M&A Back in Motion: Tempur Sealy Clears FTC Hurdles to Acquire Mattress Firm

Benjamin Franklin once said, “In this world, nothing is certain except death and taxes.” Well, for me, I think there was one more certainty to tack on in the past few years: M&A antitrust scrutiny under Lina Khan’s FTC. It felt like every time a major merger hit the headlines in recent years, there was an FTC lawsuit right around the corner. If you’ve been following the consumer and retail space, you’ve probably seen the carnage firsthand. Last year, the $25 billion Albertsons-Kroger merger was blocked. Tapestry’s $8.5 billion acquisition of Capri got tied up. And then there was Tempur Sealy’s $4 billion bid to acquire Mattress Firm. That one didn’t escape unscathed either—or at least not at first.

Just a few days ago, on January 31st, 2025, U.S. District Court Judge Charles Eskridge denied the FTC’s request to block the merger, allowing Tempur Sealy to move forward. The FTC still has a seven-day window to appeal, but analysts see that as highly unlikely (*Deal officially closed February 5th). This legal victory sent Tempur Sealy’s (NYSE: TPX) shares soaring by 7% to an all-time high, and many banks are revising Sealy’s price target upwards to $75-$80 per share. For context, the stock is currently trading at $64.44 as of market close on February 7th, 2025.

Before we move on, here is a timeline of key events for everyone to get up to speed on this deal:

May 2023: Tempur Sealy announces a definitive agreement to acquire Mattress Firm for $4 billion. The initial deal was structured as a mix of $2.7 billion in cash and $1.3 billion in stock, aiming to create a vertically integrated bedding leader with over 3,000 retail locations and enhanced manufacturing and R&D capabilities.

July 2024: The FTC files an administrative complaint, arguing that the vertical merger would harm competition by restricting rivals’ access to Mattress Firm’s retail channels and potentially raising prices for consumers. The agency also seeks a temporary restraining order to block the deal.

September 2024: In response to regulatory concerns, Tempur Sealy agrees to divest certain assets. The final plan now calls for divesting 73 Mattress Firm retail locations along with the Sleep Outfitters subsidiary—comprising 103 specialty mattress stores and seven distribution centers.

November 2024: Court hearings commence. Tempur Sealy defends the merger by emphasizing that Mattress Firm represents only a modest share of U.S. brick-and-mortar bedding stores amid fierce competition from digital DTC (direct to consumer) disruptors like Casper and Purple.

January 31, 2025: Judge Eskridge rules in favor of Tempur Sealy—rejecting the FTC’s claims, dismissing the narrow market definition, and deeming the competitor testimony unconvincing—thereby allowing the merger to proceed.

February 5th, 2025: The acquisition officially closes at a revised purchase price of nearly $5 billion.

February 18th, 2025: Tempur Sealy International will rebrand as Somnigroup International Inc., with the new ticker symbol “SGI.”

For M&A dealmakers, this ruling could signal the dawn of a more business-friendly regulatory landscape under the Trump administration, whose pro-business stance has been creating optimism for increased deal activity since last November. For several months now, there has been a general consensus among dealmakers that a more lenient regulatory environment under President Trump's administration— which is believed to foster a more conducive atmosphere for corporate transactions— will increase M&A activity in 2025 and beyond.

Giving Tempur Sealy the go-ahead on a deal that has been stalled since 2023 is perhaps the first instance of the new administration’s pro-business regulations in effect, and this matters because M&A thrives on one thing: certainty. Deals can be like dominoes—you won’t tip the first one unless you trust the others will fall into place. Over the past few years, that trust has been hard to come by. High-profile deals kept hitting regulatory walls, and buyers became wary of even stepping to the table.

So now, with regulators easing up and businesses eyeing opportunities in a new landscape, the question is: How will the rest of 2025 play out? Will strategic buyers reignite their appetite for mega deals? How will financial sponsors deploy their mountain of dry powder? And what about wildcards like tariffs, which continue to loom over international and domestic M&A?

In this post, I’ll take you through the Tempur Sealy-Mattress Firm deal—what it says about where we've been and where we might be headed. Think of this as your roadmap to the consumer & retail M&A landscape for the year ahead. Let's dive in.

Company Overviews:

Tempur Sealy

Tempur Sealy International, headquartered in Lexington, Kentucky, is the world’s largest bedding provider, with a portfolio of iconic brands including Tempur-Pedic®, Sealy®, and Stearns & Foster®. The company’s history is deeply rooted in over a century of innovation and craftsmanship, driven by a commitment to delivering high-quality sleep solutions (that I should probably look into).

The story of Tempur Sealy International is a tale of three pioneering brands—Sealy, Stearns & Foster, and Tempur-Pedic—converging to form the world’s largest bedding provider. Its origins stretch back to the mid-19th century, with the founding of Stearns & Foster in 1846, Sealy in 1881, and Temper Pedic in 1992. Tempur Sealy ultimately became the powerhouse it is today after Tempur-Pedic acquired the Sealy Corporation (who had already acquired Stearns & Foster) in 2013, merging a legacy of luxury and high-tech innovation all under one roof. While the company today is known for its premium foam mattresses and iconic Sealy Posturepedic line, this industry leader owes its legacy to over a century of innovation, craftsmanship, and timely acquisitions—some of which even trace back to NASA’s Space-Age research into G-forces.

The oldest chapter in this story begins in 1846, when Stearns & Foster, originally a producer of cotton goods, pivoted to luxury mattress-making. The company quickly gained a reputation for high-end craftsmanship, with its mattresses becoming fixtures in upscale hotels across the U.S. Decades later, in 1881, another chapter unfolded in Sealy, Texas, where Daniel Haynes, a cotton gin builder, invented a machine that compressed cotton for use in mattresses. His innovation transformed mattress production at the time and eventually led to the creation of the Sealy brand in 1889. Over the years, Sealy introduced several groundbreaking advancements in mattress technology, including the development of Posturepedic in 1950, which was specifically designed to offer enhanced back support.

By the mid-20th century, both Sealy and Stearns & Foster were recognized leaders in the bedding industry, and the two ultimately crossed paths in 1983 when Sealy acquired Stearns & Foster, adding Stearns & Foster’s luxury brand to its expanding portfolio. For decades after the acquisition, the two companies operated under a unified strategy to serve both mass-market and high-end consumers.

Daniel Haynes of Sealy, Texas, and his innovative machine compressed cotton easier and more efficiently.

Finally, the last piece of the Tempur Sealy puzzle came in 1992, when Tempur-Pedic revolutionized the mattress industry with their TEMPUR® material, a viscoelastic foam originally developed by NASA to absorb G-forces. Tempur-Pedic introduced a completely new concept of sleep, as the foam’s pressure-relieving and motion-isolating properties quickly gained a loyal following, making Tempur-Pedic a household name in premium sleep technology.

In 2013, the three brands officially came together when Tempur-Pedic acquired Sealy, who already owned Stearns & Foster. The merger created Tempur Sealy International, combining a legacy of handcrafted luxury with cutting-edge sleep technology. This newly formed powerhouse became a vertically integrated global leader, overseeing every aspect of its operations, from R&D and manufacturing to distribution and sales. Yet, Tempur Sealy’s growth didn’t stop there. In 2018, the company acquired Comfort Revolution, a New Jersey-based manufacturer known for gel memory foam pillows and bed-in-a-box solutions. This acquisition enhanced Tempur Sealy’s presence in alternative distribution channels and OEM (original equipment manufacturing), aligning with consumers' growing preference for online mattress shopping and direct-to-home delivery.

Today, Tempur Sealy operates over 71 manufacturing facilities and more than 750 retail stores worldwide, complemented by a robust e-commerce presence. Its portfolio includes mattresses designed to cater to a wide range of needs—whether for hot sleepers, side sleepers, or those seeking specialized back support. The company’s vertically integrated model ensures consistent quality across its global operations, allowing it to innovate and adapt in a highly competitive $120 billion bedding market. Now, following the successful acquisition of Mattress Firm and in line with its evolving omnichannel strategy, Tempur Sealy is set to rebrand as Somnigroup International Inc. Effective February 18, 2025, this new identity reflects its broadened global ambitions and diversified business model, with shares trading under the ticker “SGI.”

In its most recent Q3 FY 2024 earnings call, Tempur Sealy International reported solid financial performance, with total net sales rising 1.8% to $1,300.0 million, driven by a 12.4% increase in the international segment, which offset a 0.8% decline in North America. Gross margin improved to 45.4%, while operating income increased 10.2% to $201.8 million. Net income saw a 14.7% boost to $130.0 million, with earnings per diluted share climbing 14.1% to $0.73. Adjusted EPS rose 6.5% to $0.82. Additionally, the company's leverage ratio improved significantly to 2.41x, reflecting progress in reducing debt and strengthening its balance sheet. Looking ahead, Tempur Sealy’s planned acquisition of Mattress Firm positions the company to further expand its direct-to-consumer reach and strengthen its retail presence. If successful, the acquisition will deepen Tempur Sealy’s insights into consumer behavior and enhance its operational efficiency on a scale few competitors can match.

Mattress Firm

As opposed to Tempur Sealy, I’m guessing more of us are going to be familiar with Mattress Firm. I mean, at least I see it everywhere. Mattress Firm, headquartered in Houston, Texas, is the largest specialty mattress retailer in the United States, with a network of over 2,300 stores spanning 49 states. Over the decades, Mattress Firm has evolved into a key player in the U.S. sleep industry, offering products from leading brands like Tempur-Pedic®, Sealy®, Serta®, and Stearns & Foster®, along with its own private label, Tulo®.

Now, the story of Mattress Firm all started on July 4, 1986, in Houston, Texas. Three college friends—Steve Fendrich, Harry Roberts, and Paul Stork—pooled their $5,000 investments to open a single mattress store with a vision to modernize the sleep shopping experience. Back then, buying a mattress often meant visiting rundown stores with plastic-wrapped beds and waiting up to two weeks for delivery. But these three entrepreneurs did things differently. They created inviting showrooms, offered same-day delivery (sometimes strapping mattresses to the roof of a car), and focused on personalized service. This simple yet innovative approach set the foundation for what would become Mattress Firm, the largest specialty mattress retailer in the U.S.

Throughout the 1990s and early 2000s, Mattress Firm became a regional success story, rapidly expanding its footprint. The company’s competitive edge lies in its high-energy sales culture and strategic focus on customer convenience. But to truly dominate the market, Mattress Firm pursued an aggressive acquisitions strategy. In 2014, it acquired Sleep Train, and in 2015, it bought Sleepy’s for $780 million, catapulting its store count to over 3,500 locations. For a time, this strategy worked wonders, boosting revenue and expanding the company's presence into nearly every major U.S. market.

However, the rapid expansion came with growing pains. Many stores were located too close to one another, cannibalizing sales and driving up lease costs. By 2016, Mattress Firm was acquired by Steinhoff International, a South African retail giant, for $3.8 billion. The timing of the deal proved unfortunate. The mattress industry was undergoing a seismic shift as direct-to-consumer brands like Casper, Purple, and Tuft & Needle began to disrupt traditional retail with their bed-in-a-box models and hassle-free trial periods. Meanwhile, Steinhoff was entangled in a major accounting scandal, leaving Mattress Firm without the support needed to navigate this disruption.

The pressure reached a boiling point in 2018, when Mattress Firm filed for Chapter 11 bankruptcy. Over 700 underperforming stores were closed, and the company underwent a significant restructuring to reduce debt and streamline operations. Remarkably, Mattress Firm emerged from bankruptcy within a few months, leaner and more focused. The company strengthened its omni-channel strategy, blending e-commerce with physical retail. Recognizing that many customers still wanted to try out mattresses in person, they invested in their Sleep Experts™, who provide tailored consultations in-store. At the same time, they enhanced their online platform to better compete with digital-first rivals.

Today, Mattress Firm operates over 2,300 stores across 49 states and maintains strong partnerships with top mattress brands, like those under Tempur Sealy International. Its hybrid business model allows customers to shop in whichever way suits them best—whether through online research and purchase or in-store testing and advice. This adaptability is keeping Mattress Firm alive— and an attractive acquisition target— in a fast-changing market where convenience and experience both play crucial roles in consumer decision-making. In its most recent Q1 FY2025 financial report, Mattress Firm posted net revenue of $937.4 million, a slight increase from $924.8 million in the same period the previous year. Adjusted EBITDA rose to $89.8 million, up from $85.3 million, reflecting a stable adjusted EBITDA margin of 9.6%. The company continues to focus on strategic initiatives, store optimization, and integrating cloud-based operational improvements to sustain profitability.

From humble beginnings—with frozen lunches heating on a car dashboard—to becoming a cornerstone of the American sleep industry, Mattress Firm’s journey is one of reinvention and resilience. As it possibly enters this new chapter alongside Tempur Sealy, the company is poised to redefine how Americans shop for sleep solutions once again.

Mattress Firm Verdi Square in Manhattan in 2022

Industry Overview:

The global mattress market, valued at approximately USD 46.48 billion in 2024, is projected to grow at a 6.5% compound annual growth rate (CAGR) from 2025 to 2030. This growth is fueled by increasing consumer awareness of sleep quality's role in overall well-being, driving demand for high-performance, premium sleep solutions. Innovations in mattress technology—such as memory foam, hybrid mattresses, and smart mattresses equipped with sleep-tracking features—are reshaping the industry, catering to consumers' desire for enhanced comfort and health benefits. Leading brands like Tempur-Pedic and Sleep Number are at the forefront of this trend, integrating customizable features that improve the sleep experience.

There are a few interesting trends worth noting, with the current market growth supported by trends in both residential and commercial sectors. On the residential side, the rise in disposable income has spurred greater investment in home furnishings, including high-quality mattresses and sleep accessories. This trend accelerated during the pandemic when e-commerce saw a significant boom, prompting companies to adopt innovative online strategies like bed-in-a-box models to meet consumer needs. E-commerce also allows consumers to easily access and compare products through platforms like Amazon, Wayfair, and dedicated mattress retailers such as Casper or Mattress Firm. This shift has been bolstered by free trial policies and convenient home delivery, which eliminate traditional buying obstacles and promote higher conversion rates.

On the other hand, the commercial segment is also growing as hospitality and healthcare providers prioritize sleep quality for guests and patients. Hotels, resorts, and luxury spas are investing in ergonomic and premium mattresses to enhance customer experience and differentiate their offerings.

The overall mattress industry is further shaped by demographic trends, with older consumers seeking ergonomic support and younger generations favoring sustainable, tech-enhanced options. Foam mattresses, with their superior motion isolation and pressure relief, currently dominate the market, holding a 45% share. Hybrid models, however, are gaining momentum, with expected growth driven by their blend of support and comfort. Moreover, new smart mattresses are now equipped with sleep-tracking technology that analyzes factors like breathing and heart rate, offering insights into sleep cycles such as REM and deep sleep. Such innovations are expected to further drive demand for smart mattresses in the evolving smart home ecosystem.

Currently, The U.S. mattress market is moderately consolidated, with leading players such as Tempur Sealy International (~20% market share), Serta Simmons Bedding, Purple Innovations, and Casper holding significant market share.

Deal Rationale:

Buyer— Tempur Sealy’s Perspective

Tempur Sealy’s planned $4 billion acquisition of Mattress Firm represents a targeted effort to reinforce its leadership in the global bedding market. By integrating approximately 3,000 retail stores and 30 e-commerce platforms, Tempur Sealy aims to broaden its consumer reach and enhance its ability to respond to shifting sleep preferences. This approach is expected to strengthen customer relationships, position the company more competitively in the expanding market for wellness-oriented sleep solutions, and solidify its international footprint.

A central objective of the acquisition is to accelerate Tempur Sealy’s omnichannel strategy. I mean, Tempur Sealy’s Chairman and CEO Scott Thompson literally said this himself:

"We are thrilled to announce a new name to our expanded vision. The name Somnigroup is derived from the Latin somn meaning sleep, omni meaning all, and "group" to represent our omnichannel strategy. The name Somnigroup International reflects our position as a global holding company and provider of sleep solutions with a portfolio of outstanding businesses – Tempur Sealy, Dreams and Mattress Firm – as well as the future direction of the company.”

Mattress Firm’s extensive brick-and-mortar network will complement the company’s established direct-to-consumer and digital operations, creating a seamless shopping experience that caters to both in-store and online customers. This integration is designed to reinforce brand loyalty through consistent, cross-channel engagement while expanding the overall customer base.

Source: TPX to Acquire Mattress Firm Investor Presentation

A second rationale aims to simplify the often-complex process of purchasing a mattress. By combining Mattress Firm’s experienced salesforce with Tempur Sealy’s marketing capabilities, the new entity can offer targeted advertising, comprehensive sleep education, and personalized product recommendations. The objective is to make the buying process more intuitive and accessible, addressing a common consumer pain point in the industry.

Additionally, this vertical integration between a mattress manufacturer and retail distributor allows Tempur Sealy to benefit from expedited innovation cycles. Gaining access to Mattress Firm’s substantial customer feedback will inform Tempur Sealy’s product development and enhance alignment with consumer demands—particularly for smart mattress technologies, ergonomic designs, and health-focused features. This direct feedback loop is expected to shorten time-to-market for new solutions and reinforce product differentiation. Furthermore, by merging Mattress Firm’s retail logistics with Tempur Sealy’s vertically integrated manufacturing, the combined company can also improve demand forecasting, streamline warehousing and transportation, and optimize order fulfillment. These efforts are likely to reduce costs, enhance delivery times, and ultimately support a better customer experience.

Finally, from a financial standpoint, Tempur Sealy anticipates the transaction will be accretive to adjusted earnings per share (EPS) in the first year. Management projects $100 million in annual run-rate synergies by year four, attributable to economies of scale in logistics, sourcing, and manufacturing. Tempur Sealy also expects to return to its targeted leverage range of 2.0x to 3.0x adjusted EBITDA within 12 months, supported by earnings growth and free cash flow from the merged operations. More recently, during the February 6, 2025, conference call marking the official close of the acquisition, the company noted: “On a pro forma basis for the acquisition of Mattress Firm, the Company generated approximately $8 billion in sales over the previous twelve months ending December 31, 2024, net of intercompany sales. This translates to roughly 85% of sales in North America and 15% internationally, with about 65% of sales derived from direct-to-consumer channels and 35% from third-party retailers.”

Overall, the acquisition is designed to fortify Tempur Sealy’s omnichannel platform, enhance operational efficiency through robust vertical integration, and sustain long-term growth via continuous innovation. Now that the deal has officially closed after 21 months of waiting, Tempur Sealy will be well-positioned to compete in the $120 billion global bedding market (A bigger market that includes the mattress market that I covered) and deliver enhanced sleep solutions to a broader consumer base.

Seller— Mattress Firm’s Perspective

For Mattress Firm, this acquisition provides an opportunity to stabilize its finances and reinforce its competitive position following a period of overexpansion and a Chapter 11 restructuring in 2018. John Eck, CEO of Mattress Firm, has stated that the deal aligns with the company’s mission to deliver personalized sleep experiences. As part of the merged entity, Mattress Firm will leverage expanded digital capabilities, enhanced marketing, and deeper customer engagement tools while retaining its core strength in hands-on, in-store consultations through its Sleep Experts™.

For Mattress Firm shareholders, the deal’s structure—offering 16.6% ownership in the combined company—presents the potential for meaningful returns tied to future synergies, earnings growth, and market expansion.

Deal Structure

Tempur Sealy's acquisition of Mattress Firm intended to vertically integrate the world’s largest mattress manufacturer with the largest U.S. specialty mattress retailer. The transaction was first announced on May 9, 2023, structured as a $4.0 billion transaction, with a mix of $2.7 billion in cash and $1.3 billion in stock. The stock portion involved the issuance of 34.2 million shares of Tempur Sealy common stock at $37.62 per share, based on the closing price as of May 8, 2023. However, in the 21 months between the initial announcement and the official closure of this acquisition, the total purchase price has gone up to approximately $5 billion. This increase in purchase price is attributable to the appreciation of the 34.2 million shares of common stock since the cash portion of the deal is still $2.7 billion. Still, under the terms of the deal, Mattress Firm shareholders would hold 16.6% ownership in the combined company, while Tempur Sealy shareholders would retain the remaining 83.4% stake.

As per the initial announcement, the cash consideration was to be financed through a combination of existing cash and new secured and unsecured debt. A portion of this capital was earmarked for repaying Mattress Firm’s outstanding debt to improve the financial health of the combined entity. Tempur Sealy anticipated a net leverage ratio of 3.0x to 3.25x adjusted EBITDA at closing, with plans to reduce it to 2.0x to 3.0x within the first 12 months through increased earnings and stronger free cash flow.

As part of the deal, Mattress Firm would continue to operate as a separate business unit within Tempur Sealy, preserving its brand identity and management expertise. Tempur Sealy committed to expanding its Board of Directors by appointing two directors mutually agreed upon by both companies.

Immediately after the announcement of the transaction, it was subject to regulatory review and customary closing conditions, including clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976. Despite both companies receiving board approval and over 80% of Mattress Firm shareholders agreeing to support the merger, the FTC immediately raised concerns about potential anti-competitive effects. These concerns ultimately resulted in a request for additional documentation and further scrutiny, delaying the deal’s progress until ultimately, On July 2, 2024, the FTC voted unanimously (5-0) to block the transaction. The Commission issued an administrative complaint and authorized a federal lawsuit, alleging that the acquisition would enable Tempur Sealy to control both supply and retail access, thereby suppressing competition and raising prices for millions of consumers.

FTC’s Challenge and the Aftermath

The FTC’s complaint centered on concerns that Tempur Sealy would have the incentive to restrict rivals’ access to Mattress Firm’s extensive retail network. According to the FTC, Tempur Sealy could limit floor space for competing brands, incentivize sales associates to steer customers toward Tempur Sealy products, and ultimately reduce market access for other mattress suppliers like Serta Simmons and Purple Innovations. The agency warned that this vertical integration could result in higher prices, lower product quality, reduced innovation, and even factory closures across key manufacturing states such as Georgia, North Carolina, Ohio, and Arizona.

“Through emails, presentations, and other deal documents, Tempur Sealy has made it abundantly clear that its acquisition of Mattress Firm is intended to kneecap competitors and dominate the market,” stated Henry Liu, Director of the FTC’s Bureau of Competition. The FTC emphasized that controlling a major retail channel like Mattress Firm would significantly impair smaller manufacturers’ ability to compete, which could lead to job losses and factory closures in several states.

Following the FTC's administrative complaint, legal proceedings were initiated in the U.S. District Court for the Southern District of Texas to prevent the transaction from closing. However, on January 31, 2025, U.S. District Court Judge Charles Eskridge dismissed the FTC’s claims—citing an overly narrow market definition and discounting self-serving competitor testimony—thereby clearing the path for the acquisition’s closure on February 5–6, 2025. Although an administrative hearing is scheduled for March 12, 2025, it is not anticipated to alter the outcome of the finalized transaction.

Deal Discussion:

Tempur Sealy’s cleared acquisition of Mattress Firm serves as an ideal entry point into the broader M&A dynamics that will define 2025. This ruling against the FTC antitrust clampdown is a signal that the long-stifled M&A engine may finally be warming up. In the paragraphs that follow, I’m going to break down my M&A outlook for 2025 from two key perspectives: that of strategic buyers and that of financial sponsors. This approach will help us understand how a more favorable regulatory environment, improved capital market conditions, and evolving deal economics are poised to transform dealmaking next year. After a muted period for M&A driven by regulatory crackdowns and a sharp rise in borrowing costs, 2025 is shaping up to be the year where both strategic buyers and financial sponsors step back into the spotlight.

Strategic Buyers: Renewed Appetite in a More Desirable Environment

For several years, strategic buyers were forced into defensive postures—constrained by high borrowing costs, protracted antitrust reviews, and a market that rewarded short-term cost-cutting over aggressive growth-oriented moves. Under the previous Biden administration, deals took nearly twice as long to close as they did a decade ago— deals that once closed in about 9 months now stretched to 18 months on average. This created an environment where companies were reluctant to commit to transformative M&A transactions that require tons of time and effort to plan, negotiate, and execute. Thus, without a clear pathway to closing the deal and actually reaping the rewards of scale, synergies, new revenue streams, etc., companies might as well not think about M&A to begin with.

But now, with the incoming administration promising a return to a more predictable, traditional review process and hints of relaxed antitrust enforcement, corporate leaders are regaining confidence. In a recent November survey of Goldman Sachs Investment Banking clients, nearly 60% of respondents indicated that strategic growth—and the acquisition of new capabilities—will be the primary drivers of M&A decisions in 2025 for corporations.

The Trump administration has a few important pro-business factors:

1. Corporate Tax Cuts:

During his first term, President Trump passed the 2017 Tax Cuts and Jobs Act, lowering the corporate tax rate and thereby increasing corporate cash reserves, which in turn helped spur M&A activity. Now, with Trump again promising to cut the corporate tax rate in his second term, companies could see reduced liabilities that free up additional capital, potentially driving more acquisitions through the use of those tax savings.

2. A Flexible Approach to Antitrust:

Trump’s first presidency saw a judiciary inclined toward “behavioral remedies” for antitrust issues. Rather than blocking mergers entirely, the Department of Justice often allowed deals to proceed under conditions that preserved competition—frequently seen in vertical mergers (i.e., Tempur Sealy’s vertical integration with Mattress Firm), where parties were encouraged to modify their operations. A second Trump administration would likely continue this approach, especially for vertical mergers that improve supply-chain efficiency or innovation without significantly lessening market competition.

3. Changes in DOJ and FTC Leadership:

The individuals appointed to the Department of Justice and Federal Trade Commission will heavily influence how Trump’s regulatory agenda unfolds, shaping the types of cases pursued and the enforcement methods adopted for M&A and antitrust matters. Lina Khan, former Chair of the FTC, previously appointed by the Biden Administration, officially left the FTC on Monday, January 20, 2025, with Andrew N. Ferguson taking over as the new Chairman. This leadership change may signal a more market-oriented tone at the FTC, emphasizing negotiated settlements and behavioral restrictions rather than structural breakups.

On top of easing antitrust pressures, as public markets show signs of stabilization and interest rates trend downward—moving, for instance, from recent peaks in 2023-24 of a 5.25-5% target fed funds rate down toward levels 4.25-4.5% currently—the cost of capital is improving, which further incentivizes strategic buyers to reposition to go on the “offense.” Historical evidence actually supports this shift, where companies that actively engage in M&A, executing at least one deal per year, have achieved an average annual total shareholder return growth of about 8.5%, compared to a mere 3.7% for their less active peers.

Despite modest increases in 2024—where deal volume grew by 7% (from 9,653 to 9,780 deals) and total deal value ticked up from $1.02 trillion to $1.05 trillion—M&A activity remains low relative to overall market capitalization compared to 20 years ago. But as we have been discussing, the broader economic and regulatory environment is beginning to shift. CEO confidence is rising as monetary policy stabilizes and regulators move back toward a more traditional, predictable review process for mergers and acquisitions. According to Morgan Stanley’s 2025 M&A Outlook, this renewed clarity is expected to drive a significant increase in strategic deals, especially in industries like consumer & retail, technology/media/telecom (TMT), and healthcare, which have been previously held back by regulatory uncertainty.

In short, strategic buyers are emerging from a long period of defensive retrenchment. With a more predictable regulatory framework, lower financing costs, and historical performance data that underscore the value of active M&A, corporate leaders are poised to move decisively in 2025. The stage is set for a new M&A cycle, where strategic deals will redefine business models and unlock growth in a way that the market hasn’t seen in recent years.

Financial Sponsors: Unleashing Dry Powder and Accelerating Exits

While strategic buyers were held hostage by protracted antitrust reviews and steep financing costs, private equity firms have contended with a different but perhaps equally binding challenge. Over the past two years, elevated interest rates and valuation mismatches forced sponsors to delay exits—resulting in roughly 50% of their portfolio companies being held for more than five years and nearly 30% for over seven. Meanwhile, these firms are now sitting on over $2.6 trillion in uncommitted capital as of mid-2024, and after years of an exit drought, the pressure to monetize these aging investments is mounting.

Source: Morgan Stanley 2025 M&A Outlook

Source: Blackrock 2025 Private Markets Outlook

The reality is that sponsor activity has slowed down not only on the buy side but also on the sell side by an even greater magnitude. Many private equity buyout firms bought assets at the peak multiples of 2021, and now, with exit valuations falling short of those peaks, many GPs cannot find the right exit valuations to book a profit. According to BlackRock's 2025 Private Market Outlook, purchase multiples in PE deals fell sharply from 13.3x EBITDA in 2021 to 11.2x EBITDA in 2023. In practical terms, many sponsors locked in deals at the peak of the market in 2021, only to find that exit valuations have not kept pace. This gap has effectively imposed a premium on holding periods—as sponsors are forced to wait longer to achieve exits that match their entry multiples. As we can see, regulatory uncertainty isn’t the major friction point here; rather, it’s the valuation mismatch in the game of leveraged buyouts that has forced sponsors into longer holding periods.

Morgan Stanley’s 2025 M&A Outlook reinforces this narrative. Tom Miles, Co‑Global Head of M&A at Morgan Stanley, has pointed out that with funds nearing the end of their typical investment cycles, the mounting pressure to unlock liquidity is set to accelerate in 2025. Supporting this, sponsor-to-sponsor deal volumes have jumped 54% year‑over‑year in Q3, and global sponsor IPO volumes have surged 75% YoY. These figures suggest that as macro uncertainties recede and valuations begin to normalize, PE firms will pivot decisively from a prolonged exit drought to a period of active monetization.

On the operational side, there are additional signs that PE is ready to move. Scott Nuttall, Co-Chief Executive Officer of KKR, highlighted on KKR’s recent FY 2024 Q4 earnings call:

“In asset management, pipelines are up, more exits are possible, and we see more deployment opportunities globally and across asset classes. Exits should see fundraising momentum even more at the exact time we're in the market with a number of our flagship funds.”

This quote underscores that the market’s infrastructure is now in place for a more robust exit environment— not just a theoretical shift in sentiment. At Blackstone, the belief is similar. President and Chief Operating Officer Jonathan Gray noted in BX’s Q4 FY 2024 earnings call,

“We've got a regulatory climate for M&A that is far better for us. Strategics can now start to buy again, and some of those dialogues are picking up. And then you do have this sort of desire for people (sponsors) to get transactions after three years of being on the sidelines. So, we sort of see the ingredients for a very positive M&A cycle coming together.”

Blackstone’s alternative asset management business spans multiple asset classes, and Mr. Gray’s comment really captures the broader market mood: after years of forced patience, the appetite for transactions is returning. This convergence of factors—from the large dry powder reserves and lengthy holding periods to the growing readiness to monetize—is setting the stage for a structural shift in the sponsor exit landscape.

In synthesis, with massive dry powder, aging portfolios purchased at peak valuations, and improved macro conditions (interest rates trending down and a robust US economy), financial sponsors are poised to transition from net buyers to net sellers in 2025. The record‑high take‑private deal values at the end of 2024, the significant increase in sponsor-to-sponsor deal volumes, and the surge in global sponsor IPO activity all signal that the exit environment is about to revamp— injecting a long held-back supply of assets into the M&A ecosystem.

A Convergence of Forces

Together, these dynamics point to a structural shift in the M&A landscape. On one side, strategic buyers are ready to leverage a more predictable regulatory framework and a stabilizing macro environment to drive transformative acquisitions that deliver both near-term synergies and long-term growth. On the other, financial sponsors are compelled to monetize their aging portfolios, setting off a wave of exits that will feed the pipeline for corporate acquirers.

However, I would be lying if the outlook for 2025 is all sunshine and rainbows. The one wildcard that dealmakers must navigate and navigate very carefully is none other than their very own president of the United States— Donald Trump (2.0). Without getting too into the weeds of policies, many things that Trump has vowed to do on his agenda are inherently inflationary, i.e., tariffs. Whether Trump will actually implement tariffs or merely use them as a bluff/negotiation strategy is really out of my circle of competence. Just this past Saturday, on February 1st, Trump said the U.S. would impose a 25% levy on imports from Canada and Mexico, a 10% tariff on energy products from Canada, and an additional 10% tariff on China. But as the stock market opened on Monday and investors reacted with a sell-off and the S&P dropping by over 2%, by the end of that same day, President Trump and the leaders of Mexico and Canada had already reached a deal to put tariffs on hold for a month, in which both neighbors agreed to take measures to fight fentanyl trafficking across the U.S. border.

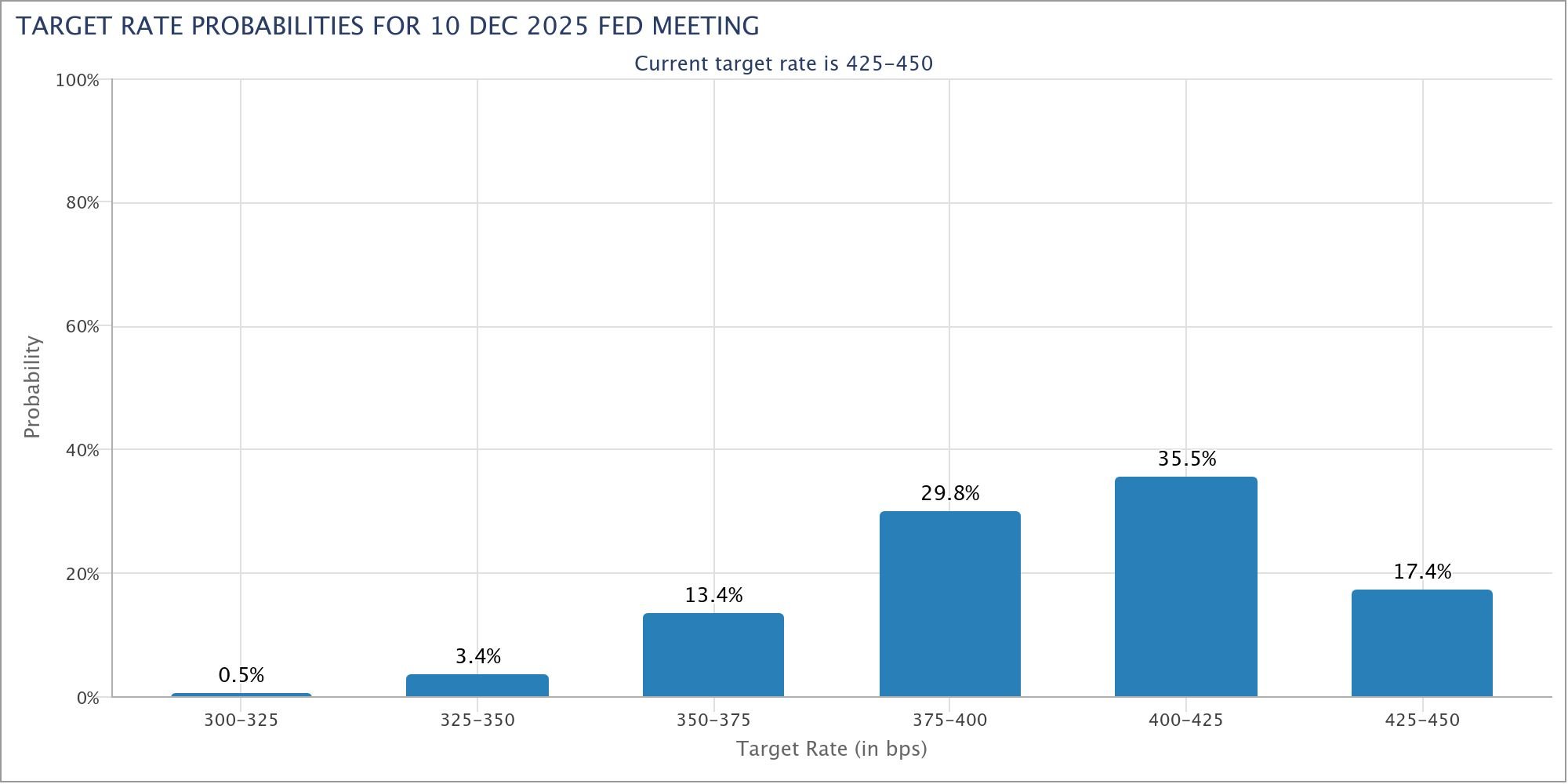

So, while what the President will actually do is anyone’s guess, one thing that may hinder the revival of the M&A market seems to be relatively certain given the way it’s being priced in is the fewer rate cuts in 2025. The first FOMC meeting of 2025 saw the Fed hold rate constant at a 4.25% - 4.50% target. According to the CME Group's FedWatch Tool, 75% of interest rate futures traders have priced in 0-2 cuts of 25 basis points in 2025. Although the largest odds are placed on two 2025 rate cuts of 25 basis points each, this 50bp cut is still significantly down from the 100bp cut expectation back in the September 2024 Fed meeting. Thus, as interest rate cuts slow down and geopolitical uncertainties still pose potential headwinds, the winners in 2025 will be those who are proactively planning and actively recalibrating.

*Checking the FedWatch tool again just before publishing the blog: The greatest odds are now placed on just one cut of 25bp by the December meeting in 2025. This implies an even slower decline in interest rates and keeps the borrowing costs at a higher rate for long than corporations would like.

But all in all, 2025 still appears poised to be the year when the twin engines of strategic growth and financial sponsor monetization converge to accelerate M&A activity. With strategic buyers set to deploy capital to reengineer their business models and financial sponsors under mounting pressure to unlock value, the conditions are ripe for a robust rebound. I mean, if Tempur Sealy’s recent win over the FTC is any indication, the dominoes are finally beginning to fall.

Bear or Bull?

So, this deal is a win for the M&A world... But is it going to be a win for Tempur Sealy?

Bull Case:

The bull case is fairly straightforward: Tempur Sealy’s integrated omnichannel strategy is designed to do much more than generate short-term cost savings. By combining a robust manufacturing base with a well-established retail network, the company is positioned to gain end-to-end control over product quality, supply chain agility, and customer experience. This alignment is expected to drive faster product innovation through richer consumer insights, ultimately creating a resilient business model capable of capturing additional market share and sustaining long-term growth.

Bear Case:

However, merging a legacy manufacturer with a retail network that has experienced bankruptcy introduces substantial execution risks. Potential cultural misalignments and operational integration challenges could delay or dilute the anticipated synergies. Furthermore, aligning disparate technology platforms to fully leverage cross-channel insights is a complex task, and persistent competition from more agile online disruptors may further impede the realization of the merger’s full strategic potential.

Final Verdict:

The overall outlook remains bullish, but that optimism is contingent on Tempur Sealy’s ability to execute the integration seamlessly and achieve its synergy targets. If the company successfully harmonizes its diverse operations and navigates competitive pressures, I don’t see why this vertical integration wouldn’t deliver substantial long-term value.

Secondaries: The Solution of Private Market Liquidity?

The secondaries market is something I wanted to talk about but wasn’t entirely sure where it fits in the structure of the blog, so here it is. In talking about my M&A outlook for the future, the pent-up demand and aging vintages of private equity funds were a big part of my analysis for an increase in M&A. However, in recent years, apart from traditional PE exits of a direct sale or public IPO, there has been a rise in private market secondaries as a solution for both general partners (fund managers) and limited partners (investors like pension funds, sovereign wealth funds, family offices, etc.) to return capital and liquidity to LPs. This rise of the secondaries market—especially on the GP-led side of the deals—has been really intriguing to me.

The Evolution of the Secondaries Market: A Primer

In a nutshell, private market secondaries transactions involve buying and selling existing interests in private equity, or actually, any type of private funds. When I was first introduced to secondaries, one of my mentors said he liked to imagine secondaries like an investor taking a lengthy journey on a highway with a destination in mind… but since the journey is really far along, the secondary market will basically allow you to take an exit, whether the investor just wants to take a break, want to reroute and go somewhere else, or if the journey is just too long. Secondaries basically solve this issue by providing liquidity to LP invested in relatively illiquid funds like private equity and also allow outside investors to gain exposure to private equity funds with shorter investment periods, accelerated returns, and generally safer, better risk-adjusted investments than primaries.

Historically, the secondary market for private equity and other alternative assets classes was viewed as a niche strategy reserved for distressed or forced liquidity situations. As Nigel Dawn, global head of Evercore's Private Capital Advisory group, put it during his appearance on Evercore’s podcast earlier in 2024, “Back then, selling LP interests was like asking for a divorce with your GP.” Over the decades, however, secondaries have transformed into a much more mainstream mechanism, and Mr. Dawn later points out that this evolution has been driven by shifting perceptions and better fund structuring: “The secondaries market has pivoted from propping up low-quality GPs with challenged assets to enabling the very best GPs to retain their best assets. The pandemic accelerated the adoption of continuation funds as a core strategy” (We’ll talk about continuation vehicles in a second).

So it’s safe to say that today, secondary transactions are a well-established part of portfolio management.

Transaction Structures: LP-Led and GP-Led Dynamics

Although the secondary market began with LP-initiated sales of fund interests, the market now encompasses a spectrum of transaction types led by both LPs and GPs. On the LP-led side, individual limited partners sell their stakes in private equity funds to secondary buyers. These buyers assume the seller’s commitments, gaining immediate exposure to mature assets. Sometimes, instead of full equity sales of fund interests, LPs may pursue preferred equity solutions that allow LPs to collect upfront liquidity while retaining some upside in their investments. LP-led deals often arise from the need for portfolio rebalancing, regulatory shifts, or capital calls that exceed the LP’s current allocation limits—a situation exacerbated by what’s known as the "denominator effect." When public market valuations drop, alternative investments (like private equity) make up a larger proportion of a portfolio, forcing some LPs to divest to restore balance in their portfolio’s asset allocations.

On the other hand, GP-led transactions have become increasingly popular as a strategic liquidity tool. In a typical continuation vehicle setup, a GP selects a trophy asset (SACV, single asset continuation vehicle) or multiple key assets (MACV, multiple asset continuation vehicle) from a maturing fund and transfers them into a new special-purpose vehicle. Existing LPs can choose to either cash out or roll over their investment into the continuation fund, while secondary investors provide fresh capital to fund buyouts of existing LPs or new growth initiatives. This structure allows GPs to extend the holding period for high-performing assets while realigning economic terms, such as management fees and carried interest, for new and existing investors.

Variations of GP-led transactions include strip sales (where a portion of multiple assets is sold to provide liquidity) and LP tender offers (where GPs facilitate the sale of LP stakes to secondary buyers). These transactions often require careful governance to ensure fair treatment of all stakeholders, including transparency in valuations and alignment of incentives between GPs and LPs.

Strategic Drivers and Benefits

For Limited Partners:

Secondary transactions have become an indispensable lever for LPs looking to navigate today’s market uncertainties, particularly as traditional exit routes like M&A and IPOs have become less predictable. By proactively managing their private equity exposure, LPs can mitigate risks, meet liquidity needs, and realign portfolio strategies—all in a relatively streamlined fashion.

Liquidity on Demand: In an environment with lengthening exit timelines, secondaries give LPs the option to monetize illiquid positions well before a fund’s final close. This immediate cash availability can help address other financial commitments or tactical reinvestment opportunities without locking capital up for a decade.

Active Portfolio Management & Rebalancing: Whether it’s due to the denominator when public markets take a hit and private assets suddenly consume a disproportionate share of an LP’s allocation, or just LP’s wanting to take a more proactive approach in portfolio management, secondary transactions let investors right-size their portfolios—quickly trimming or shifting positions so they can remain aligned with target allocations despite fluctuating market conditions.

Tactical Strategy Shifts: As private equity mandates evolve, secondaries offer a quick pivot mechanism. For instance, an LP might decide to reduce buyout exposure and rotate into growth equity or venture strategies. Selling out of existing funds and redeploying capital into new commitments allows for a more agile approach to portfolio construction.

Reduced Capital Call Exposure: Ongoing capital calls can strain liquidity, especially if market volatility collides with higher-than-expected commitments. By offloading fund interests, LPs sidestep future capital calls and free up reserves for higher-priority opportunities.

Trimming Tail-End Funds: What I mean here is that the older vintage tail-end funds can potentially harbor a handful of lingering assets that yield limited upside. Divesting these residual positions allows LPs to liquidate capital and potentially refocus attention on higher-potential investments and new strategies.

For General Partners:

From the perspective of fund managers, not only do secondaries help provide their investors with more bespoke and creative liquidity options, but GPs also increasingly view secondaries as a strategic tool to prolong control over marquee assets, crystallize returns, and attract new investors with fresh capital.

1. Maximizing Asset Value: Continuation vehicles enable GPs to hold onto top-performing “trophy” companies rather than selling at a suboptimal time to a potential competitor GP down the street.

2. Crystallizing Returns: Even without a traditional exit like an IPO, secondary deals can realize returns for the fund and bolster the GP’s track record. A solid performance across multiple vintages can be a persuasive factor for prospective LPs in upcoming fundraisers.

3. Fresh Capital for Growth: Injecting secondary capital into existing portfolio companies allows GPs to fund follow-on investments to further grow the assets. Moreover, in stapled transactions, the GP might secure commitments to a new fund, creating a runway for future deals.

4. Realigning Economic Incentives: By resetting management fees and carried interest, GPs can ensure they remain fully aligned with investors over the life of a new continuation vehicle.

5. Tailored LP Liquidity Solutions: Every LP has a unique liquidity profile and strategic timeline. GPs can segment transactions, offering partial exits or bundling multiple funds into one deal structure. Such flexibility enhances GP-LP relationships, building trust through bespoke solutions.

*Coller Fund = Secondaries buyer. Coller Capital is one of the largest global investors in the private equity secondary market. The firm is headquartered in London.

For Secondary Investors

Now that we’ve covered all these benefits for the sellers, some may ask, what’s in it for the buyers? The short answer is a lot. For instance, by skipping the earliest—and typically riskiest—stages of private equity, secondary buyers stand to gain much better risk-adjusted returns and faster cash flows.

Reduced J-curve exposure: In a typical private equity fund's life cycle, returns initially dip due to high capital expenditures and management fees—a pattern known as the “J-curve.” Secondary buyers mitigate this by purchasing mature fund positions that are already generating returns. As a result, secondaries investors avoid the initial negative returns and see distributions faster.

Better Risk-Adjusted Returns: Investing in mid-stage private equity portfolios provides secondary investors with access to proven (or at least evaluated) assets. This maturity reduces "blind pool" risks and increases predictability. There are tons of data showing that secondary strategies have outperformed other private equity types on a risk-adjusted basis.

Visibility into Underlying Assets: Unlike primary commitments, where investors have limited insight into target investments, secondaries let buyers evaluate the assets on the table. This transparency helps in pricing the deal appropriately and aligning projected returns with actual risk factors.

Discounted Entry Point: Since secondary interests are often acquired at a discount to Net Asset Value (NAV), there is potential for enhanced Internal Rates of Return (IRRs), especially if the underlying assets perform well. The discount also provides a margin of safety if certain assets falter.

Diversification Across Vintages and Strategies Secondary buyers can cast a wide net, picking up positions in varied funds across different vintages, geographies, and sectors. This broad approach helps balance sector-specific volatilities, smoothing returns in the face of market ebbs and flows.

Capital Called is the money investors put into a fund. Capital Distributed is the money they get in return. See how secondaries bypass stages of net negative returns.

Risks and Considerations

The secondary market's rapid growth has opened doors for new opportunities—but also for new risks. One of the most prominent risks in GP-led secondary transactions is the potential for conflicts of interest. Imagine this: a GP extends the life of a high-performing asset through a continuation vehicle, offering existing LPs the choice to cash out or reinvest. Sounds like a win-win situation, right? Well, not always. Without transparent governance agreements, LPs may worry that the GP’s primary motive is resetting fees rather than maximizing returns. As Coller Capital emphasizes, “trust can break down quickly if these governance structures aren’t in place, discouraging both new and existing investors from participating.”

Valuation uncertainty is another challenge that casts a long shadow over the market. Evercore's 2024 secondary market survey observed that bid-ask spreads widened significantly during volatile periods, with some buyers demanding discounts of up to 15% to Net Asset Value (NAV). When valuations become a battleground, deal execution slows, as sellers hesitate to transact at prices they perceive as too low. The so-called “stapled deals” can add further complexity. In these transactions, buyers commit not only to acquiring fund stakes but also to providing fresh capital for the GP's next fund. The Institutional Limited Partners Association (ILPA) recommends full disclosure of how these components influence pricing to maintain transparency and mitigate tensions.

Then there’s the question of underlying asset quality. Single-asset continuation funds often feature trophy assets with strong visibility and stable cash flows. While these are attractive to secondary investors, they also heighten exposure to concentrated risk. PJT Park Hill (PJT’s Private Capital Solutions team) has noted that sectors like technology and healthcare are particularly appealing due to their growth trajectories, but investors must remain vigilant about sector-specific risks.

To counter these risks, market participants are increasingly focusing on governance and alignment strategies. For example, adopting the right waterfall structure can be critical in bolstering LP confidence. A standard private equity waterfall comprises four key tiers that structure how cash is allocated as investments are liquidated:

Return of Capital: In the initial tier, all distributions are directed to LPs until their original investment is fully recouped.

Preferred Return (Hurdle Rate): Once capital is returned, the fund continues to allocate all distributions to LPs to achieve a predetermined preferred return/hurdle rate. This ensures that investors receive a baseline return— typically about 8%— before any profit-sharing with the GP’s incentive fees.

Catch-Up Tranche: After LPs have received both their capital and preferred return, the catch-up tranche allows the GP to get 100% of all distributions until their share of the profits reaches a specified percentage (i.e. 20%). Essentially, this tier allows GPs to “catch up” to their 20% carried interest of the returns so far that has been exclusively distributed to LPs due to the return of capital and preferred return.

Carried Interest (Residual Split): Finally, any remaining profits are split between LPs and the GP according to the carried interest arrangement. This residual allocation aligns the incentives of the investors and managers. A typical split is often 80-20 for the LPs and GPs, respectively.

Within this framework, European-style waterfall structures provide enhanced downside protection by requiring that LPs recover 100% of their capital and the full preferred return on an aggregate basis before any carried interest is paid to the GP. This arrangement ensures that investors' claims are fully met prior to any GP compensation, aligning incentives with a focus on capital preservation. In contrast, American-style waterfalls operate on a deal-by-deal basis. Under this model, once the hurdle rate is met in an individual transaction, the GP can begin earning carried interest immediately—even if LPs have not yet fully recovered their initial fund commitment. While this can expedite GP compensation, it may introduce greater variability in LP returns due to the less stringent aggregate protection.

Apart from waterfall/fee structures, GPs can also use co-investments and aligned capital commitments to signal their confidence in asset performance. By investing their own money alongside LPs in continuation vehicles, they reinforce alignment and show long-term dedication to value creation.

Finally, enhanced due diligence is becoming non-negotiable. Buyers now demand extensive documentation on asset-level performance and governance before making commitments. At the end of the day, the key to trust-building is transparency and governance. Whether this means regular valuation reviews, independent fairness opinions from investment banking advisors, or any other governance measure is an important conversation for the GPs and LPs.

Looking Ahead: Secondaries Trends in 2024 and the 2025 Outlook

The secondary market appears set to ride its record-breaking momentum right into 2025. Multiple leading advisory groups in the secondaries space— Lazard, Evercore, PJT Partners, and Jefferies—all highlight a confluence of factors driving this surge: hefty volumes in both GP-led and LP-led deals, growing allocations to evergreen ’40 Act vehicles, and a well-capitalized buyer base that has become increasingly sophisticated and competitive.

A “New Normal” for Volume and Pricing

Evercore’s H1 2024 Secondary Market Review observed over $70 billion in transactions in just the first half of 2024—an all-time high for any H1 period. By year-end, the July 2024 report estimated that total volume could hit $145–$152 billion, which was validated by their own 2024 full-year secondary market review released today in early February. The market review states that 2024 achieved “a record-breaking transaction volume of an estimated $160 billion.” This $160 billion number is more or less the consensus among the top private capital advisory banks. Lazard’s year-end report suggests a more conservative $152 billion transaction volume, but the firm further projects that secondaries transaction volume “could reach $175 billion in 2025.” Furthermore, Jefferies’ annual review recorded a slightly higher “record volume of $162 billion in 2024,” while PJT Park Hill’s FY 2024 Secondary Investor Roadmap came out with the highest number of all— citing “an estimated $165BN of total transaction volume, representing a ~40% increase YoY.”

Pricing, on the other hand, has also kept pace with volume. Jefferies data shows average LP pricing has climbed to an average of 89% of NAV—an 800-basis point improvement since 2022—buoyed by robust public markets, ample dry powder, and renewed optimism about near-term exits. According to Evercore, “the appetite for buyout, credit, infrastructure, and tail-end portfolios has especially risen in recent quarters, with some recent transactions in the high 90s to par” in terms of % to NAV. PJT and Lazard also shared a similar sentiment (see figure), with PJT noting that “The secondary market benefited from robust pricing catalyzed by differentiated pools of capital competing for high-quality supply.” Meanwhile, Lazard observes that segments like real estate and venture/growth, once lagging behind, are seeing pricing recover on the back of greater transparency, improving valuations, and the partial reopening of IPO windows. In Lazard PCA groups own words: “Given more binary outcomes and higher standard deviation of returns relative to Buyout funds, Venture Capital fund pricing improved as M&A markets became more active and increasingly benign equity markets supported increased future IPO issuance. Stability in economic growth, interest rate and inflation expectations, relative market volatility and consistent public equity multiples are all contributing to a more favorable public market exit environment in the US, driving improved pricing.”

Key Themes in 2024

1. GP-Led Deals Evolve and Expand

The consensus from these leading secondaries advisors seems to be that the second half of this decade will see continued growth in the secondary market as GPs utilize the market to regularly source liquidity for ever larger assets and LPs broaden the use of secondary market to all alternative asset classes. From what used to be predominantly an LP-led market, GP-led transactions are now making up nearly 50% of all transactions and are projected to surpass the LP-led transactions in volume in the upcoming years.

Within the rapidly growing GP-led transactions, Single-Asset Continuation Vehicles (SACVs) remained the centerpiece of the GP-led market in 2024, accounting for more than half of all GP-led transactions, according to Evercore. Lazard likewise underscores that “single-asset continuation deals surged in popularity as GPs increasingly looked to retain control of their highest-quality assets.” Mid-market sponsors brought larger, more concentrated deals, reflecting a shift toward extended ownership of top-performing portfolio companies.

Multi-asset continuation Vehicles (MACVs) also saw steady take-up among large-cap sponsors. These deals help address broader portfolio rebalancing challenges by combining underperforming assets with top-quartile companies under one continuation fund. Some investors remain cautious on multi-asset deals given inherent exposure to mixed performance, yet the overall appetite improved in 2024, aided by stronger underlying company results and an uptick in sponsor alignment measures (e.g., higher reinvestment commitments and governance enhancements).

In a recent Evercore study of Q2 2024 key performance metrics for 252 continuation fund vehicles formed between 2018- 2023, the bank’s private capital advisory group highlighted a few differences in performance between single-asset continuation vehicles and multi-asset continuation vehicles. For context, when evaluating continuation vehicles two key metrics help assess performance: Total Value to Paid-In Capital (TVPI) and Distributions to Paid-In Capital (DPI). TVPI measures the total value generated by an investment relative to the capital contributed, including both realized returns and unrealized appreciation. A higher TVPI suggests strong overall value creation, even if some of that value is still locked in the underlying assets. DPI, on the other hand, focuses on liquidity, showing how much capital has actually been returned to investors. A higher DPI means investors have received a larger portion of their initial investment back in cash. The Evercore study found that SACVs tend to have slightly higher TVPI than MACVs, meaning single asset continuation vehicles generate greater overall value, though much of it remains unrealized until exit, whereas MACVs show earlier Distributions to Paid-In Capital or DPI, meaning they return cash to investors sooner. In other words, MACVs’ diversified portfolios allow for staggered exits and faster liquidity, while SACVs take longer to return capital as they often rely on a single liquidity event.

2. LP-Led Robust Supply and Demand

In 2024, the LP-led secondary market established new benchmarks in both transaction volume and pricing, driven by pressing liquidity needs and a broadening base of sellers. Evercore observed that “liquidity pressure, along with an attractive portfolio pricing environment, resulted in more LPs—both repeat and first-time sellers—coming to market at a higher frequency.” Record LP-led volume reached approximately $87 billion, with LP portfolio sales—many exceeding the $1 billion threshold—accounting for over 50% of overall deal activity. A diverse array of sellers, including pension funds, asset managers, funds of funds, and family offices, increasingly leveraged the market to rebalance portfolios and unlock liquidity, with nearly 40% of LP-led transactions executed by first-time sellers. Demand has been further underpinned by the rise of capital inflows to evergreen ’40 Act funds, whose monthly subscription-based structures enable rapid deployment into diversified LP portfolios. And the result? More sustained pricing improvements, particularly on high-quality buyout funds with near-term distribution potential, i.e., tail-end portfolios.

A growing trend in LP-led transactions is the use of Deferred payment structures. In 2024, these delayed cash payment structures emerged as a key tactical tool in bridging the valuation gap between upfront buyer cash and seller pricing expectations. The use of deferred payment is most notably highlighted in Lazard’s 2024 report, stating that “deferred payment structures continue to prove effective at bridging pricing gaps between buyer pricing (upfront cash) and seller expectations.” In a higher interest rate environment, deferrals with durations of 6 to 12 months have maintained their foothold, though data indicates a contraction in the quantum deferred—many transactions now skew toward the lower end of the 26–50% range. Both buyers and sellers have demonstrated a measured willingness to adjust either the size or the duration of the deferral to secure execution certainty. This pragmatic adjustment not only provides sellers with a degree of pricing flexibility but also enables buyers to optimize their capital deployment—a dynamic that, while largely effective, warrants further analysis to fully quantify its long-term impact on IRR dynamics.

Finally, within the LP-led transactions, buyout remains the dominant secondary strategy, driven by strong liquidity, stable cash flows, and broader investor demand. In comparison, VC and Growth activity remains more muted due to valuation challenges, while Infrastructure and Credit continue to gain traction as investors seek defensive, yield-driven opportunities in a high-rate environment in 2024. More on this in the later section.

3. Infrastructure, Credit, Venture/Growth, Real Estate

The infrastructure secondary market experienced record expansion in 2024 to a transaction volume of $15.2 billion by year end, fueled by growing institutional demand, inflation-hedged returns, and increasing LP liquidity needs. Lazard forecasts “a four-to-fivefold expansion by 2030,” propelled by resilient cash-flow profiles and increased demand for energy transition, telecom, and transportation assets. Evergreen funds and specialist secondary managers have been particularly drawn to infrastructure’s inflation-hedging qualities and long-dated income streams, prompting GP-led and LP-led transactions in areas such as decarbonization projects and data centers.

Credit secondaries are also gathering momentum, aided by new, specialized pools of capital aimed at direct lending, mezzanine, and distressed debt. Credit secondaries transaction volume has consistently reached new highs each year post-2020, reaching $10.9bn in 2024, with increasing supply supplemented by greater buyer demand. PJT’s H1 2024 survey shows that credit-focused GP-led deals now account for a growing share of the market’s pipeline, as GPs seek partial liquidity or follow-on funding for existing credit portfolios. Favorable entry yields and relatively shorter durations further boost the appeal of credit secondaries, especially when M&A or refinancing options remain constrained.

Infrastructure secondaries volume. PJT

Private credit secondaries pricing. PJT

Venture and growth secondaries—once defined by wide pricing gaps—are steadily improving in both volume and pricing. Dedicated secondary vehicles now target successful, later-stage companies or blue-chip funds, helping reduce the valuation friction historically tied to these strategies. As exit markets gradually reopen, the near-term visibility on IPOs and M&A can increase buyers’ willingness to underwrite venture/growth assets at tighter discounts. LPs holding significant venture and growth allocations are leveraging secondaries to rebalance exposures and capitalize on renewed deal flow.

Real estate secondaries, meanwhile, are showing signs of an upward turn after a period of slower activity. Sponsors have become more transparent about property valuations, while investors are increasingly receptive to strategies focusing on logistics, multifamily, and single-family rentals. According to Evercore, H1 2024 volumes in real estate secondaries “showed initial signs of recovery,” but certain office-heavy portfolios remain challenged. Even so, new entrants are forming dedicated real estate secondary funds, fueling optimism around more diverse liquidity options as underlying fundamentals stabilize in select property types.

PJT had predicted that “LPs will bring forward $1BN+ LP portfolios comprised of non-buyout exposure to take advantage of expanding buy-side capital dedicated to segments such as credit, infra, real estate, and venture/growth” in the back half of 2024, and likely more in 2025. This multi-strategy push highlights the evolving appetite for differentiated risk-return profiles in secondaries and underscores just how critical these asset classes have become in broader portfolio management.

Real estate secondaries market quick facts. PJT

4. New Capital and Innovative Structures

With $216 billion in dry powder currently available for secondary transactions and another $115 billion in near-term fundraising targets in the upcoming 12 months as per Evercore, available capital seems to be less of a limiting factor in 2025. New entrants—including multi-strategy asset managers and additional ’40 Act vehicles—have widened the buyer universe and intensified competition. As a result, sophisticated structures such as preferred equity layers, synthetic secondaries, and strip sales are increasingly used to reconcile differences in valuations or to meet unique liquidity objectives. The use of Deferred payment structures also increased in 2024, enabling buyers to boost headline pricing while sellers benefit from potential near-term upside.

Nevertheless, a key piece of this innovation landscape is Structured Liquidity Solutions (SLS). These deals typically provide a combination of downside protection and upside participation through creative instruments—NAV-based loans, preferred equity financings, or hybrid debt-equity positions—that help GPs and LPs unlock capital without a full portfolio exit. Compared to standard LP- or GP-led secondaries, SLS often sits in a middle ground where investors receive immediate liquidity (or liquidity commitments) while retaining a stake in future upside. According to PJT Park Hill’s 2024 Investor Roadmap, “NAV loans and preferred equity solutions proliferated as GPs and LPs utilized structuring to provide non-dilutive liquidity.” Evercore likewise notes that such solutions help address short-term cash needs or unfunded commitments without a rushed sale of strong-performing assets. SLS solutions had made up over 7% of total secondaries transactions volumes in 2024.

5. Continued Emphasis on Governance and Transparency

Secondary investors remain vigilant about alignment, underwriting discipline, and independent valuations. Where valuations are clearly supported by operating performance and future growth prospects, demand and pricing have been strong. GPs, for their part, have embraced added governance measures in continuation funds—such as enhanced information rights or third-party fairness opinions—to maintain market confidence and foster deeper syndication across the secondary buyer base.

Heading into 2025: A Consistent Melody From Leading Private Capital Advisors

“Although M&A and IPO markets are projected to recover in the coming year, secondary deal volume is expected to remain robust going forward as sponsors and LPs increasingly search for creative and attractive ways to manage their portfolios.”

“As 2025 commences, the secondary market is well-positioned for continued growth and innovation, building on the record-setting momentum of 2024. With an expanding buyer universe, increasing adoption of creative liquidity solutions and competitive pricing levels, we expect both LP and GP-led markets to continue to thrive.”

“As has long been the case, innovation will abound in the secondary market as GPs, LPs, and buy-side participants craft creative solutions to meet evolving needs of private markets participants”

“The market continues to innovate to meet the growing needs of investors around the world. It is a riveting time for the secondary market...”

Looking ahead to 2025, heightened allocations from retail and institutional capital, coupled with ongoing innovations in liquidity structures, are likely to sustain the secondary market’s record pace. Both LP-led and GP-led segments should see a deepening investor pool, as robust fund closings and new entrants boost market participation. While improving M&A and IPO conditions may reduce some near-term liquidity pressure, sponsors and LPs appear more inclined than ever to integrate secondaries into their core portfolio management strategies.

As Evercore puts it, the market continues to “innovate to meet the growing needs of investors around the world,” suggesting secondaries will remain a pivotal source of both liquidity and strategic portfolio realignment well into 2025 and beyond.

Final Thoughts, Really: M&A Revs Up, with Secondaries Along for the Ride

Tempur Sealy’s success in overcoming the FTC’s challenge offers a tangible sign that the regulatory chill on deals may be thawing. For strategic acquirers, it raises the prospect that large-scale transactions—once slowed by protracted reviews—can be navigated with more confidence. For financial sponsors, it underscores a more predictable environment where they can finally rotate out of aging portfolio companies and return capital to investors. Throw in the Fed’s partial pivot on interest rates, and you have all the ingredients for a robust M&A rebound in 2025.

This case also spotlights how secondaries—once seen as a niche, last-resort market—are increasingly woven into the fabric of modern dealmaking. Evercore’s data shows higher dry powder and more flexible deal constructs powering a secondary market that’s now a regular tool for portfolio rebalancing and tailored liquidity. PJT Partners points to “expanding buy-side capital dedicated to non-buyout strategies,” signaling that infrastructure, credit, venture/growth, and real estate are well-positioned to drive secondary volumes further.

In many ways, M&A and secondaries are two sides of the same coin: both harness shifting market forces to unlock or redeploy capital. Tempur Sealy’s vertical integration strategy is a classic M&A play aimed to fend off the increasing competition of digital native mattress sellers. Meanwhile, GPs and LPs who hold other private assets—possibly with extended timelines or specialized risk profiles—are turning to secondaries for liquidity and value-maximizing solutions. Taken together, these avenues reflect a broader theme of capital mobility in 2025.

Ultimately, deals like Tempur Sealy–Mattress Firm signal a turning point: regulatory hurdles may still exist, but they’re no longer the insurmountable barrier many feared. And should another bottleneck emerge in traditional M&A or IPO routes, secondaries can offer a more flexible off-ramp or re-entry point. For those watching the marketplace, the takeaway is clear: big-ticket acquisitions are back in motion, and the ever-expanding secondary market stands ready to help investors pivot whenever—and however—they see fit.