveraging its food brands, tomorrow's convenience stores must simultaneously pivot to fresh food offerings, invest in digital capabilities, reimagine stores for EV charging, and compete with rapid delivery services. This makes the Ito family's proposed leverage of nearly 6x EBITDA particularly concerning. Even with strong Japanese cash flows mirroring RJR's tobacco profits, Seven & i's recent 5% EBITDA decline suggests limited room for error.

However, the financing structures do offer one crucial difference that could affect the outcome. Where RJR relied on Drexel's junk bonds at interest rates exceeding 14%, the Ito bid draws on Japan's largest banks— Mitsui, Mitsubishi UFJ, and Mizuho— operating in a remarkably different monetary landscape. While U.S. banks face a federal funds rate of 4.5%-4.75%, the Bank of Japan maintains a low interest rate of 0.25%— a “hawkish” policy enacted earlier this year, given Japan’s history of negative rates. And as reported in The Wall Street Journal, these three banks have combined balance sheets rivaling JPMorgan Chase and Bank of America together, giving them significant capacity to support what could become the largest leveraged buyout in history.

While cheaper debt provides more breathing room, the fundamental challenge remains the same— attempting a complex transformation while carrying a massive debt burden. RJR's cautionary tale suggests that even strong cash flows can quickly prove inadequate when industry headwinds combine with heavy leverage. Seven & i's board must weigh whether access to cheap Japanese financing truly makes their situation different or if they risk repeating history with an even more ambitious transformation ahead. In the most recent development of this story on December 4th, 2024, the proposed management buyout is now set to include plans for an IPO of its North American convenience stores and gasoline stations business to better repay loans and alleviate financing concerns. The Bloomberg report mentioned that the IPO could generate over ¥1 trillion in cash, which may provide the crucial reassurance needed for both the lenders and the Seven and i board.

More than Financial Engineering: Operating the Business

After paying $31.4 billion for RJR Nabisco, KKR’s initial strategy seemed straightforward: deploy the classic buyout playbook of slashing costs, selling assets, and refinancing debt. But as often happens in financial markets, elegant theories collide with messy reality.

Consider the cascade of crises that followed. Within months, the junk bond market's collapse forced hasty refinancing at punitive rates. Then came Moody's December 1989 debt downgrade - a financial body blow that, combined with $7 billion in pay-in-kind bonds facing steep interest rate resets, pushed RJR toward default. By July 1990, KKR was doubling down on their troubled investment, injecting $1.7 billion in emergency equity and securing $2.25 billion in new bank loans. Their ownership increased from 58% to 83% - the financial equivalent of catching a falling knife.

Even operational improvements proved ephemeral. Under Lou Gerstner, KKR's hand-picked CEO, operating profits initially jumped 31%. But then came what George Roberts later called the deal's death knell: Philip Morris's 1993 decision to slash Marlboro prices. The ensuing price war burned through $900 million in profits and 2% market share. Combined with mounting tobacco litigation threats, this competitive assault effectively cremated KKR's exit plans.

By 1994, KKR faced a stark reality: their prized investment was flatlining, with both KKR's partners ($126 million invested) and limited partners staring at negligible returns. Their solution was creative, if desperate - swapping their remaining 40% RJR stake for full control of Borden, a struggling consumer goods company, in a $1.9 billion deal. While this financial origami earned praise for its cleverness (even from estranged partner Jerry Kohlberg), it merely postponed the inevitable. KKR ultimately sold Borden to Apollo Management in 2005 for $1.2 billion, closing the books on an investment that generated less than 1% IRR - a far cry from KKR's targeted returns. The aftermath transformed KKR’s approach to LBOs, and Kravis’ famous quote encapsulates the essence:

“Look, don’t congratulate us when we buy a company, congratulate us when we sell it. Because any fool can overpay and buy a company, as long as money will last to buy it”

— Henry Kravis

KKR's 1987 fund, which would have returned 25.2% excluding RJR, managed just 12% with it. Meanwhile, RJR itself was dismembered - its international tobacco business sold to Japan Tobacco, its food operations absorbed by Kraft (ironically controlled by Philip Morris's parent), and its domestic tobacco business spun off into what would become Reynolds American.

Fast forward to 2024, Seven & i's Japanese operations rely on intricate supplier relationships and quality control systems developed over decades. Unlike the efficiency-focused models common in Western retail, Japanese 7-Eleven stores embody the philosophy of kaizen, or continuous improvement, which permeates every aspect of their supply chain. For instance, rice masters in Kyoto select specific rice varietals for onigiri, adjusting seasonally to account for variations in flavor and texture caused by weather patterns and crop yields. This attention to detail extends beyond the final product; suppliers are held to stringent standards through regular audits and feedback loops to ensure that every ingredient—even down to the soy sauce packet in a bento box—meets customer expectations.

Then there’s the logistical marvel underpinning the operation: Japanese 7-Eleven locations receive up to three fresh food deliveries daily, with delivery times aligned with peak customer traffic periods. These deliveries are not just about restocking but reflect a commitment to freshness and quality. Perishable items that remain unsold are promptly removed, ensuring that customers consistently experience products at their peak. This system relies on advanced inventory management technology that forecasts demand not just by store but by hour, considering variables like weather, holidays, and local festivals. Such operational granularity is not common in Couche-Tard’s Western markets, where the emphasis has historically been on maximizing scale and standardizing operations across geographies.

Bridging this operational gulf would challenge even Couche-Tard's proven integration capabilities. The convenience retail giant, while no stranger to acquisitions, has historically focused on expanding its footprint and improving efficiencies in more uniform markets like North America and Europe. Its integration of Circle K involved streamlining existing operations rather than adopting entirely new business philosophies. Adapting Seven & i’s operational practices to a broader, Western-oriented framework would require Couche-Tard to rethink its approach to inventory management, supplier relationships, and product localization. This is not just a technical challenge but also a cultural one. Western convenience stores have long prioritized speed and volume, focusing on shelf-stable snacks, soft drinks, and fuel as primary revenue drivers. Introducing fresh, locally sourced food offerings—a key aspect of Seven & i's success in Japan—would necessitate reengineering supply chains and reshaping customer expectations.

Of all the lessons to be learned from KKR’s turbulent aftermath of its record-breaking LBO, there is one that seems so obvious that it is often overlooked: beyond financial engineering, a successful business transaction still depends on its ability to do business—and doing it well.

Source: Barbarians at the Gate (Paperback published by Harper Business in 2009)

The Path Forward in History’s Guidance

As Seven & i's special committee evaluates these competing visions, the RJR precedent casts a long shadow. The eventual winner must balance ambitious transformation plans against the constraints of leverage while preserving the operational excellence that made Seven & i an attractive target in the first place. The committee's challenge is ensuring that operational synergies and excellence can offset the premium paid without creating a "zombie company" focused solely on debt service. Perhaps most critically, they must determine whether Seven & i's cultural and operational distinctiveness can survive either a foreign acquisition or a heavily leveraged domestic buyout. The lessons from RJR's LBO—ego-driven overreach and the pitfalls in operating a debt-laden conglomerate— can serve as prescient warnings to the Seven and i board. And what is their task now? To shape a future for Seven & i that avoids history rhyming with itself too closely.

Which Offer to Take?

So there remains one final question: Which offer should the board of Seven and i take? Let’s quickly review the key differences between the two offers:

1. Price & Structure

Couche-Tard: $47 billion strategic acquisition financed with a mix of cash and debt.

Ito Family: $58 billion management buyout, heavily leveraged with ¥6T ($40B) debt financing.

2. Strategic Vision

Couche-Tard: Global integration, operational synergies, scale benefits

Ito Family: Independence, cultural preservation, private restructuring

3. Financial Impact

Couche-Tard: More sustainable leverage, high levels of cost synergies, better capacity for continued investment into expansion

Ito Family: 6x EBITDA leverage, no synergies, constrained investment capacity

4. Regulatory Hurdles

Couche-Tard: Major U.S. antitrust concerns (31% store overlap and 13% market share), Japanese foreign investment review of “core” business

Ito Family: Minimal regulatory issues, strong Japanese government/bank support

5. Cultural Implications

Couche-Tard: Foreign ownership, integration challenges, potential culture clash

Ito Family: Preserved Japanese identity, operational continuity, better stakeholder alignment

Now, if any of you somehow read through the entirety of my blog (Big shout out to you), you would know that this clearly isn't an easy decision. But as always, I like to give my opinion of the deal at the end of each blog.

So, here’s my verdict:

If things stay as is (which easily may not), I am leaning towards the possibility of a management buyout that keeps Seven and i in the hands of the Japanese for two main reasons: One, better maximizes shareholder returns (higher bid). Two, better alignment of stakeholder interests (keeping an iconic Japanese brand in Japanese hands for Japanese people). If I were to add a third reason, it would be the antitrust concerns from the two largest convenience store chains merging. But hey, if Couche Tard’s acquisition could somehow bring Onigiris and all those amazing Japanese fresh food options to US convenience stores, I might have to switch sides and root for them instead.